M.D. RanganathChief Financial Officer

RESILIENT FINANCIAL PERFORMANCE

During the financial year ended March 31, 2018, the company delivered a resilient financial

performance on multiple fronts, primarily driven by productivity improvements and efficient capital management.

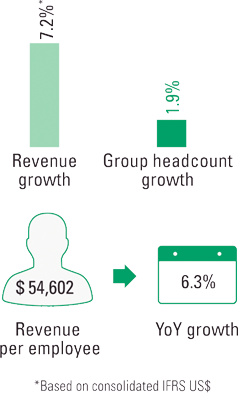

Growth driven by digital revenue : The overall revenue growth was 7.2% in US dollar terms and 5.8% in constant currency terms. The overall revenue growth was on the back of healthy growth in digital revenues. The digital revenues exceeded 25% of the total revenues of the company.

Resilient operating margin : Our operating margin was resilient at 24.3% driven by broad-based improvements in productivity, cost-optimization initiatives and improvement in key operational parameters. Revenue per employee increased by 6.3% during the year and crossed US$ 54,500. The revenue growth during the year was faster than headcount growth due to higher utilization and productivity improvements. While revenue grew by 7.2% in US dollar terms, the headcount grew by just 1.9%. Our operating margin of 24.3% was above the midpoint of our guided range of 23%‑25%.

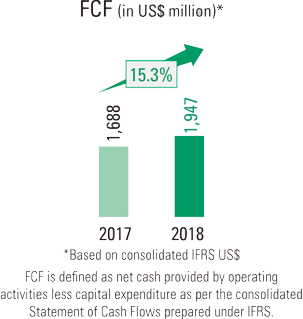

Robust cash flow : Our Free Cash Flow (FCF) was robust at US$ 1,947 million and grew by 15.3%, which was more than double the revenue

growth of 7.2%.

“For the financial year ended March 31, 2018, the company delivered a resilient financial performance on multiple fronts, including robust cash flow, strong EPS growth and healthy RoE.”

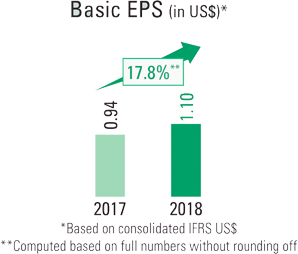

Strong EPS growth and healthy

RoE : EPS growth was strong

at 17.8%. EPS for the year was

US$ 1.10, including positive impact

of 9 cents on account of an Advance

Pricing Agreement (APA) with the US

Internal Revenue Service (IRS).

The APA improves the predictability

of the company’s tax obligations in

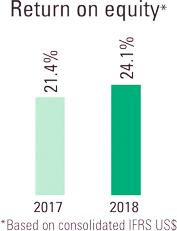

respect of its US operations. RoE

improved during the year from 21.4%

to 24.1%, driven primarily by better

capital management.

Successful execution of Capital Allocation Policy :

The company successfully executed the Capital Allocation Policy that was announced in April 2017. As part of the policy, the company completed share buyback of

₹13,000 crore (US$ 2,035 million). After including the final dividend for fiscal 2018 of US$ 823 million, special dividend of US$ 401 million and the interim dividend of US$ 529 million (including dividend distribution tax), the total capital returned to shareholders works out to US$ 3,788 million. The aggregate dividend declared during the year was Rs. 43.50 per share (including interim dividend of Rs. 13.00, final dividend of Rs. 20.50 and special dividend of Rs. 10.00).

The company announced a predictable and comprehensive Capital Allocation Policy in April 2018 after taking into consideration the strategic and operational cash requirements of the company in the medium term. The key aspects of the Capital Allocation Policy are discussed in detail in the Board’s report section of this Annual Report.

Key milestones :

The company is celebrating its 25th year of public listing in India and will be celebrating 20 years of global listing next year. The company was inducted into the

prestigious Dow Jones Sustainability Indices in this financial year.

The company continues its endeavor towards building a competitive cost structure and at the same

time investing to leverage growth opportunities so as to create sustainable value for its stakeholders.