Shareholder information

Corporate

Infosys was incorporated in Pune, in 1981, as Infosys Consultants Private Limited, a private limited company under the Companies Act, 1956. In 1983, the corporate headquarters were relocated to Bengaluru. The name of the Company was changed to Infosys Technologies Private Limited in April 1992 and to Infosys Technologies Limited in June 1992, when the Company became a public limited company. We made an initial public offering in February 1993 and were listed on stock exchanges in India in June 1993. Trading opened at ₹ 145 per share, compared to the IPO price of ₹ 95 per share. In October 1994, we made a private placement of 5,50,000 shares at ₹ 450 each to Foreign Institutional Investors (FIIs), Financial Institutions (FIs) and body corporates.

In March 1999, we issued 20,70,000 American Depositary Shares (ADSs) (equivalent to 10,35,000 equity shares of par value ₹ 10 each) at US$ 34 per ADS under the ADS Program, and these ADSs were listed on the NASDAQ National Market.

The above data is unadjusted for stock split and bonus shares. In July 2003, June 2005 and November 2006, we issued secondary-sponsored American Depositary Receipts (ADRs) of US$ 294 million, US$ 1.1 billion and US$ 1.6 billion, respectively.

During fiscal 2012, the name of the Company was changed from Infosys Technologies Limited to Infosys Limited to mark the transition from being a technology services provider to a business transformation partner to our clients.

During fiscal 2013, we delisted our ADSs from NASDAQ, and listed them in the New York Stock Exchange (NYSE), Euronext London and Euronext Paris. On July 5, 2018, we voluntarily delisted ADSs from Euronext Paris and Euronext London and ADSs were removed from the operation of Euroclear France on July 10, 2018. The primary reason for voluntary delisting from Euronext Paris and Euronext London was the low average daily trading volume of Infosys ADSs on these exchanges, which was not commensurate with the related administrative expenses. Infosys ADSs will continue to be listed on the NYSE under the symbol “INFY” and investors can continue to trade their ADSs on the New York Stock Exchange.

Bonus issues and stock split

|

Fiscal |

1986 |

1989 |

1991 |

1992 |

1994 |

1997 |

1999 |

2005 |

2007 |

2015 |

2016 |

2019 |

|

Bonus |

1:1 |

1:1 |

1:1 |

1:1 |

1:1 |

1:1 |

1:1 |

3:1 |

1:1 |

1:1 |

1:1 |

1:1 |

Notes : In addition to issuing the above bonus shares, the Company split the stock in the ratio of 2:1 in fiscal 2000.

Unclaimed dividend

Section 124 of the Companies Act, 2013, read with Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016 (“the Rules”), mandates that companies transfer dividend that has remained unclaimed for a period of seven years from the unpaid dividend account to the Investor Education and Protection Fund (IEPF). Further, the Rules mandate that the shares on which dividend has not been paid or claimed for seven consecutive years or more be transferred to the IEPF.

The following table provides a list of years for which unclaimed dividends and their corresponding shares would become eligible to be transferred to the IEPF on the dates mentioned below :

|

Year |

Type of dividend |

Dividend per share(1) (₹) |

Date of declaration |

Due date for transfer |

Amount (₹)(2) |

|

2011-12 |

Final(3) |

32.00 |

June 09, 2012 |

July 14, 2019 |

1,24,75,904 |

|

2012-13 |

Interim |

15.00 |

October 12, 2012 |

November 17, 2019 |

68,25,060 |

|

2012-13 |

Final |

27.00 |

June 15, 2013 |

July 20, 2020 |

1,06,95,105 |

|

2013-14 |

Interim |

20.00 |

October 18, 2013 |

November 23, 2020 |

93,65,780 |

|

2013-14 |

Final |

43.00 |

June 14, 2014 |

July 19, 2021 |

1,41,00,087 |

|

2014-15 |

Interim |

30.00 |

October 10, 2014 |

November 14, 2021 |

97,40,370 |

|

2014-15 |

Final |

29.50 |

June 22, 2015 |

July 23, 2022 |

1,92,81,053 |

|

2015-16 |

Interim |

10.00 |

October 12, 2015 |

November 17, 2022 |

1,50,68,840 |

|

2015-16 |

Final |

14.25 |

June 18, 2016 |

July 17, 2023 |

2,14,96,439 |

|

2016-17 |

Interim |

11.00 |

October 14, 2016 |

November 19, 2023 |

1,78,36,643 |

|

2016-17 |

Final |

14.75 |

June 24, 2017 |

July 25 , 2024 |

2,77,09,040 |

|

2017-18 |

Interim |

13.00 |

October 24, 2017 |

November 24, 2024 |

3,06,07,044 |

|

2017-18 |

Final(4) |

30.50 |

June 23, 2018 |

July 24, 2025 |

6,91,37,609 |

|

2018-19 |

Interim |

7.00 |

October 16, 2018 |

November 14, 2025 |

2,12,23,511 |

|

2018-19 |

Special |

4.00 |

January 11, 2019 |

February 10, 2026 |

22,90,044 |

(1) Not adjusted for bonus issue

(2) Amount unclaimed as on March 31, 2019

(3) Includes special dividend of ₹ 10 per share on the successful completion of 10 years of Infosys BPM (formerly known as Infosys BPO) operations

(4) Includes special dividend of ₹ 10 per share

The Company sends periodic intimation to the shareholders, advising them to lodge their claims with respect to unclaimed dividends. Shareholders may note that both the unclaimed dividend and corresponding shares transferred to IEPF, including all benefits accruing on such shares, if any, can be claimed from IEPF following the procedure prescribed in the Rules. No claim shall lie in respect thereof with the Company.

Dividend remitted to IEPF during the last three years

|

Fiscal |

Type of dividend |

Dividend declared on |

Date of transfer to IEPF |

Amount transferred to IEPF (₹) |

|

2018-19 |

Interim 2011-12 |

October 12, 2011 |

November 16, 2018, March 26, 2019(1) |

69,18,540 |

|

2018-19 |

Final 2010-11 |

June 11, 2011 |

July 16, 2018 |

68,70,340 |

|

2017-18 |

Interim 2010-11 |

October 15, 2010 |

November 20, 2017 |

1,45,91,560 |

|

2017-18 |

Final 2009-10 |

June 12, 2010 |

July 17, 2017 |

58,56,210 |

|

2016-17 |

Interim 2009-10 |

October 09, 2009 |

November 12, 2016 |

53,48,610 |

|

2016-17 |

Final 2008-09 |

June 20, 2009 |

July 25, 2016 |

15,69,766 |

(1) The amounts transferred during the year to IEPF also include bank credits received pursuant to cancellation of demand drafts beyond the validity period. The banks have cancelled the issued demand draft in accordance with the SEBI circular dated April 20, 2018 on “Strengthening the Guidelines and Raising Industry Standards for RTA, Issues companies & Banker to an issue”. Apart from the above, the Company has also transferred ₹ 16,31,056 during the year pertaining to previous years.

Shares transferred to IEPF

During the year, the Company has transferred the following shares in accordance with IEPF rules due to dividends unclaimed for seven consecutive years.

- 8,564 shares on August 10, 2018

- 49,123 shares on December 20, 2018

Further, the Company has also transferred 1,13,798 shares due to bonus entitlement for the shares held by the IEPF authority in the ratio of 1:1 during September 2018.

Financial year and Registered office

The Company’s financial year begins on April 1 and ends on March 31. The address of our registered office is Electronics City, Hosur Road, Bengaluru 560100, Karnataka, India.

Investor services

Tentative calendar

|

Quarter ending |

Earnings release |

Trading window closure |

|

Jun 30, 2019 |

Jul 12, 2019 |

Jun 16, 2019 to Jul 16, 2019 |

|

Sep 30, 2019 |

Oct 11, 2019 |

Sep 16, 2019 to Oct 15, 2019 |

|

Dec 31, 2019 |

Jan 10, 2020 |

Dec 16, 2019 to Jan 14 , 2020 |

|

Mar 31, 2020 |

Apr 14, 2020 |

Mar 16, 2020 to Apr 16, 2020 |

Annual General Meeting (AGM)

|

Date and time |

June 22, 2019, Saturday, |

|

Venue |

Christ University Auditorium, Hosur Road, Bengaluru 560 029 |

|

Webcast and transcripts |

https://www.infosys.com/Investors/ |

|

E-voting dates |

June 17, 2019 to June 21, 2019 |

|

Book closure date |

June 15, 2019 |

|

Dividend payment date |

June 25, 2019 |

Dematerialization of shares and liquidity

Infosys shares are tradable in the electronic form only. We have established connectivity with the National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL) through Karvy Fintech Private Limited, our registrars and share transfer agents. The International Securities Identification Number (ISIN) allotted to our shares under the Depository System is INE009A01021.

As on March 31, 2019, 99.86% of our shares were held in dematerialized form and the rest in physical form.

We were the first company in India to pay a one-time custodial fee of ₹ 44.43 lakh to NSDL. Consequently, our shareholders do not have to pay depository participants the custodial fee charged by NSDL on their holding.

Shares held in demat and physical mode (folio-based) as on March 31, 2019 are as follows :

|

Category |

Number of |

% to total equity |

|

|

cases(1) |

shares |

||

|

Demat mode |

9,53,639 |

435,54,27,729 |

99.86 |

|

Physical mode |

361 |

63,05,715 |

0.14 |

|

Grand total |

9,54,000 |

436,17,33,444 |

100.00 |

(1) The total number of cases will not tally with the number of shareholders, since shareholders can have multiple demat accounts with the same PAN. The number of shareholders based on PAN as on March 31, 2019 is 9,19,720.

We request shareholders whose shares are in the physical mode to dematerialize their shares and update their bank accounts and email IDs with the respective depository participants to enable us to provide better service.

Investor awareness

We have provided a synopsis of the rights and responsibilities of shareholders on our website, https://www.infosys.com/investors/shareholder-services/faqs.html. We encourage you to read the details provided and seek answers to questions that you may have regarding your rights as a shareholder.

The Company is committed towards promoting effective and open communication with all the stakeholders, ensuring consistency and clarity of disclosure at all times. We aim to communicate with investors throughout the year by providing frequent interaction through a variety of forums including meetings, earning calls, investor conferences and management presentations. We strive to be accessible to both institutional and other investors, and proactively encourage all shareholders to participate in the AGM. Every quarter, the Company holds results briefings for investors. The Company also participates in investor conferences held both in India and overseas, in an ongoing effort to communicate directly with investors.

In order to educate the shareholders and with an intent to protect their rights, the Company also sends persistent reminders to the shareholders to claim the unclaimed dividend / shares before it is transferred to IEPF.

Swagatham – Shareholders’ visit to Mysuru campus

During the year, the Company organized a day’s event named ‘Swagatham’ for the shareholders to visit the Company’s Mysuru campus on November 24, 2018. More than 275 shareholders participated in the event.

Secretarial audit

Pursuant to Section 204 of the Companies Act, 2013 and rules thereunder, the Board of Directors of the Company appointed Parameshwar G. Hegde of Hegde & Hegde, Practicing Company Secretaries, to conduct Secretarial Audit of the records and documents of the Company. The Secretarial Audit Report confirms that the Company has complied with all applicable provisions of the Companies Act, 2013, Depositories Act, 1996, and all the Regulations and Guidelines of the Securities and Exchange Board of India (SEBI), as applicable to the Company. The audit also covers the reconciliation on a quarterly basis, the total admitted capital with NSDL and CDSL, and the total issued and listed capital. The audit has confirmed that the total issued / paid-up capital is in agreement with the aggregate total number of shares in physical form and the total number of dematerialized shares held with NSDL and CDSL. Further, the Company complies with the applicable Secretarial Standards issued by the Institute of Company Secretaries of India (ICSI).

Investor grievances

|

Nature of complaints |

Received |

Resolved |

||

|

2019 |

2018 |

2019 |

2018 |

|

|

Dividend / Annual Report related / others |

2,507 |

1,286 |

2,507 |

1,286 |

|

Buyback(1) |

– |

12,349 |

– |

12,349 |

(1) In addition to the above the Company has received and resolved 154 queries from shareholders between January 11, 2019 to March 31, 2019.

We attended to most of the investors’ grievances and postal / electronic communications within a period of seven days from the date of receipt of such grievances. The exceptions have been for cases constrained by disputes or legal impediments.

Shareholders may note that the share transfers, dividend payments and all other investor-related activities are attended to and processed at the office of the Registrar and Transfer Agents (RTA).

For any grievances / complaints, shareholders may contact the RTA, Karvy

Fintech Private Limited. For any escalations, shareholders may write

to the Company at

investors@infosys.com.

The contact details of RTA and the Company are available in ‘Investor contacts’

of this section.

Legal proceedings

There are certain pending cases related to disputes over title to shares in which we had been made a party. However, these cases are not material in nature.

Paid-up capital

Shareholding pattern

During the year, the total shareholding of the Company changed due to ESOP allotment, bonus and buyback of shares. The total shareholding as on March 31, 2019 is 436,17,33,444.

Movement in shareholding during fiscal 2019 :

|

Date |

Transaction details |

Allotment |

Extinguishment |

No. of equity shares |

|

April 1, 2018 |

Opening balance |

|

|

218,41,14,257 |

|

April 7, 2018 |

ESOP allotment |

12,834 |

|

218,41,27,091 |

|

July 6, 2018 |

ESOP allotment |

185 |

|

218,41,27,276 |

|

August 15, 2018 |

ESOP allotment |

64,214 |

|

218,41,91,490 |

|

September 6, 2018 |

Bonus issue |

218,41,91,490 |

|

436,83,82,980 |

|

October 16, 2018 |

ESOP allotment |

13,988 |

|

436,83,96,968 |

|

November 23, 2018 |

ESOP allotment |

2,08,250 |

|

436,86,05,218 |

|

December 15, 2018 |

ESOP allotment |

42,680 |

|

436,86,47,898 |

|

January 24, 2019 |

ESOP allotment |

4,424 |

|

436,86,52,322 |

|

March 5, 2019 |

ESOP allotment |

2,79,122 |

|

436,89,31,444 |

|

March 27, 2019 |

Buyback of shares |

|

35,62,000 |

436,53,69,444 |

|

March 29, 2019 |

Buyback of shares |

|

36,36,000 |

436,17,33,444 |

The detailed report on the shareholding pattern of the Company as on March 31, 2019 is presented in MGT-9 enclosed to the Board’s report as Annexure 6.

Shareholders holding more than 1% of the shares

The details of shareholders (non-promoters and non-ADR-holders) holding more than 1% (PAN-based) of the equity as on March 31, 2019 are as follows :

|

Name of the shareholder |

No. of shares |

% |

|

Life Insurance Corporation of India |

25,43,32,376 |

5.83 |

|

HDFC Mutual Fund |

12,62,54,239 |

2.89 |

|

SBI Mutual Fund |

9,81,79,730 |

2.25 |

|

Government of Singapore |

8,25,65,400 |

1.89 |

|

ICICI Prudential Mutual Fund |

7,62,81,297 |

1.75 |

|

Vanguard Emerging Markets Stock Index Fund, A Series of Vanguard International Equity Index Fund |

5,93,14,854 |

1.36 |

|

Vanguard Total International Stock Index Fund |

5,87,11,707 |

1.35 |

|

Abu Dhabi Investment Authority |

5,18,86,545 |

1.19 |

|

UTI Mutual Fund |

4,67,22,073 |

1.07 |

|

ICICI Prudential Life Insurance Company Limited |

4,58,97,932 |

1.05 |

|

Government Pension Fund Global |

4,51,32,387 |

1.03 |

|

Reliance Capital Trust Co Ltd – A/C Reliance Dual Advantage fixed tenure fund XII plan A |

4,38,07,952 |

1.00 |

Distribution of shareholding as on March 31, 2019

|

No. of shares held |

No. of holders |

% to holders |

No. of shares |

% to equity |

|

1 |

13,104 |

1.37 |

13,104 |

0.00 |

|

2-10 |

1,61,960 |

16.98 |

10,78,774 |

0.02 |

|

11-50 |

3,21,775 |

33.73 |

97,39,991 |

0.22 |

|

51-100 |

1,70,942 |

17.92 |

1,35,75,351 |

0.31 |

|

101-200 |

1,29,449 |

13.57 |

2,02,96,615 |

0.47 |

|

201-500 |

85,824 |

8.99 |

2,77,67,945 |

0.64 |

|

501-1,000 |

33,941 |

3.56 |

2,46,97,383 |

0.57 |

|

1,001-5,000 |

25,481 |

2.67 |

5,34,27,770 |

1.22 |

|

5,001-10,000 |

4,296 |

0.45 |

3,03,13,158 |

0.70 |

|

10,001 and above |

7,228 |

0.76 |

418,08,23,353 |

95.85 |

|

Total |

9,54,000 |

100.00 |

436,17,33,444 |

100.00 |

Listing on stock exchanges

|

Codes |

India |

Global |

|

|

NSE |

BSE |

NYSE |

|

|

Exchange |

INFY |

500209 |

INFY |

|

Reuters |

INFY.NS |

INFY.BO |

INFY.K |

|

Bloomberg |

INFO IS |

INFO IB |

INFY UN |

The listing fees for fiscal 2019 have been paid for all of the above stock exchanges in India and overseas.

ISIN Code for ADS : US4567881085

Stock market data relating to shares listed in India and NYSE

Our market capitalization is included in the computation of the S&P BSE Sensex (Sensex), the NIFTY 50 Index, NYSE Composite Index and Dow Jones Sustainability Indices (DJSI), among others.

Stock market data – exchanges in India

The monthly high and low quotations, as well as the volume of shares traded at the BSE, the NSE, and NYSE for the current year are provided as follows :

|

2018-19 |

BSE |

NSE |

Volume |

||||

|

Months |

High (<₹) |

Low (<₹) |

Volume A (No.) |

High (<₹) |

Low (<₹) |

Volume B (No.) |

(A+B) (No.) |

|

April |

606 |

550 |

92,78,544 |

607 |

551 |

23,88,90,178 |

24,81,68,722 |

|

May |

624 |

578 |

59,55,224 |

624 |

578 |

15,26,59,266 |

15,86,14,490 |

|

June |

657 |

606 |

48,47,100 |

658 |

606 |

14,88,92,806 |

15,37,39,906 |

|

July |

696 |

634 |

2,51,21,798 |

697 |

634 |

22,27,50,566 |

24,78,72,364 |

|

August |

727 |

674 |

1,66,03,168 |

727 |

674 |

15,32,20,648 |

16,98,23,816 |

|

September |

748 |

692 |

88,73,687 |

749 |

692 |

15,15,20,717 |

16,03,94,404 |

|

October |

755 |

630 |

1,59,59,080 |

755 |

630 |

18,65,38,368 |

20,24,97,448 |

|

November |

694 |

601 |

1,33,29,923 |

690 |

600 |

16,97,40,064 |

18,30,69,987 |

|

December |

714 |

638 |

1,06,28,577 |

714 |

637 |

15,47,14,992 |

16,53,43,569 |

|

January |

751 |

651 |

1,37,53,258 |

751 |

651 |

21,25,09,846 |

22,62,63,104 |

|

February |

771 |

723 |

55,79,162 |

772 |

721 |

11,90,07,692 |

12,45,86,854 |

|

March |

748 |

706 |

1,23,64,583 |

748 |

705 |

16,23,57,177 |

17,47,21,760 |

|

Total |

14,22,94,104 |

207,28,02,320 |

221,50,96,424 |

||||

Note : Share prices and volumes have been adjusted for the September 2018 bonus issue.

Share prices have been rounded off to the nearest whole number.

The volume traded / outstanding shares (%) in the last three fiscals is as follows :

|

Fiscal |

Volume (BSE) |

Volume (NSE) |

Volume (BSE +NSE) |

|

2018-19 |

4 |

57 |

61 |

|

2017-18 |

5 |

69 |

74 |

|

2016-17 |

4 |

47 |

51 |

Note : The number of shares outstanding was 361,54,78,796 as of March 31, 2019. ADSs have been excluded for the purpose of this calculation.

Stock market data – NYSE

|

2018-19 |

High ($) |

Low ($) |

High (<₹) |

Low (<₹) |

Volume (No.) |

|

Months |

|||||

|

April |

9.11 |

8.25 |

596 |

538 |

35,58,84,246 |

|

May |

9.25 |

8.62 |

632 |

579 |

21,23,04,378 |

|

June |

9.76 |

9.07 |

669 |

617 |

20,52,06,798 |

|

July |

10.34 |

9.46 |

712 |

650 |

28,60,43,434 |

|

August |

10.57 |

10.07 |

738 |

688 |

18,87,45,674 |

|

September |

10.65 |

9.89 |

776 |

711 |

17,55,98,150 |

|

October |

10.52 |

8.85 |

777 |

650 |

29,78,84,796 |

|

November |

9.89 |

8.95 |

701 |

639 |

15,66,21,985 |

|

December |

10.05 |

9.07 |

708 |

635 |

19,69,21,537 |

|

January |

10.82 |

9.47 |

768 |

660 |

25,05,54,803 |

|

February |

10.94 |

10.38 |

783 |

741 |

13,66,47,364 |

|

March |

11.11 |

10.36 |

763 |

726 |

14,11,94,366 |

|

Total |

260,36,07,531 |

Note : 1 ADS = 1 equity share. The US dollar has been converted into the Indian rupee at the daily rates. The number of ADSs outstanding as on March 31, 2019 was 74,62,54,648. The percentage of volume traded for the year at NYSE, to the total float was 349%. ADS prices and volumes have been adjusted for the September 2018 bonus issue.

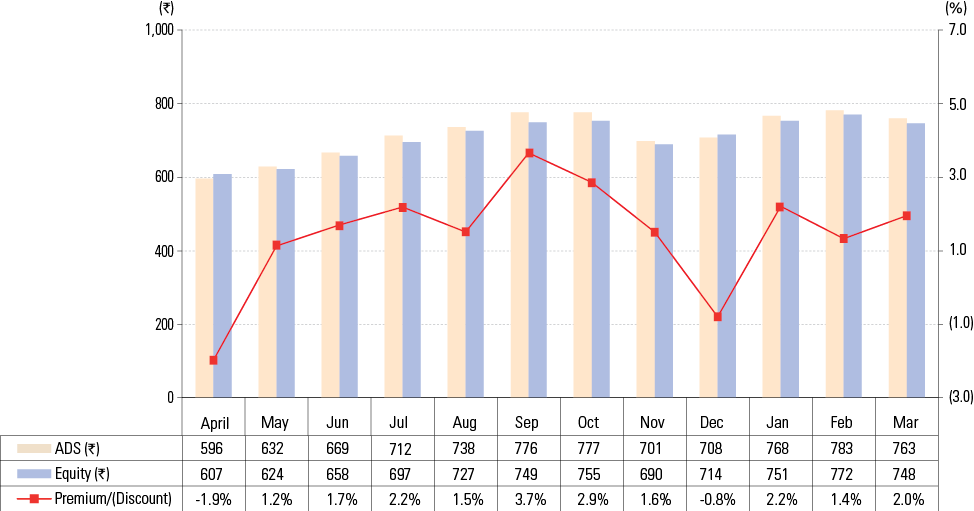

ADS premium compared to price quoted on NSE

Outstanding ADSs

Our ADSs, as evidenced by ADRs, are traded in the US on the NYSE at New York Stock Exchange under the ticker symbol ‘INFY’. The currency of trade of ADS in the US is USD. Each equity share is represented by one ADS. The ADRs evidencing ADSs began trading on the NYSE, New York, from December 12, 2012, and Euronext London and Paris from February 20, 2013, when they were listed pursuant to the Listing Agreement entered with the NYSE. The ADSs listed on Euronext Paris and London were delisted effective July 5, 2018. As on March 31, 2019, there were 85,209 record holders of ADRs evidencing 74,62,54,648 ADSs (1 ADS = 1 equity share).

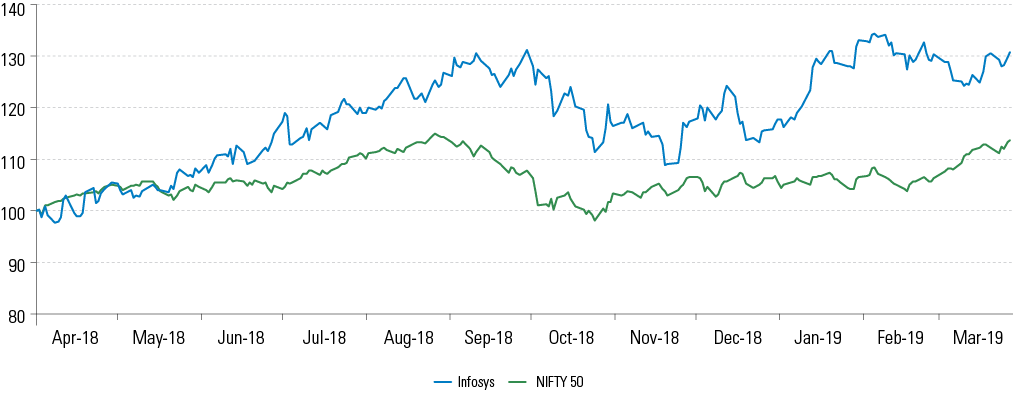

Infosys share price versus the NSE Nifty 50 index

Note : Base 100 – Infosys share price on April 2, 2018 and NSE Nifty 50 index value on April 2, 2018 have been baselined to 100. Share prices and volumes have been adjusted for the September 2018 bonus issue.

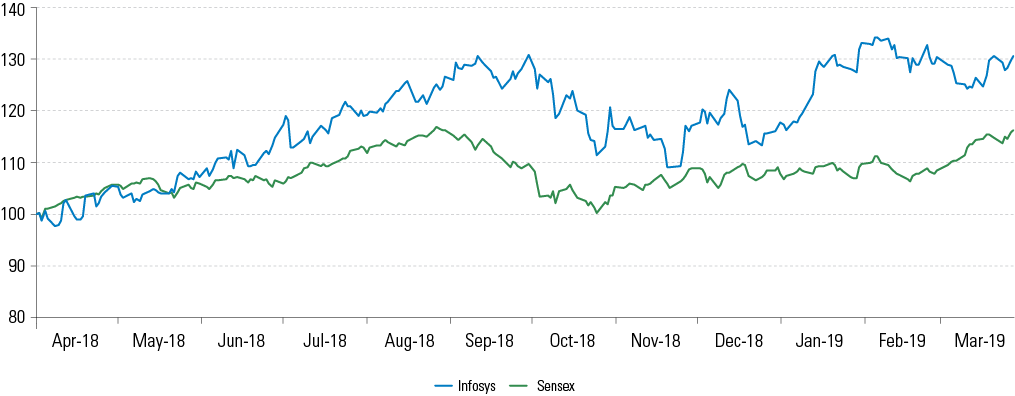

Infosys share price versus the S&P BSE Sensex (Sensex)

Note : Base 100 – Infosys share price on April 2, 2018 and S&P BSE Sensex (Sensex) value on April 2, 2018 have been baselined to 100. Share prices and volumes have been adjusted for the September 2018 bonus issue.

Credit ratings

The Company has obtained rating from Moody’s during the year ended March 31, 2019. There has been no change in credit ratings from Standard & Poor’s and Dun & Bradstreet during the year.

|

Rating agency |

Rating |

Outlook |

|

Moody’s |

A3 |

Stable |

|

Standard & Poor’s |

A- |

Stable |

|

Dun & Bradstreet |

5A1 |

Condition : Strong |

Global locations

Infosys is a leading provider of technology services and consulting and has operations spread across 191 locations in 46 countries. We do not have any manufacturing plants, but have development centers and offices in India and overseas. Visit https://www.infosys.com/investors/reports-filings/Documents/global-presence2019.pdf for details related to our global locations.

Investor contacts

For queries relating to financial statements

Jayesh Sanghrajka

Deputy Chief Financial Officer & EVP

Tel : 91 80 2852 1705 Fax : 91 80 2852 0754

Email : jayesh.sanghrajka@infosys.com

Investor correspondence

Sandeep Mahindroo

VP, Financial Controller & Head – Investor Relations

Tel : 91 80 3980 1018 Fax : 91 80 2852 0754

Email : sandeep_mahindroo@infosys.com

For queries relating to shares / dividend / compliance

A.G.S. Manikantha

Company Secretary

Tel : 91 80 4116 7775 Fax : 91 80 2852 0754

Email : investors@infosys.com

For queries relating to Business responsibility report

Aruna C. Newton

AVP & Head – Diversity and Inclusion

Tel : 91 80 2852 0261

Email : arunacnewton@infosys.com

Registrar and share transfer agents

Karvy Fintech Private Limited

Karvy Selenium Tower B, Plot No. 31 & 32,

Financial

District, Nanakramguda

Serilingampally Mandal, Hyderabad – 500 032

Contact person

Shobha Anand

Deputy General Manager, Karvy Fintech Private Limited

Tel : 91 40 6716 1559

Email : shobha.anand@karvy.com

Depositary bank (ADS)

United States

Deutsche Bank Trust Company Americas

Deutsche Bank, 60 Wall Street, 16th Floor

Global Transaction Banking

Depositary Receipts

New York 10005, NY, U.S.

Tel : 1 212 250 2500 Fax : 1 732 544 6346

India

Deutsche Bank AG, Filiale Mumbai

Global Transaction Banking – Depositary Receipts

The Capital, C-70, G Block

Bandra Kurla Complex, Mumbai 400 051, India

Tel : 91 22 7180 6449 Fax : 91 22 7180 3794

Custodian in India (ADS)

ICICI Bank Limited

Securities Market Services

1st Floor, Empire Complex, 414, Senapati Bapat Marg,

Lower Parel, Mumbai 400 013,

Maharashtra, India.

Tel : 91 22 6667 2005 / 4343 4116 / 4343 4121

Fax : 91 22 6667 2779

Depository for equity shares in India

National Securities Depository Limited

Trade World, ‘A’ Wing, 4th Floor

Kamala Mills Compound Senapati Bapat Marg,

Lower Parel, Mumbai 400 013, India

Tel : 91 22 2499 4200 Fax : 91 22 2497 6351

Central Depository Services (India) Limited

Phiroze Jeejeebhoy Towers, 17th Floor

Dalal Street, Fort, Mumbai 400 001, India

Tel : 91 22 2302 3333 Fax : 91 22 2272 3199

Addresses of stock exchanges

In India

National Stock Exchange of India Ltd.

Exchange Plaza, Plot No. C / 1, G Block

Bandra Kurla Complex

Bandra (East), Mumbai 400 051, India

Tel : 91 22 2659 8100 Fax : 91 22 2659 8120

BSE Ltd.

Phiroze Jeejeebhoy Towers

Dalal Street, Kala Ghoda, Mumbai 400 001, India

Tel : 91 22 2272 1233 Fax : 91 22 2272 1919

Outside India

New York Stock Exchange

11 Wall Street, New York, NY 10005, US

Tel : 1 212 656 3000 Fax : 1 212 656 5549

Shareholder voting

Shareholders are requested to cast their votes on the resolutions mentioned in Notice of the 38th Annual General Meeting of the Company by using any of the following options :

|

Vote in advance of the meeting |

Remote e-voting at https://www.evoting.nsdl.com/ Voting through proxy : Sign, date, and return the proxy form on or before June 20, 2019, 3:00 p.m. IST. |

|

Vote in person at the meeting |

Please refer to the Notes section in the Notice for details on admission requirements to attend the Annual General Meeting. |