Board’s report

Dear members,

The Board of Directors hereby submits the report of the business and operations of your Company (“the Company” or “Infosys”), along with the audited financial statements, for the financial year ended March 31, 2019. The consolidated performance of the Company and its subsidiaries has been referred to wherever required.

1. Results of our operations and state of affairs

in ₹ crore, except per equity share data

|

Particulars |

Standalone |

Consolidated |

||

|

For the year ended March 31, |

For the year ended March 31, |

|||

|

2019 |

2018 |

2019 |

2018 |

|

|

Revenue from operations |

73,107 |

61,941 |

82,675 |

70,522 |

|

Cost of sales |

47,412 |

39,138 |

53,867 |

45,130 |

|

Gross profit |

25,695 |

22,803 |

28,808 |

25,392 |

|

Operating expenses |

|

|

||

|

Selling and marketing expenses |

3,661 |

2,763 |

4,473 |

3,560 |

|

General and administration expenses |

4,225 |

3,562 |

5,455 |

4,684 |

|

Total operating expenses |

7,886 |

6,325 |

9,928 |

8,244 |

|

Operating profit |

17,809 |

16,478 |

18,880 |

17,148 |

|

Reduction in fair value of assets held for sale / disposal group held for sale(2) |

(265) |

(589) |

(270) |

(118) |

|

Adjustment in respect of excess of carrying amount over recoverable amount on reclassification from ‘Held for Sale’(2) |

(469) |

– |

(451) |

– |

|

Other income, net(3)(4) |

2,852 |

4,019 |

2,882 |

3,311 |

|

Profit before non-controlling interests / share in net loss of associate |

19,927 |

19,908 |

21,041 |

20,341 |

|

Share in net loss of associate, including impairment of associate(4) |

– |

– |

– |

(71) |

|

Profit before tax |

19,927 |

19,908 |

21,041 |

20,270 |

|

Tax expense(1) |

5,225 |

3,753 |

5,631 |

4,241 |

|

Profit after tax |

14,702 |

16,155 |

15,410 |

16,029 |

|

Profit attributable to owners of the Company |

14,702 |

16,155 |

15,404 |

16,029 |

|

Non-controlling interests |

– |

– |

6 |

– |

|

Other comprehensive income |

|

|

||

|

Items that will not be reclassified subsequently to profit or loss |

57 |

59 |

48 |

62 |

|

Items that will be reclassified subsequently to profit or loss |

22 |

(38) |

86 |

281 |

|

Total other comprehensive income, net of tax |

79 |

21 |

134 |

343 |

|

Total comprehensive income for the year attributable to owners of the Company |

14,781 |

16,176 |

15,538 |

16,372 |

|

Non-controlling interest |

– |

– |

6 |

– |

|

Earnings per share (EPS)(5) |

|

|

||

|

Basic |

33.66 |

35.64 |

35.44 |

35.53 |

|

Diluted |

33.64 |

35.62 |

35.38 |

35.50 |

1 crore = 10 million

Notes : The above figures are extracted from the audited standalone and consolidated financial statements as per Indian Accounting Standards (Ind AS).

(1) During the quarter ended December 31, 2017, on account of the conclusion of an Advance Pricing Agreement (APA) with the US Internal Revenue Service (IRS), the Company had reversed income tax expense provision of US$ 225 million (₹ 1,432 crore), which pertained to previous periods.

(2) During the year ended March 2018, Kallidus and Skava (together referred to as “Skava”) and Panaya were classified under ‘Held for Sale’, resulting in a reduction in fair value in respect of Panaya amounting to ₹ 118 crore. In the year ended March 31, 2019, a further reduction of ₹ 270 crore was recorded in respect of Panaya and on reclassification of Panaya and Skava from ‘Held for Sale’, the Company recognized an adjustment in respect of excess of carrying amount over recoverable amount of ₹ 451 crore in respect of Skava.

In the Standalone financial statements of the Company, during the year ended March 31, 2018, investments in respect of these subsidiaries were reclassified under ‘Held for Sale’. On reclassification, these investments were measured at the lower of carrying amount and fair value less cost to sell and consequently, a reduction in the fair value of assets held for sale of ₹ 589 crore in respect of Panaya has been recognized in the Standalone Statement of Profit and Loss. During the year ended March 31, 2019, a further reduction of ₹ 265 crore was recorded in respect of Panaya and on reclassification of these investments from ‘Held for Sale’, the Company recognized an adjustment in respect of excess of carrying amount over recoverable amount of ₹ 469 crore in respect of Skava.

(3) Other income includes ₹ 51 crore and ₹ 262 crore for the years ended March 31, 2019 and March 31, 2018, respectively, in the Consolidated financial statements of the Company towards interest on income tax refund.

Other income includes ₹ 50 crore and ₹ 257 crore for the years ended March 31, 2019 and March 31, 2018, respectively, in the Standalone financial statements of the Company towards interest on income tax refund.

(4) During the year ended March 31, 2018, the Company has written down the entire carrying value of the investment in its associate, DWA Nova LLC, amounting to ₹ 71 crore in the Consolidated Statement of Profit and Loss. Consequent to the above, the Company has written down the entire carrying value of the investment in its subsidiary, Infosys Nova Holdings LLC, amounting to ₹ 94 crore in the Standalone Statement of Profit and Loss.

(5) Equity shares are at par value of ₹ 5 per share and adjusted for the September 2018 bonus issue.

Financial position

in ₹ crore, except equity share data

|

Particulars |

Standalone |

Consolidated |

||

|

As at March 31, 2019 |

As at March 31, 2018 |

As at March 31, 2019 |

As at March 31, 2018 |

|

|

Cash and cash equivalents |

15,551 |

16,770 |

19,568 |

19,818 |

|

Current investments |

6,077 |

5,906 |

6,627 |

6,407 |

|

Assets held for sale(1) |

– |

1,525 |

– |

2,060 |

|

Net current assets(2) |

30,793 |

30,903 |

34,240 |

34,176 |

|

Property, plant and equipment(1) |

11,606 |

10,469 |

12,867 |

11,722 |

|

Goodwill(1) |

29 |

29 |

3,540 |

2,211 |

|

Other intangible assets(1) |

74 |

101 |

691 |

247 |

|

Other non-current assets |

20,998 |

21,188 |

14,762 |

15,693 |

|

Total assets |

78,930 |

75,877 |

84,738 |

79,890 |

|

Liabilities directly associated with assets held for sale(1) |

– |

– |

– |

324 |

|

Non-current liabilities |

789 |

713 |

1,094 |

861 |

|

Retained earnings – opening balance |

55,671 |

49,957 |

58,477 |

52,882 |

|

Add : |

|

|

||

|

Profit for the year |

14,702 |

16,155 |

15,404 |

16,029 |

|

Transfer from Special Economic Zone Re-investment Reserve on utilization(4) |

1,386 |

582 |

1,430 |

617 |

|

Less : |

||||

|

Dividends including dividend distribution tax |

(13,768) |

(7,500) |

(13,712) |

(7,469) |

|

Transfer to general reserve |

(1,615) |

(1,382) |

(1,615) |

(1,382) |

|

Transfer to Special Economic Zone Re-investment Reserve(4) |

(2,306) |

(2,141) |

(2,417) |

(2,200) |

|

Transferred to other reserves |

– |

– |

(1) |

– |

|

Retained earnings – closing balance |

54,070 |

55,671 |

57,566 |

58,477 |

|

Equity share capital(3) |

2,178 |

1,092 |

2,170 |

1,088 |

|

Other reserves and surplus(5) |

6,368 |

6,723 |

4,309 |

4,589 |

|

Other comprehensive income |

95 |

16 |

903 |

769 |

|

Non-controlling interest |

– |

– |

58 |

1 |

|

Total equity(3) |

62,711 |

63,502 |

65,006 |

64,924 |

|

Total equity and liabilities |

78,930 |

75,877 |

84,738 |

79,890 |

|

Number of equity shares(3) |

435,62,79,444 |

218,41,14,257 |

433,59,54,462 |

217,33,12,301 |

(1) During the year ended March 2018, Kallidus and Skava (together referred to as “Skava”) and Panaya were classified under ‘Held for Sale’, resulting in a reduction in fair value in respect of Panaya amounting to ₹ 118 crore. Accordingly, assets amounting to ₹ 2,060 crore and liabilities amounting to ₹ 324 crore in respect of the disposal group had been classified under ‘Held for Sale’. In the year ended March 31, 2019, a further reduction of ₹ 270 crore was recorded in respect of Panaya and on reclassification of Panaya and Skava from ‘Held for Sale’, the Company recognized an adjustment in respect of excess of carrying amount over recoverable amount of ₹ 451 crore in respect of Skava.

In the Standalone financial statements of the Company, on reclassification, these investments were measured at the lower of carrying amount and fair value less cost to sell and consequently, a reduction in the fair value of assets held for sale of ₹ 589 crore in respect of Panaya has been recognized in the Standalone Statement of Profit and Loss during the year ended March 31, 2018. Accordingly, investments amounting to ₹ 1,525 crore in respect of these subsidiaries were reclassified under ‘Held for Sale’. During the year ended March 31, 2019, a further reduction of ₹ 265 crore was recorded in respect of Panaya and on reclassification of these investments from ‘Held for Sale’, and an adjustment was recognized in respect of excess of carrying amount over recoverable amount of ₹ 469 crore in respect of Skava.

(2) Excludes assets held for sale and liabilities directly associated with assets held for sale as at March 31, 2018.

(3) In line with the Capital Allocation Policy announced in April 2018, shareholders approved a buyback of equity shares from the open market route through Indian stock exchanges of up to ₹ 8,260 crore (maximum buyback size) at a price not exceeding ₹ 800 per share (maximum buyback price). The buyback shall close within six months from the date of opening of the buyback, i.e. March 20, 2019, or such other period as may be permitted under the Companies Act, 2013 or SEBI (Buy-Back of Securities) Regulations, 2018.

Accordingly, during the year ended March 31, 2019, 1,26,52,000 equity shares were purchased from the stock exchange, which includes 18,18,000 shares that have been purchased but not extinguished as of March 31, 2019 and 36,36,000 shares that have been purchased but have not been settled and therefore not extinguished. The buyback of equity shares through the stock exchange commenced on March 20, 2019 and is expected to be completed by September 2019. Subsequent to the year end, the Company has purchased 81,31,000 shares till the date of the Board’s report.

During the previous year, 11,30,43,478 equity shares (not adjusted for the September 2018 bonus issue) were bought back by the Company for a total amount of ₹ 13,000 crore.

(4) The Special Economic Zone (SEZ) Re-investment Reserve has been created out of the profit of eligible SEZ units in terms of the provisions of Section 10AA(1)(ii) of the Income-tax Act, 1961. The reserve should be utilized by the Company for acquiring new plant and machinery for the purpose of its business in the terms of Section 10AA(2) of the Income-tax Act, 1961.

(5) Excluding retained earnings.

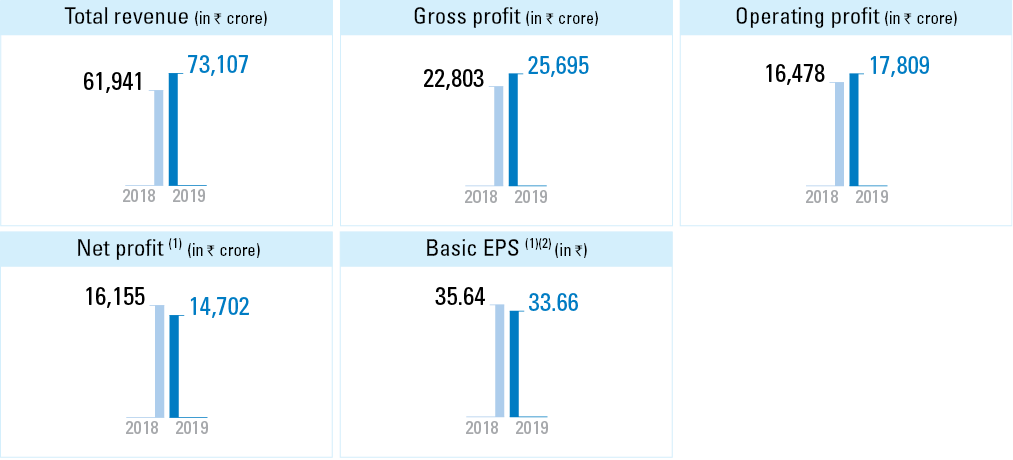

Summary Profit and Loss – standalone

|

Particulars |

Year ended March 31, |

||||

|

2019 |

% of revenue |

2018 |

% of revenue |

YoY growth (%) |

|

|

Revenue from operations |

73,107 |

100.0 |

61,941 |

100.0 |

18.0 |

|

Gross profit |

25,695 |

35.2 |

22,803 |

36.8 |

12.7 |

|

Selling and marketing expenses |

3,661 |

5.0 |

2,763 |

4.5 |

32.5 |

|

General and administration expenses |

4,225 |

5.8 |

3,562 |

5.7 |

18.6 |

|

Operating profit |

17,809 |

24.4 |

16,478 |

26.6 |

8.1 |

|

Profit before tax |

19,927 |

27.3 |

19,908 |

32.1 |

0.1 |

|

Net profit(1) |

14,702 |

20.1 |

16,155 |

26.1 |

(9.0) |

Based on Ind AS standalone financial statements

(1) Includes the following :

- Reversal of income tax provision of US$ 225 million (₹ 1,432 crore) pertaining to previous periods on account of conclusion of APA during the previous year

- During the year ended March 2018, recorded a reduction in fair value in respect of Panaya amounting to ₹ 589 crore. In the year ended March 31, 2019, a further reduction of ₹ 265 crore was recorded in respect of Panaya.

- During the year ended March 31, 2019, on reclassification of Panaya and Skava from ‘Held for Sale’, the Company recognized an adjustment in respect of excess of carrying amount over recoverable amount of ₹ 469 crore in respect of Skava.

(2) Adjusted for the September 2018 bonus issue.

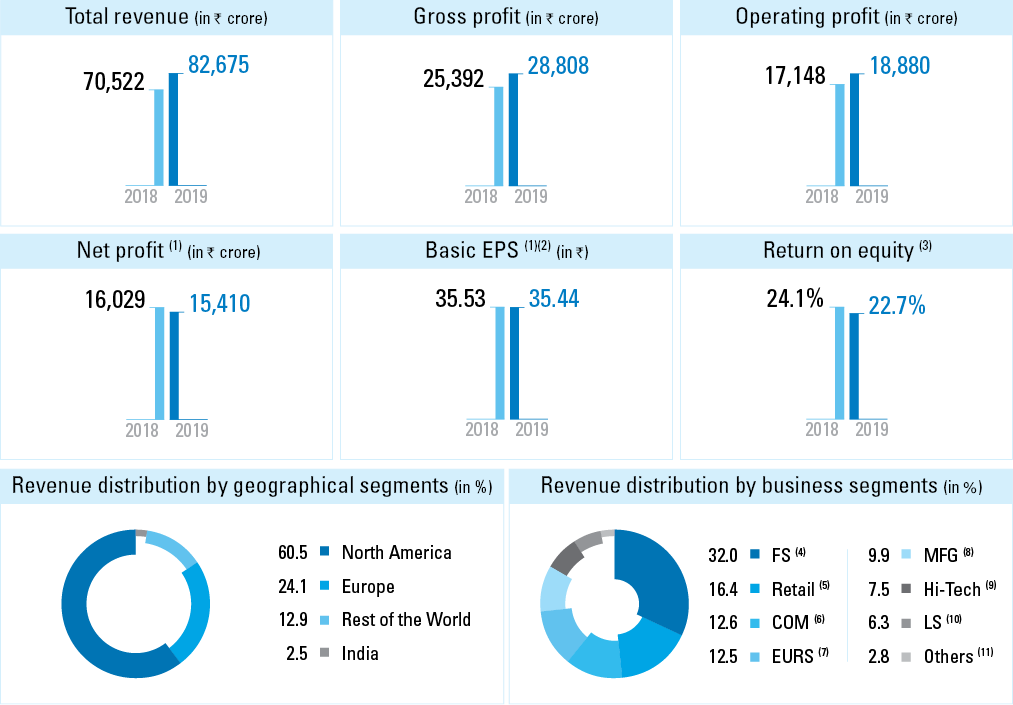

Summary Profit and Loss – consolidated

|

Particulars |

Year ended March 31, |

||||

|

2019 |

% of revenue |

2018 |

% of revenue |

YoY growth (%) |

|

|

Revenue from operations |

82,675 |

100.0 |

70,522 |

100.0 |

17.2 |

|

Gross profit |

28,808 |

34.8 |

25,392 |

36.0 |

13.5 |

|

Selling and marketing expenses |

4,473 |

5.4 |

3,560 |

5.1 |

25.6 |

|

General and administration expenses |

5,455 |

6.6 |

4,684 |

6.6 |

16.5 |

|

Operating profit |

18,880 |

22.8 |

17,148 |

24.3 |

10.1 |

|

Profit before tax |

21,041 |

25.5 |

20,270 |

28.7 |

3.8 |

|

Net profit(1) |

15,410 |

18.6 |

16,029 |

22.7 |

(3.9) |

Based on Ind AS consolidated financial statements

(1) Includes impact on account of :

- Reversal of income tax provision of US$ 225 million (₹ 1,432 crore) pertaining to previous periods on account of conclusion of an APA during the previous year

- Recorded a reduction in fair value in respect of Panaya amounting to ₹ 118 crore and ₹ 270 crore, for the years ended March 31, 2018 and March 31, 2019, respectively

- On reclassification of Panaya and Skava from ‘Held for Sale’, the Company recognized an adjustment in respect of excess of carrying amount over recoverable amount of ₹ 451 crore in respect of Skava during the year ended March 31, 2019

(2) Adjusted for the September 2018 bonus issue

(3) Based on IFRS USD financial statements

(4) FS – Includes enterprises in Financial Services and Insurance

(5) Retail – Includes enterprises in Retail, Consumer Packaged Goods and Logistics

(6) COM – Includes enterprises in Communication, Telecom OEM and Media

(7) EURS – Includes enterprises in the Energy, Utilities, Resources and Services

(8) MFG – Includes enterprises in Manufacturing

(9) Hi-Tech – Includes enterprises in Hi-Tech

(10) LS – Includes enterprises in Life Sciences and Healthcare

(11) Others – Includes segments of businesses in India, Japan, China, Infosys Public Services and other public services enterprises.

Capital expenditure on tangible assets – standalone

This year, on a standalone basis, we incurred a capital expenditure of ₹ 3,040 crore. This comprises ₹ 2,008 crore in infrastructure, ₹ 1,023 crore for investment in computer equipment, and ₹ 9 crore in vehicles.

In the previous year, we had incurred a capital expenditure of ₹ 1,823 crore. This comprised ₹ 1,422 crore in infrastructure, ₹ 396 crore for investment in computer equipment, and ₹ 5 crore in vehicles.

Capital expenditure on tangible assets – consolidated

This year, on a consolidated basis, we incurred a capital expenditure of ₹ 3,193 crore. This comprises ₹ 2,055 crore in infrastructure, ₹ 1,129 crore in computer equipment and ₹ 9 crore in vehicles.

In the previous year, we had incurred a capital expenditure of ₹ 1,955 crore. This comprised ₹ 1,479 crore in infrastructure, ₹ 471 crore for investment in computer equipment and ₹ 5 crore in vehicles.

Liquidity

Our principal sources of liquidity are cash and cash equivalents, current investments and the cash flow that we generate from our operations. We continue to be debt-free and maintain sufficient cash to meet our strategic and operational requirements. We understand that liquidity in the Balance Sheet has to balance between earning adequate returns and the need to cover financial and business requirements. Liquidity enables us to be agile and ready for meeting unforeseen strategic and business needs. We believe that our working capital is sufficient to meet our current requirements.

As of March 31, 2019, we had ₹ 30,793 crore in working capital (working capital defined as current assets minus current liabilities) on a standalone basis, and ₹ 34,240 crore on a consolidated basis.

Liquid assets stand at ₹ 25,790 crore on a standalone basis and ₹ 30,690 crore on a consolidated basis as at March 31, 2019, as against ₹ 27,752 crore on a standalone basis, and ₹ 31,765 crore on a consolidated basis as on March 31, 2018.

Liquid assets, on both standalone and consolidated basis, include deposits with banks and high-rated financial institutions, investments in liquid mutual funds, fixed maturity plan securities, tax-free bonds, government bonds and securities, non-convertible debentures, certificates of deposit (CDs), and commercial paper. CDs represent marketable securities of banks and eligible financial institutions for a specified time period with high credit rating given by domestic credit rating agencies. Investments made in non-convertible debentures are issued by government-owned institutions and financial institutions with high credit rating. The details of these investments are disclosed under the ‘non-current and current investments’ section in the standalone and consolidated financial statements in this Annual Report.

Capital Allocation Policy

- In line with the Capital Allocation Policy announced in April 2018, the Board, at its meeting on January 11, 2019, approved the buyback of equity shares through the open market route through the Indian stock exchanges, amounting to ₹ 8,260 crore (maximum buyback size) at a price not exceeding ₹ 800 per equity share (maximum buyback price), subject to the shareholders’ approval by way of a postal ballot. Further, the Board also approved a special dividend of ₹ 4 per share which resulted in a payout of ₹ 2,107 crore (including dividend distribution tax).

- The buyback is offered to all eligible equity shareholders of the Company (other than the Promoters, the Promoter Group and Persons in Control of the Company) under the open market route through Indian stock exchanges.

The shareholders approved the proposal of buyback of equity shares through the postal ballot that concluded on March 12, 2019. At the maximum buyback price of ₹ 800 per equity share and the maximum buyback size of ₹ 8,260 crore, the maximum indicative number of equity shares bought back would be 10,32,50,000 equity shares (maximum buyback shares) comprising approximately 2.36% of the paid-up equity share capital of the Company.

The Company will fund the buyback from its free reserves. The buyback of equity shares through Indian stock exchanges commenced on March 20, 2019 and is expected to be completed by September 2019. During the year ended March 31, 2019, 1,26,52,000 equity shares were bought back from the Indian stock exchanges. Subsequent to the year end, the Company has purchased 81,31,000 shares till the date of the Board’s report.

After the execution of the above, along with the special dividend (including dividend distribution tax) of ₹ 2,633 crore already paid in June 2018, the Company would complete the distribution of ₹ 13,000 crore to the shareholders, which was announced as part of its Capital Allocation Policy in April 2018.

Basic EPS

Basic earnings per share decreased by 5.6% to ₹ 33.66 at the standalone level and by 0.3% to ₹ 35.44 at the consolidated level.

Dividend

Dividend per share declared is in line with the Capital Allocation Policy approved by the Board on April 13, 2018. The Company declared dividend as under :

|

Fiscal 2019 |

Fiscal 2018(1) |

|||

|

Dividend per share (in ₹) |

Dividend Payout |

Dividend per share (in ₹) |

Dividend Payout |

|

|

Interim dividend |

7.00 |

3,680 |

6.50 |

3,422 |

|

Final dividend |

(2) 10.50 |

(3) 5,504 |

10.25 |

5,349 |

|

Special dividend |

4.00 |

2,107 |

5.00 |

2,633 |

|

Total dividend |

21.50 |

21.75 |

||

|

Payout ratio(4) (interim and final dividend) |

(5) 68.6% |

69.8% |

||

Dividend payout includes dividend distribution tax

(1) Adjusted for the September 2018 bonus issue

(2) Recommended by the Board of Directors at its meeting held on April 12, 2019. The payment is subject to the approval of the shareholders at the ensuing Annual General Meeting (AGM) of the Company to be held on June 22, 2019 and will be paid on June 25, 2019.

(3) Actual dividend payout will be based on the number of shares outstanding as on the book closure date.

(4) Our dividend policy is to pay up to 70% of free cash flow. Free cash flow is defined as net cash provided by operating activities less capital expenditure as per the Consolidated Statement of Cash Flows prepared under IFRS.

(5) Based on the outstanding number of shares as on March 31, 2019.

The Register of Members and Share Transfer Books will remain closed on June 15, 2019 for the purpose of payment of the final dividend for the financial year ended March 31, 2019. The AGM is scheduled to be held on June 22, 2019 and the final dividend will be paid on June 25, 2019.

Bonus issue

The Board, at its meeting held on July 13, 2018, approved and recommended the issue of bonus shares to celebrate the 25th year of the Company’s public listing in India and to further increase the liquidity of its shares. The shareholders approved the issue of bonus shares (vide postal ballot concluded on August 22, 2018). The Company had allotted 218,41,91,490 fully-paid-up equity shares of face value ₹ 5 each. A bonus share of one equity share for every equity share held, and a bonus issue, viz., a stock dividend of one American Depositary Share (ADS) for every ADS held have been allotted. The bonus shares were credited to the eligible shareholders as on the record date, i.e. September 5, 2018.

Particulars of loans, guarantees or investments

Loans, guarantees and investments covered under Section 186 of the Companies Act, 2013 form part of the Notes to the financial statements provided in this Annual Report.

Transfer to reserves

We propose to transfer ₹ 1,470 crore to the general reserve on account of the declaration of dividend.

Fixed deposits

We have not accepted any fixed deposits, including from the public, and, as such, no amount of principal or interest was outstanding as of the Balance Sheet date.

Particulars of contracts or arrangements made with related parties

Particulars of contracts or arrangements with related parties referred to in Section 188(1) of the Companies Act, 2013, in the prescribed Form AOC-2, is appended as Annexure 2 to the Board’s report.

Management’s discussion and analysis

In terms of the provisions of Regulation 34 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the Management’s discussion and analysis is set out in this Annual Report.

Risk management report

In terms of the provisions of Section 134 of the Companies Act, 2013, a Risk management report is set out in this Annual Report.

Board policies

The details of the policies approved and adopted by the Board are provided in Annexure 9 to the Board’s report.

Material changes and commitments affecting financial position between the end of the financial year and date of the report

Acquisition

Hitachi Procurement Service Co. Ltd

On April 1, 2019, Infosys Consulting Pte Limited (a wholly-owned subsidiary of Infosys Limited) acquired 81% of voting interests in Hitachi Procurement Service Co., Ltd. (HIPUS), Japan, a wholly-owned subsidiary of Hitachi Ltd, Japan for a total cash consideration of JPY 3.29 billion (approximately ₹ 206 crore), on fulfilment of closing conditions. The Company had paid an advance of JPY 3.29 billion (approximately ₹ 206 crore) to Hitachi towards cash consideration on March 29, 2019. HIPUS handles indirect materials purchasing functions for the Hitachi Group. The name of the Company – Hitachi Procurement Service Co., Ltd. – has been changed to HIPUS Co., Ltd. with effect from April 1, 2019.

As of April 12, 2019 (i.e., the date of adoption of financial statements by the Board of Directors), the Company is in the process of finalizing the accounting for acquisition of HIPUS, including allocation of purchase consideration to identifiable assets and liabilities.

2. Business description

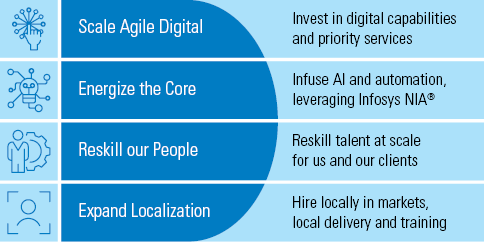

Strategy

Our strategic objective is to build a sustainable organization that remains relevant to the agenda of our clients, while creating growth opportunities for our employees and generating profitable growth for our investors.

Our clients and prospective clients are faced with transformative business opportunities due to advances in software and computing technology. These organizations are dealing with the challenge of having to reinvent their core offerings, processes and systems rapidly and position themselves as ‘digitally enabled’. The journey to the digital future requires not just an understanding of new technologies and new ways of working, but a deep appreciation of existing technology landscapes, business processes and practices. Our strategy is to be a navigator for our clients as they ideate on, plan and execute their journey to a digital future.

We have embraced a four-pronged strategy to strengthen our relevance to clients and drive accelerated value creation. Towards implementing the strategy, we will :

|

|

|

|

Scale Agile Digital

We will continue to make targeted investments to rapidly accelerate our Agile Digital business. We define ‘digital’ as a set of use cases that drive business outcomes for our clients across five areas :

- Experience : Well-designed systems for digital marketing, omnichannel interaction, personalization and content management that can enhance customer experience

- Insight : AI-based systems for advanced analytics, leveraging Big Data

- Innovate : Engineering new and digital-first products and offerings leveraging Internet of Things and advanced industry Software-as-a-Service platforms

- Accelerate : The digitization of core systems by migrating to cloud technologies, abstracting APIs, modernizing legacy systems and infrastructure, integrating applications and leveraging Robotic Process Automation (RPA)

- Assure : Implementing advanced cyber-security systems and specialized validation of software systems.

We use our Digital Navigation Framework to help our clients transform their organization and achieve these business outcomes. The framework is a set of accelerators that, when combined together, fast-track the process of transformation. These accelerators are distinct capabilities in the areas of Design, Proximity centers, Agile methodologies, Automation assets and Learning platforms.

In addition to these, we will also invest in sales and consulting capabilities to engage with clients both in their technology divisions and their business organizations.

We will continue to leverage alliances that complement our core competencies. We will continue to partner with leading technology software and hardware providers in creating, deploying, integrating and operating business solutions for our clients.

We will continue to invest in research and development (R&D) to stay abreast of new technologies and to incubate new offerings in areas such as blockchain, AR / VR and speech, vision, video and image intelligence. We will expand the scope of our collaborations to encompass universities, research organizations and the startup innovation ecosystem.

We will continue to deploy our capital in making selective business acquisitions that augment our Agile Digital expertise, to complement our presence in certain market segments.

Energize the core

We will continue to embrace automation and artificial intelligence (AI)-based techniques and software automation platforms to boost productivity of our clients’ core processes and systems.

We will continue to leverage these, along with lean processes, agile development and our Global Delivery Model to deliver solutions and services to our clients in the most cost-effective manner, while at the same time optimizing our cost structure to remain competitive.

We will continue to invest in our flagship RPA platform AssistEdge®, our AI platform, Infosys NIA®, and in core business applications such as Finacle®, McCamish and others to bring differentiated and market-leading features and capabilities to our projects with clients.

Reskill our people

An exponential adoption of new technologies is leading to a wide digital talent gap. As technology shifts gain rapid acceleration, we will continue to drive talent reskilling at scale for our own employees and for our clients’ organizations in the new areas of digital services.

Teaching and learning are central to the Infosys culture. Our investments in our Global Education Center and in creating various learning opportunities for our employees help our employees stay abreast of new developments in software technologies, spur innovation and help them build a lifelong career with the Company.

We will continue to invest in advanced, anytime-anywhere learning systems such as our Lex platform and in creating and harnessing up-to-date content from internal and external sources. Further, we are expanding our relationships with universities around the world to curate specific curricula for our employees in areas such as creative design skills, machine learning, autonomous technologies, blockchain etc.

Expand localization

We believe that client proximity lends several benefits while delivering Agile Digital transformations, and we will continue to invest in localizing our workforce in various geographies. We had announced the setting up of four delivery and innovation centers in the US in fiscal 2018, and announced one more in fiscal 2019. These centers are already operational in Indiana, Connecticut, Rhode Island, Texas and North Carolina. We are recruiting locally from universities in the US. We aim to become an employer of choice for US universities and will set up dedicated leadership and support teams in the US, Europe and Australia. Our strategy to localize will also reduce our dependence on immigration policies.

Organization

Our go-to-market business units are organized as :

- Financial Services and Insurance

- Life Sciences and Healthcare

- Manufacturing

- Retail, Consumer Packaged Goods and Logistics

- Hi-Tech

- Communications, Telecom OEM and Media

- Energy, Utilities, Resources and Services

- China

- Japan

- India

- Infosys Public Services

- Other public services enterprises

Our solutions are primarily classified as digital and core.

- Digital

- Experience

- Insight

- Innovate

- Accelerate

- Assure

- Core

- Application management services

- Proprietary application development services

- Independent validation solutions

- Product engineering and management

- Infrastructure management services

- Traditional enterprise application implementation

- Support and integration services

- Products and Platforms

- Finacle®

- Edge suite

- Infosys NIA®

- Infosys McCamish

- Panaya®

- Skava®

- Business Process Management – Infosys BPM

Client base

Our client-centric approach continues to bring us high levels of client satisfaction. We derived 97.3% of our consolidated revenues from repeat business this fiscal. We, along with our subsidiaries, added 345 new clients, including a substantial number of large global corporations. Our total client base at the end of the year stood at 1,279. The client segmentation, based on the last 12 months’ revenue for the current and previous years, on a consolidated basis, is as follows :

|

Clients |

2019 |

2018 |

|

100 million dollar + |

25 |

20 |

|

50 million dollar + |

60 |

57 |

|

10 million dollar + |

222 |

198 |

|

1 million dollar + |

662 |

634 |

Infrastructure

We added 2.75 million sq. ft. of physical infrastructure space during the year. The total available space as on March 31, 2019 stands at 49.32 million sq. ft. We have presence in 191 locations across 46 countries as on March 31, 2019.

Infosys Innovation Fund

Our investment and acquisition strategy is designed to strengthen our competitive positioning and bring technology innovation to our clients. We have a multi-pronged strategy in identifying, investing in, and evangelizing next-generation technologies. We believe we will achieve this through organic investments in R&D, as well as by making investments in external innovation ecosystems and in particular, technology startup companies.

The Infosys Innovation Fund identifies early-stage startup companies developing innovative, next-generation solutions and technologies in the areas of AI and machine learning, Big Data and analytics, convergence of physical and digital processes, technology infrastructure management, cloud systems and cybersecurity. The Fund partners with startups by providing early-stage capital and in helping bring their innovations to market, attaining scale, product validation and customer introductions.

The Fund has invested US$ 59 million to date in the form of minority holdings in early-stage companies. During the year, the Company divested its stake in two investments resulting in a net gain of US$ 8 million. As of March 31, 2019, the Fund has an additional US$ 12 million in uncalled / pending capital commitments. The carrying value of investments as on March 31, 2019 was US$ 20 million (₹ 138 crore).

Subsidiaries

We, along with our subsidiaries, provide consulting, technology, outsourcing and next-generation digital services. At the beginning of the year, we had 20 direct subsidiaries and 26 step-down subsidiaries. As on March 31, 2019, we have 25 direct subsidiaries and 34 step-down subsidiaries.

We have acquired following subsidiaries during the year :

- On May 22, 2018, Infosys acquired 100% of the voting interests in WongDoody Holding Company Inc., (WongDoody) an US-based, full-service creative and consumer insights agency. The business acquisition was conducted by entering into a share purchase agreement for a total consideration of up to US$ 75 million (approximately ₹ 514 crore on acquisition date).

- On October 11, 2018, Infosys Consulting Pte Limited (a wholly-owned subsidiary of Infosys Limited) acquired 100% voting interests in Fluido Oy (Fluido), a Nordic-based Salesforce advisor and consulting partner in cloud consulting, implementation and training services, for a total consideration of up to € 65 million (approximately ₹ 560 crore).

- On November 16, 2018, Infosys Consulting Pte Limited (a wholly-owned subsidiary of Infosys Limited) acquired 60% stake in Infosys Compaz Pte. Ltd, a Singapore-based IT services company. The business acquisition was conducted by entering into a share purchase agreement for a total consideration of up to SGD 17 million (approximately ₹ 91 crore on acquisition date).

Assets held for sale : During the year ended March 2018, the Company had initiated identification and evaluation of potential buyers for its subsidiaries, Kallidus and Skava (together referred to as “Skava”) and Panaya, collectively referred to as “the disposal group”. The disposal group was classified and presented separately as ‘Held for Sale’ and was carried at the lower of carrying value and fair value. Consequently, a reduction in the fair value of the disposal group held for sale amounting to ₹ 118 crore in respect of Panaya had been recognized in the Consolidated Statement of Profit and Loss for the year ended March 31, 2018. Accordingly, assets amounting to ₹ 2,060 crore and liabilities amounting to ₹ 324 crore in respect of the disposal group had been classified as “held for sale”. In the standalone financial statements, on reclassification, the investment in these subsidiaries was classified and presented separately as ‘Held for Sale’ and was carried at the lower of carrying value and fair value. Consequently, a reduction in the fair value of investment of ₹ 589 crore in respect of Panaya was recognized in the Standalone Statement of Profit and Loss. Accordingly, investments amounting to ₹ 1,525 crore in respect of these subsidiaries had been reclassified as “held for sale”.

During the year ended March 31, 2019, on remeasurement, including consideration of progress in negotiations on offers from prospective buyers for Panaya, the Company recorded a reduction in the fair value of the disposal group held for sale amounting to ₹ 270 crore in respect of Panaya in the consolidated financial statements and a reduction in the fair value of investment amounting to ₹ 265 crore in respect of Panaya in the standalone financial statements.

Further, during the year ended March 31, 2019, based on the evaluation of proposals received and progress of negotiations with potential buyers, the Company concluded that the disposal group does not meet the criteria for ‘Held for Sale’ classification because it is no longer highly probable that the sale would be consummated by March 31, 2019 (12 months from the date of initial classification under ‘Held for Sale’). Accordingly, as per Ind AS 105, Non-current Assets held for Sale and Discontinued Operations, the assets and liabilities of Panaya and Skava have been included on a line-by-line basis in the consolidated financial statements for the period and as at March 31, 2019. On reclassification from ‘Held for Sale’, the assets of Panaya and Skava have been remeasured in the year ended March 31, 2019 at the lower of cost and recoverable amount resulting in an adjustment in respect of excess of carrying amount over recoverable amount on reclassification from ‘Held for Sale’ of ₹ 451 crore (comprising ₹ 358 crore towards goodwill and ₹ 93 crore towards the value of customer relationships) in respect of Skava in the Consolidated Statement of Profit and Loss for the year ended March 31, 2019. In the standalone financial statements, the investment in subsidiaries Panaya and Skava have been remeasured at the lower of cost and recoverable amount resulting in recognition of an adjustment in respect of excess of carrying amount over recoverable amount on reclassification from ‘Held for Sale’ of ₹ 469 crore in respect of Skava in the Standalone Statement of Profit and Loss for the year ended March 31, 2019. Refer to Note 2.1.2 of the Consolidated financial statements and Note 2.3.8 of the Standalone financial statements.

Proposed acquisition

Stater N.V.

On March 28, 2019, Infosys Consulting Pte Limited (a wholly-owned subsidiary of Infosys Limited) entered into a definitive agreement to acquire 75% of the shareholding in Stater N.V., a wholly-owned subsidiary of ABN AMRO Bank N.V., the Netherlands, for a consideration including base purchase price of up to € 127.5 million (approximately ₹ 990 crore) and customary closing adjustments, subject to regulatory approvals and fulfilment of closing conditions.

During the year, the Board of Directors reviewed the affairs of the subsidiaries. In accordance with Section 129(3) of the Companies Act, 2013, we have prepared the Consolidated financial statements of the Company, which form part of this Annual Report. Further, a statement containing the salient features of the financial statement of our subsidiaries in the prescribed format AOC-1 is appended as Annexure 1 to the Board’s report. The statement also provides details of the performance and financial position of each of the subsidiaries.

In accordance with Section 136 of the Companies Act, 2013, the audited financial statements, including the consolidated financial statements and related information of the Company and audited accounts of each of its subsidiaries, are available on our website, www.infosys.com. These documents will also be available for inspection till the date of the AGM during business hours at our registered office in Bengaluru, India.

Quality

The Quality function at Infosys internalized the organization’s vision and strategy of ‘Navigate the Next’, and formulated three strategic imperatives :

- Differentiate

- Optimize

- De-Risk

Our Quality department drove the org-wide agile transformation to scale our capabilities for Agile Digital in tune with the Company strategy. It led the way in driving Lean and Automation throughout the organization to enhance productivity and improve quality. It deployed robust frameworks and tools for service lines in a collaborative manner and has enabled several thousand employees on these over the past year. The Quality department was instrumental in developing and Open Sourcing the Infosys DevOps Platform – a key differentiator for Infosys in its Agile & DevOps offering.

The Quality department-led ‘Be the Navigator’ workshops across the organization helped enhance monetization of these ideas for Infosys. The Quality department worked with cross-functional teams to drive enterprise agility by simplifying processes, reducing cost and enhancing employee experience.

We proactively led compliance and assurance through audits and assessments to intensely reduce risk for the organization, with increased coverage of services and centers. We continue to comply with international management system standards and models viz. ISO 9001, ISO 27001, CMMI, ISO 14001, OHSAS 18001, ISO 22301, ISO 20000 and AS 9100 in fiscal 2019. Our European centers have been assessed for GDPR requirements as well. Infosys Limited as an enterprise is assessed for ISAE 3402 / SSAE 18 SOC 1 type II and has received an independent auditors’ assurance compliance report.

Branding

The Infosys brand is a key intangible asset for the Company. It positions Infosys as a next-generation digital services company that helps enterprises navigate their digital transformation. Brand Infosys is built around the premise that our three decades of experience in managing the systems and workings of global enterprises uniquely positions us to be navigators for our clients. We do it by enabling the enterprise with an AI-powered core that helps prioritize the execution of change. We also empower the business with Agile Digital at scale to deliver unprecedented levels of performance and customer delight. Our Always-on Learning foundation drives their continuous improvement through building and transferring digital skills, expertise and ideas from our innovation ecosystem. Our Localization investments in talent and digital centers help accelerate the enterprise transformation agenda. We deliver on this promise with our Digital Navigation Framework.

Our marketing reach extends globally through digital-first multi-channel campaigns. A good example is the Infosys Boosting American Innovation campaign that has helped elevate the perception of the brand as a locally-relevant digital partner. As the digital innovation partner for the Australian Open, Roland-Garros and the ATP, we help showcase how brand Infosys is reimagining the tennis ecosystem for a billion fans globally leveraging data, insights and digital experiences. We participate in premier business and industry events around the world, while also organizing our own signature events and CXO roundtables. Confluence, our flagship client event series across the US, Europe and APAC, is rated highly by our clients and industry partners.

Awards and recognition

In fiscal 2019, we won multiple awards and honors, both international and national. The significant ones among them are as follows :

Business and management

- Rated for the second time in a row under the leadership category in a corporate governance study conducted jointly by BSE Limited and the International Finance Corporation, a member of the World Bank Group, and Institutional Investors Advisory Services, based on

G20 / OECD principles, which are globally accepted benchmarks for corporate governance - Won the Platinum award at the Asset Corporate Awards, the longest running Environment, Social, and Governance awards in Asia, for the ninth consecutive year. This award is based on an evaluation of financial performance, management, corporate governance, social and environmental responsibility and investor relations

- Received awards for Best CFO, Best Investor Relations Professional, Best Investor Relations Program, Best Asia In-house Tax Team, Best Corporate Governance, Best ESG SRI Metrics, and Best Analyst Day in the 2018 All-Asia Executive Team rankings in the Technology / IT Services and Software sector

- Won the 2018 Golden Peacock Award for risk

management

Digital services and technology innovation

- Recognized as a Leader in The Forrester Wave™ : Digital Process Automation Service Providers, Q3 2018

- Positioned as a Leader in IDC MarketScape : Western Europe Digital Quality Assurance Services 2018 Vendor Assessment

- Recognized as a Leader in NelsonHall NEAT, Digital Banking Services 2018

- Recognized as a Leader in Gartner’s Magic Quadrant for Public Cloud Infrastructure Professional and Managed Services worldwide

- Honored with five awards at the DevOps Industry Awards, 2018

- Won five prestigious Oracle North America Specialized Partner of the Year Awards

- Positioned as a Leader in IDC MarketScape 2018 for Worldwide Oracle Implementation Services

Banking (for Finacle®)

- Finacle® was positioned as a leader in the Gartner Magic Quadrant for Global Retail Core Banking

- A consortium of seven leading banks in India powered by Finacle’s blockchain-based trade network won the Best Trade Finance and Supply Chain Initiative award at the Celent Model Bank Awards 2018

Human resources

- The Company’s global internship program, InStep, was ranked No.1 in the Best Overall Internship category by Vault.com’s survey on Top Internships for 2019

- Recognized by the Top Employers Institute as a top employer of 2019 for excellence in employment practices. Also ranked among the top three employers in Europe and the Middle East

- Our performance management system – iCount – bagged the Association of Talent Development’s Excellence in Practice award for talent management

Sustainability

- Listed as an index component of the prestigious Dow Jones Sustainability Indices (DJSI) and is part of the DJSI World and DJSI Emerging Markets indices

- Included in the prestigious Climate A list for a second consecutive year by the Carbon Disclosure Project

- Received Gold recognition from EcoVadis for CSR practices including environment, labor and human rights, ethics and sustainable procurement

For the complete list of awards and recognition, refer to https://www.infosys.com/about/awards.

3. Human resources management

At Infosys, we focus on the workplace of tomorrow that promotes a collaborative, transparent and participative organization culture, encourages innovation, and rewards individual contribution. The focus of human resources management at Infosys is to ensure that we enable each and every employee to navigate the next, not just for clients, but also for themselves. We have reimagined our employee value proposition, to make it more meaningful to our employees.

The three key strategic pillars under this are :

- Inspiring them to build what’s next

- Making sure their career never stands still

- Navigating further, together

Here are some of the initiatives we have pioneered this year :

- Be the Navigator : An empowerment program to encourage purposeful innovation for clients. Impetus is given in the form of hackathons, makeathons, ideathons and knowledge-sharing sessions. The initiative has been taken up in the US, Australia and UK as well. We already have a repository of 2,000+ stories of incremental innovation.

- Awards for Excellence : The Awards for Excellence remains our largest rewards and recognition platform for employees. This year, we received the highest number of nominations across geographies, covering over 20 categories.

- Petit Infoscion Day : An eagerly-awaited family-day event for employees completes 25 exciting years. Children are engaged through fun and educational activities and their academic and co-curricular achievements rewarded.

- HALE : Our Health Assessment & Lifestyle Enrichment program for employees is celebrating 15 years of building and sustaining a healthy and productive workforce by promoting health and well-being, ensuring safety, and encouraging work-life balance.

- Manager enablement : Empowering managers through analytics-based, customizable learning tools such as MaQ, and initiatives such as MPACT, MSPEED and Pravesh, that focus on continuous learning, reskilling and refactoring of talent. Significant rewards await the top managers who ace the challenges.

- Digital transformation : A key HR initiative to create an agile, connected and empowered workforce. InfyMe, our new mobile app, helps employees with first-hand information and access to systems and processes anytime, anywhere.

- Onboarding experience : The Launchpad app has simplified the joining process for our new hires in the US and in India, ensuring easy connect, less paperwork, and seamless integration into the organization.

- Skill Tags and Bridge programs : To help our employees reskill, we introduced Skill Tags, aligned to our digital and niche service offerings which offer employees a new-age skill identity. The Bridge Program enables employees to steer their career into new areas of work such as domain and techno-functional consulting, specialist programming, technical architect and design roles.

- Expanding our overseas workforce : With a constant focus on localization, we have increased our emphasis on rewards and recognition to keep the local talent pool motivated in our key markets, such as the US. In the UK and the rest of Europe, we have partnered with local universities, supported large people transition and integration programs, and for the first time, made it to the list of Forbes’ Best Employers for New Graduates List. Infosys China celebrated 15 years, and Impressions, the new joinee assimilation program, was reinstated. In Australia, we have been hiring local talent and absorbing them into key accounts.

- Stock Incentive Rewards program : We have focused on differentiated rewards for high performers via Restricted Stock Units (RSUs) in the form of Indian shares or ADRs across levels. We also have points-based incentives for learning new skills, enhanced maternity benefits in the US, new retail insurance plans in India, and various compensation programs across geographies to attract and retain the best talent.

Internal complaints committee

Infosys has constituted an Internal Committee (IC) in all the development centers of the Company across India to consider and resolve all sexual harassment complaints reported by women. The constitution of the IC is as per the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 and the committee includes external members from NGOs or with relevant experience. Investigation is conducted and decisions made by the IC at the respective location, and a senior woman employee is the presiding officer over every case. Half of the total members of the IC are women. The details of complaints pertaining to sexual harassment that were filed, disposed of and pending during the financial year are provided in the Business responsibility report of this Annual report.

Education, training and assessment

Infosys believes in lifelong learning and competency development for its employees. Our Education, Training and Assessment (ETA) team has been instrumental in creating a culture of learning in the organization. Lex, a highly scalable, mobile-first, modular learning platform that allows our employees to access learning content from anywhere, any device, at any time, is ETA’s newest offering. The recommendation engine in Lex suggests appropriate learning paths based on the adjacency skills of employees. We now have about 700 courses on Lex, in addition to over 1,500 courses in instructor-led training mode. Managers can create their own learning paths and goals and share them with their teams. The platform is being made available to our customers as Wingspan.

We are working with various academic institutions to reskill our employees. We have collaborations with the Rhode Island School of Design to train employees on design skills, with Purdue University on cybersecurity, with Trinity College, Hartford on business analysis skills, with Cornell University on program management, and with the University of North Carolina for data analytics.

We launched a platform called InfyTQ, with several courses on technical and professional skills, aimed at improving the understanding of the fundamental building blocks of technology among engineering students across India, to help them become industry-ready.

Campus Connect, our industry-academia partnership program, made progress with the launch of electives to help engineering colleges run new programs within their curricula. In fiscal 2019, we engaged with 564 faculty members who in turn trained 52,051 students. With this, the total number of beneficiaries covered has reached 15,783 faculty members and 5,08,375 students from 274 engineering institutions.

Infosys Leadership Institute

Deepening our focus on enabling leaders on their personalized development journey, Infosys Leadership Institute (ILI) offered a variety of leadership development experiences in fiscal 2019. ILI continued to work closely with business leaders and HR leaders to gain deep insights into the development focus areas and learning themes across the organization. Based on these insights, ILI offered executive-level skill-building programs such as Executive Presence, Boardroom Excellence, Powerful Communication, and sales enablement programs such as Human Side of the Deal, Consultative Selling and Deal Coaching. These programs were facilitated in partnership with best-in-class global leadership development organizations across locations, including the US, the UK, Australia and India.

ILI also continued its partnership with Stanford Graduate School of Business and had one cohort of 64 leaders graduating this year. The cohort also participated in strategic enterprise-wide projects, along with executive coaching as part of their development. We also completed Leadership Talent Reviews across our business to identify leadership capability and successor readiness. In support of the organizational objectives on Diversity and Inclusion, ILI also enhanced its focus on women leaders by designing and offering exclusive programs for them. Overall, we had 1,352 participants across leadership levels leverage the various development interventions through the year.

Infosys Knowledge Institute

The Infosys Knowledge Institute (IKI), established in 2018, helps industry leaders develop a deeper understanding of business and technology trends through compelling thought leadership. Our researchers and subject matter experts provide a fact base that aids decision-making on critical business and technology issues. Our current research focuses on five strategic themes : employee experience and learning, impact of AI and automation, agile enterprises, design as a multi-faceted discipline, and the role of physical location in the future of work. IKI also publishes regularly on industry, function, and technology trends.

Particulars of employees

The Company had 1,80,457 employees (on a standalone basis) as of March 31, 2019. The percentage increase in remuneration, ratio of remuneration of each director and key managerial personnel (KMP) (as required under the Companies Act, 2013) to the median of employees’ remuneration, and the list of top 10 employees in terms of remuneration drawn, as required under Section 197(12) of the Companies Act, 2013, read with Rule 5 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, form part of Annexure 3 to this Board’s report.

The statement containing particulars of employees employed throughout the year and in receipt of remuneration of ₹ 1.02 crore or more per annum and employees employed for part of the year and in receipt of remuneration of ₹ 8.5 lakh or more per month, as required under Section 197(12) of the Companies Act, 2013, read with Rule 5 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, is provided in a separate exhibit forming part of this report and is available on the website of the Company at https://www.infosys.com/investors/reports-filings/Documents/exhibit-boards-report2019.pdf. The Annual Report and accounts are being sent to the shareholders excluding the aforesaid exhibit. Shareholders interested in obtaining this information may access the same from the Company website or send a written request to the Company.

In accordance with Section 136 of the Companies Act, 2013, this exhibit is available for inspection by shareholders at the Registered Office of the Company during business hours on all working days, 21 days before the Annual General Meeting and copies may be made available on request.

Notes :1. The employees mentioned in the aforesaid exhibit have / had permanent employment contracts with the Company.

2. The employees are neither relatives of any directors of the Company, nor hold 2% or more of the paid-up equity share capital of the Company as per Rule 5 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014.

3. The details of employees posted outside India and in receipt of a remuneration of ₹ 60 lakh or more per annum or ₹ 5 lakh or more a month can be provided on request.

Employee stock options / RSUs

The Company, under the 2015 Stock Incentive Compensation Plan (“the 2015 Plan”), approved by the shareholders (vide postal ballot concluded on March 31, 2016), grants share-based benefits to eligible employees with a view to attracting and retaining the best talent, encouraging employees to align individual performances with Company objectives, and promoting increased participation by them in the growth of the Company.

The total number of equity shares and American Depositary Receipts (ADRs) to be allotted to the employees of the Company and its subsidiaries, pursuant to the exercise of the stock incentives under the 2015 Plan, shall not cumulatively exceed 1% of the issued capital. The 2015 Plan is in compliance with SEBI (Share Based Employee Benefits) Regulations, 2014, as amended from time to time and there has been no material changes to the plan during the fiscal. The details of the 2015 Plan, including terms of reference, and the requirement specified under Regulation 14 of the SEBI (Share Based Employee Benefits) Regulations, 2014, are available on the Company’s website, at

https://www.infosys.com/investors/reports-filings/Documents/disclosures-pursuant-SEBI-regulations2019.pdf.

The details of the 2015 Plan form part of the Notes to accounts of the financial statements in this Annual Report.

4. Corporate governance

Our corporate governance philosophy

Our corporate governance practices are a reflection of our value system encompassing our culture, policies, and relationships with our stakeholders. Integrity and transparency are key to our corporate governance practices to ensure that we gain and retain the trust of our stakeholders at all times. Corporate governance is about maximizing shareholder value legally, ethically and sustainably. At Infosys, our Board exercises its fiduciary responsibilities in the widest sense of the term. Our disclosures seek to attain the best practices in international corporate governance. We also endeavor to enhance long-term shareholder value and respect minority rights in all our business decisions.

Our Corporate governance report for fiscal 2019 forms part of this Annual Report.

Board diversity

The Company recognizes and embraces the importance of a diverse board in its success. We believe that a truly diverse board will leverage differences in thought, perspective, knowledge, skill, regional and industry experience, cultural and geographical backgrounds, age, ethnicity, race and gender, that will help us retain our competitive advantage. The Board Diversity Policy adopted by the Board sets out its approach to diversity. The policy is available on our website, at https://www.infosys.com/investors/corporate-governance/documents/board-diversity-policy.pdf.

Additional details on Board diversity are available in the Corporate governance report that forms part of this Annual Report.

Number of meetings of the Board

The Board met 12 times during the financial year. The meeting details are provided in the Corporate governance report that forms part of this Annual Report. The maximum interval between any two meetings did not exceed 120 days, as prescribed in the Companies Act, 2013.

Policy on directors’ appointment and remuneration

The current policy is to have an appropriate mix of executive, non-executive and independent directors to maintain the independence of the Board, and separate its functions of governance and management. As of March 31, 2019, the Board had nine members, two of whom are executive directors, one a non-executive and non-independent member and six independent directors. Three of the independent directors of the Board are women.

The policy of the Company on directors’ appointment and remuneration, including the criteria for determining qualifications, positive attributes, independence of a director and other matters, as required under sub-section (3) of Section 178 of the Companies Act, 2013, is available on our website, at https://www.infosys.com/investors/corporate-governance/documents/nomination-remuneration-policy.pdf.

We affirm that the remuneration paid to the directors is as per the terms laid out in the Nomination and Remuneration Policy of the Company.

Declaration by independent directors

The Company has received necessary declaration from each independent director under Section 149(7) of the Companies Act, 2013, that he / she meets the criteria of independence laid down in Section 149(6) of the Companies Act, 2013 and Regulation 25 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

Board evaluation

The nomination and remuneration committee engaged Egon Zehnder, external consultants, to conduct Board evaluation for the year. The evaluation of all the directors, committees, Chairman of the Board, and the Board as a whole was conducted based on the criteria and framework adopted by the Board. The evaluation parameters and the process have been explained in the Corporate governance report.

Familiarization program for independent directors

All new independent directors inducted into the Board attend an orientation program. The details of the training and familiarization program are provided in the Corporate governance report. Further, at the time of the appointment of an independent director, the Company issues a formal letter of appointment outlining his / her role, function, duties and responsibilities. The format of the letter of appointment is available on our website, at

https://www.infosys.com/investors/corporate-governance/Documents/appointment-independent-director.pdf.

Directors and KMP

Inductions

- Michael Gibbs was appointed as an independent director to the Board, effective July 13, 2018. The appointment was approved by shareholders (vide postal ballot concluded on August 22, 2018).

- Nilanjan Roy was appointed as Chief Financial Officer and as a KMP, effective March 1, 2019.

Reappointments

- Kiran Mazumdar-Shaw was reappointed as an independent director, effective April 1, 2019, and the same was approved by shareholders (vide postal ballot concluded on March 12, 2019).

- Based on the terms of appointment, executive directors and the non-executive and non-independent chairman are subject to retirement by rotation. Nandan M. Nilekani, who was appointed on August 24, 2017, in the current term, being the longest-serving member and who is liable to retire, being eligible, seeks reappointment. The Board recommends his reappointment.

Retirements and resignations

- Ravi Venkatesan, an independent director, resigned as member of the Board effective May 11, 2018 to pursue new opportunities. The disclosure in this regard is available at https://www.infosys.com/newsroom/press-releases/Pages/resignation-independent-director-11may2018.aspx

- M.D. Ranganath resigned as Chief Financial Officer and as KMP effective November 16, 2018.

Change in designation

The Board, upon the resignation of M.D. Ranganath, appointed Jayesh Sanghrajka, Deputy Chief Financial Officer, as the Interim Chief Financial Officer at its meeting held on November 15, 2018. The Board, at its meeting held on December 20, 2018, appointed Nilanjan Roy as Chief Financial Officer effective March 1, 2019 and accordingly, re-designated Jayesh Sanghrajka as Deputy Chief Financial Officer with effect from March 1, 2019.

Committees of the Board

As on March 31, 2019, the Board had five committees : the audit committee, the corporate social responsibility committee, the nomination and remuneration committee, the risk management committee, and the stakeholders relationship committee. During the year, the risk and strategy committee changed its name to risk management committee effective April 1, 2019. All committees, except the corporate social responsibility committee, consist entirely of independent directors.

A detailed note on the composition of the Board and its committees is provided in the Corporate governance report.

Internal financial control and its adequacy

The Board has adopted policies and procedures for ensuring the orderly and efficient conduct of its business, including adherence to the Company’s policies, safeguarding of its assets, prevention and detection of fraud, error reporting mechanisms, accuracy and completeness of the accounting records, and timely preparation of reliable financial disclosures. Refer to ‘Internal control systems and their adequacy’ in Management’s discussion and analysis in this Annual Report.

Significant and material orders

There are no significant and material orders passed by the regulators or courts or tribunals impacting the going concern status and the Company’s operations in future.

SEBI settlement order

The Company had submitted a settlement application on December 5, 2017 with the Securities and Exchange Board of India (SEBI). SEBI passed a settlement order dated February 15, 2019 (“the Settlement Order”) in respect of the settlement application. The settlement application pertained to matters relating to the severance agreement entered into with the former CFO of the Company, Rajiv Bansal, in October 2015, and was based on an undertaking by the Company without admitting the findings of facts and conclusion of law. The Company has paid a settlement amount of Rupees thirty-four lakh thirty-five thousand (₹ 34,35,000) in respect of the said settlement of allegations under the Settlement Order. Pursuant to the Settlement Order, the possible proceedings against the Company stand settled and no enforcement action will be initiated by SEBI against the Company in respect of the said allegations.

Reporting of frauds by auditors

During the year under review, neither the statutory auditors nor the secretarial auditor has reported to the audit committee, under Section 143 (12) of the Companies Act, 2013, any instances of fraud committed against the Company by its officers or employees, the details of which would need to be mentioned in the Board’s report.

Annual return

In accordance with the Companies Act, 2013, an extract of the annual return in the prescribed format is appended as Annexure 6 to the Board’s report.

Secretarial standards

The Company complies with all applicable mandatory secretarial standards issued by the Institute of Company Secretaries of India.

Listing on stock exchanges

The Company’s shares are listed on BSE Limited and National Stock Exchange of India Limited, and its ADSs are listed on New York Stock Exchange (NYSE).

Delisting of ADSs on Euronext Paris and Euronext London

In July 2018, the Company voluntarily delisted its ADSs from the Euronext Paris and Euronext London exchanges. The primary reason for delisting is the low average daily trading volume of Infosys ADSs on these exchanges, which was not commensurate with the related administrative requirements. During the five-year period of the Company’s listing on Euronext Paris and Euronext London, the average daily trading volume of the Company’s ADSs was significantly lower than its average daily trading volume on the NYSE. There was no change in the Infosys share / ADS count, capital structure and float as a result of the delisting from the above exchanges. Infosys ADSs continues to be listed on the NYSE under the symbol ‘INFY’ and investors can continue to trade their ADSs on the NYSE as before.

Investor Education and Protection Fund (IEPF)

Pursuant to the applicable provisions of the Companies Act, 2013, read with the IEPF Authority (Accounting, Audit, Transfer and Refund) Rules, 2016 (“the IEPF Rules”), all unpaid or unclaimed dividends are required to be transferred by the Company to the IEPF, established by the Government of India, after the completion of seven years. Further, according to the Rules, the shares on which dividend has not been paid or claimed by the shareholders for seven consecutive years or more shall also be transferred to the demat account of the IEPF Authority. During the year, the Company has transferred the unclaimed and unpaid dividends of ₹ 1,54,19,936. Further, 1,71,485 corresponding shares on which dividends were unclaimed for seven consecutive years were transferred as per the requirements of the IEPF rules. The details are provided in the Shareholder information section of this Annual Report and are also available on our website, at www.infosys.com/IEPF.

Directors’ responsibility statement

The financial statements are prepared in accordance with Indian Accounting Standards (Ind AS) under the historical cost convention on accrual basis except for certain financial instruments, which are measured at fair values, the provisions of the Companies Act, 2013 (to the extent notified) and guidelines issued by SEBI. The Ind AS are prescribed under Section 133 of the Companies Act, 2013, read with Rule 3 of the Companies (Indian Accounting Standards) Rules, 2015 and Companies (Indian Accounting Standards) Amendment Rules, 2016. Accounting policies have been consistently applied except where a newly-issued accounting standard is initially adopted or a revision to an existing accounting standard requires a change in the accounting policy hitherto in use.

The directors confirm that :

- In preparation of the annual accounts for the financial year ended March 31, 2019, the applicable accounting standards have been followed and there are no material departures.

- They have selected such accounting policies and applied them consistently and made judgments and estimates that are reasonable and prudent so as to give a true and fair view of the state of affairs of the Company at the end of the financial year and of the profit of the Company for that period.

- They have taken proper and sufficient care towards the maintenance of adequate accounting records in accordance with the provisions of the Companies Act, 2013 for safeguarding the assets of the Company and for preventing and detecting fraud and other irregularities.

- They have prepared the annual accounts on a going concern basis.

- They have laid down internal financial controls, which are adequate and are operating effectively.

- They have devised proper systems to ensure compliance with the provisions of all applicable laws and such systems are adequate and operating effectively.

5. Audit reports and auditors

Audit reports

- The Auditors’ Report for fiscal 2019 does not contain any qualification, reservation or adverse remark. The Auditors’ Report is enclosed with the financial statements in this Annual Report.

- The Secretarial Auditors’ Report for fiscal 2019 does not contain any qualification, reservation or adverse remark. The Secretarial Auditors’ Report is enclosed as Annexure 5 to the Board’s report in this Annual Report.

- As required by the Listing Regulations, the auditors’ certificate on corporate governance is enclosed as Annexure 4 to the Board’s report. The auditors’ certificate for fiscal 2019 does not contain any qualification, reservation or adverse remark.

- As required under SEBI (Share Based Employee Benefits) Regulations, 2014, the auditors have issued a certificate that the share-based scheme(s) have been implemented in accordance with the regulations and the resolution of the Company passed through a postal ballot that concluded on March 31, 2016.

- In addition, the Company has also voluntarily engaged a Practicing Company Secretary to conduct an audit of corporate governance. The report does not contain any qualification, reservation or adverse remarks.

Auditors

Statutory auditors

Under Section 139 of the Companies Act, 2013 and the Rules made thereunder, it is mandatory to rotate the statutory auditors on completion of the maximum term permitted under the provisions of Companies Act, 2013. In line with the requirements of the Companies Act, 2013, Deloitte Haskins & Sells LLP, Chartered Accountants (Firm registration number 117366 W/W 100018) (“Deloitte”) was appointed as the statutory auditors of the Company to hold office for a period of five consecutive years from the conclusion of the 36th AGM of the Company held on June 24, 2017, till the conclusion of the 41st AGM to be held in the year 2022. The requirement for the annual ratification of auditors’ appointment at the AGM has been omitted pursuant to Companies (Amendment) Act, 2017 notified on May 7, 2018.

During the year, the statutory auditors have confirmed that they satisfy the independence criteria required under Companies Act, 2013, Code of ethics issued by Institute of Chartered Accountants of India and U.S. Securities and Exchange Commission and the Public Company Accounting Oversight Board.

Secretarial auditor

As required under Section 204 of the Companies Act, 2013 and Rules thereunder, the Board appointed Parameshwar G. Hegde of Hegde & Hegde, Practicing Company Secretaries, as secretarial auditor of the Company for fiscal 2019.

Cost records and cost audit

Maintenance of cost records and requirement of cost audit as prescribed under the provisions of Section 148(1) of the Companies Act, 2013 are not applicable for the business activities carried out by the Company.

6. Corporate social responsibility (CSR)

Infosys has been an early adopter of CSR initiatives. The Company works primarily through its CSR trust, the Infosys Foundation, towards supporting projects in the areas of education, eradication of hunger and malnutrition, art and culture, healthcare, destitute care and rehabilitation, environmental sustainability, disaster relief and rural development. The Company’s CSR Policy is available on our website, at https://www.infosys.com/investors/corporate-governance/Documents/corporate-social-responsibility-policy.pdf. The annual report on our CSR activities is appended as Annexure 7 to the Board’s report.

Infosys Foundation

Infosys Foundation was established in 1996 for social welfare activities. Since its inception, the Foundation, through its grant-making and partnerships with individuals, government bodies and competent non-governmental bodies, has fostered a sustainable culture of development in the areas of healthcare, promotion of education, eradication of hunger, rural development, art and culture, and destitute care across India.