Insights

- Mergers and acquisitions struggle to succeed while integrating their IT systems and processes.

- Horizontal integrations where entities are from the same industry or complementary to each other face more challenges.

- A two-tiered approach can address the integration problem with a central master system in the parent organization and distributed instances in business units with the local nuances and practices.

- In manufacturing, transportation management is one critical system that involves the physical movement of goods and is therefore a key enabler and a competitive differentiator for order fulfillment.

- Organizations looking to transform their transportation and logistics systems should keep the digital maturity of their ecosystem of partners also in mind.

When two entities merge or one acquires the other, diverse values, cultures, and systems should combine to make a successful association. However, many mergers and acquisitions (M&As) struggle to climb that ladder to success during the integration of their IT systems and processes. Strangely, this occurs even more in horizontal integrations, when the entities are from the same industry or complementary to each other.1 When more than one system and process exist to run a business, friction can arise within the organization to decide which one to keep and which one to kill.

Mergers and acquisitions struggle to succeed while integrating their IT systems and processes

A two-tiered approach can solve this problem. The parent organization can maintain a central corporate system as the master. Distributed instances of the system in business units retain the local nuances and practices.

In the manufacturing sector, for example, one critical system is the transportation management system (TMS). TMS involves the physical movement of goods inward to factories and outward to customers. It is therefore a key enabler and a competitive differentiator for timely order fulfillment.

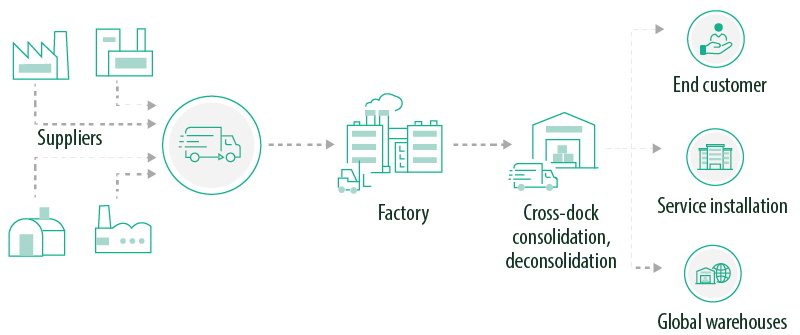

One of Infosys’ clients, a leading industrial equipment manufacturer, followed the two-tiered approach for its TMS. The firm had diverse TMSs due to several M&As over the years. It was using four TMSs in North America. This resulted in disparate processes, systems, and third-party service providers. There was no ability to consolidate and optimize freights across business units. Figure 1 explains the transportation flow from suppliers to end customers. This situation created the need for a unified TMS, replacing legacy systems, minimizing failure points, and implementing dynamic, cost-effective, and optimized routing options.

Figure 1. Transportation management across the value chain

Source: Infosys Knowledge Institute

The manufacturer planned to transform to a unified TMS on Oracle Transportation Management (OTM) Cloud. It wanted to scale up its ability to meet changing market dynamics and customer requirements. It adopted a multiphase approach to reengineer and standardize its logistics systems, resulting in improved business metrics and cost savings to the tune of 3%-5%. The firm realized that this setup could provide it with a competitive advantage and help it adhere to compliance requirements related to dangerous goods handling.

Current and targeted maturity levels

Before starting the OTM Cloud implementation, the company assessed its current maturity level for its logistics function and set itself a time-bound, feasible target state to reach. The team used Gartner’s five-stage logistics maturity model for the maturity level assessment.2

The five stages in the maturity model are Stage 1, when departments are siloed; Stage 2, when logistics gets centralized; Stage 3, when logistics is integrated with the overall supply chain, taking into account how it would affect customers, procurement, and manufacturing; Stage 4, when collaboration and visibility with suppliers take place; and Stage 5, when the firm becomes a network orchestrator of profitable customer value with real-time information flow.

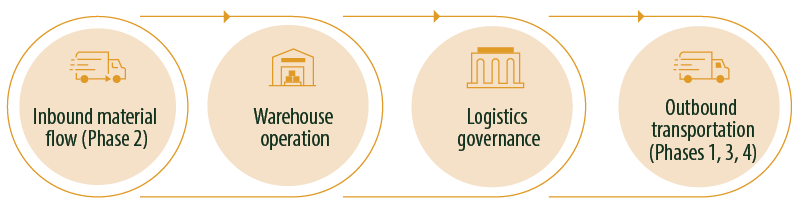

The team set a target to reach Stage 3 in the short term. There was an opportunity to integrate disparate logistics systems and reduce transportation costs. The warehouse operation was at a better maturity level than logistics was. The team decided to focus on logistics first. Within logistics, inbound was more challenging, as the suppliers were spread out geographically with multiple transportation partners. Therefore, the team decided to start from outbound logistics, specifically for high-volume locations.

According to the firm’s initial estimates, the consolidated TMS across North America and Europe, the Middle East, and Africa (EMEA) presented potential savings of a few million dollars. At the end of the first phase for outbound logistics in North America, it realized annual cost savings of up to $1 million.

However, the firm’s third-party logistics carriers were not technically advanced enough to adopt the suggested recommendations for supply chain visibility. The team came up with a road map keeping this factor in mind, with time-bound milestones to implement a unified TMS.

Logistics benchmarks

Global benchmarks help business transformation programs to compare against the best-in-class enterprises globally. The American Productivity & Quality Center (APQC) publishes benchmarks for business processes. It defines logistics under four broad areas: 1) providing logistics governance, 2) planning and managing inbound material flow, 3) operating warehouses, and 4) operating outbound transportation (Figure 2). In its logistics industry benchmarking report, APQC has provided industrywide median logistics and warehousing cost per $1,000 revenue.

Figure 2. Logistics, warehouse management, and a phased approach for digital transformation

Source: APQC

The consumer-packaged goods industry is the closest for comparison, with a median value of $32.65 for logistics cost.3 For its revenue of $22 billion in 2020, the logistics cost per $1,000 revenue was $25.35. But individual business units with logistics costs higher than the benchmark need to focus on their operations to bring down the cost.

The other important benchmark for logistics is the customer order cycle time in days. Each business unit has its business model, service level agreements (SLAs), and cycle time for order fulfillment. The units had combinations of make-to-stock, make-to-order, and engineer-to-order, depending on product complexity. The SLA for order fulfillment ranged from 24 hours to a few weeks, based on the criticality of the product for its end customer. That made it challenging to compare against one benchmark.

Multi-phase approach for reengineering logistics

The initial study showed that streamlined logistics would help achieve multimillion-dollar savings. These savings are from order consolidation, optimized routing, and the legacy system maintenance. The team implemented the transformation program in the following four phases to address the challenges and realize maximum benefits.

Phase 1: Outbound logistics

The scope of Phase 1 is for outbound logistics, from the firm’s distribution centers. As part of the scope, the organization’s existing system was replaced with OTM Cloud. The OTM Cloud platform was tightly integrated into the warehouse management system to leverage current interfaces and minimize risk around failure points. At the end of this phase, the company realized annual cost savings of $1 million.

Phase 2: Inbound logistics planning and supplier portal

The scope of Phase 2 is to replace static routing guides with an optimized plan. Optimization in the form of rate shopping and consolidation of shipments was a big part of the savings realized in this phase. A supplier portal was implemented for the transportation planning team. The team decided not to go live immediately but to plan a timeline to ensure that the business and its revenue targets are not impacted.

Phase 3: Outbound — fire extinguishing and air-conditioning systems

The purpose of Phase 3 is to enable TMS outbound functionality for all domestic and international shipments within some business units — the fire fighting and air-conditioning systems. These units represent approximately 10% of the total freight spend.

Phase 4: Outbound for remaining business units

The scope of Phase 4 is to expand the TMS functionality for EMEA shipments to more warehouses and to maximize transportation consolidation opportunities, add rate shopping capabilities, and improve cost-effective routing for paid freight.

Progress road map for operations

The company planned the following road map to improve its logistics and warehousing operations:

Advanced business processes and technology

- Replacement of legacy applications nearing end-of-life

- Consolidation of multiple TMSs into a single TMS

- Automation of manual routing processes that depend on user discretion

- Investigation into opportunities for cost reduction and better efficiency

- Implementation of richer functionalities with extended capabilities and visibility

- Integration of TMS with other applications

- Warehouse management: Integration of OTM Cloud platform with JDA WMS to leverage current interfaces and minimize risk around failure points

Progress in logistics strategy

- Replacement of static routing guides with fully optimized planning

- Access to a larger transportation network

- Usage of historical shipment data for carrier procurement, by managing the carrier bidding process (awarded to the most optimal carriers — low cost and best performing)

Prebuilt solution templates were followed for requirement gathering. The templates were enhanced further based on learnings. Planned obsolescence from the software vendor was kept in mind during solution design, to ensure forward compatibility of the product.

Key capability enablement

The unified TMS helped the company choose the lowest-cost option for every shipment with the following capabilities:

Planning

The new system reviews large order batches and creates an optimized transportation plan for cost savings. The company can consolidate and plan orders and shipments for delivery with multi-stop shipments and multimodal logistics. Each shipment’s requirements can be mapped to the carrier’s service commitment, ensuring timely delivery and customer satisfaction.

Rate shopping

The new system generates and compares the cost for multiple carriers and transportation modes for a shipment. This comparison is critical to generate the lowest-cost transportation plan and the cheapest mode of logistics and transportation for each shipment.

Tendering and tracking

Tendering communicates the shipment details to carriers to request a pickup. It receives the scheduled pickup time and load acceptance from carriers as feedback. Tracking receives and processes updates on the status of in-transit shipments. Insights from the updates are presented in a format useful for internal and external decision-makers.

The new system addresses the need for freight spend visibility and supply chain convergence. It ensures carrier compliance with contractual requirements. The following are the ongoing estimated cost savings in each category:

- 10% savings in domestic air freight cost through improved planning and visibility to in-process shipments.

- 3% savings in freight spend through shipment consolidation, rate shopping, and optimal mode and carrier selection.

- 2% savings in truckload spend from electronic tendering and automated spot bids.

Challenges faced

The team faced several challenges during the initial phases of the unified TMS project. Change management was an expected challenge, with several systems in use and a steep learning curve related to new processes. Several legacy rules were required to be either overwritten or carried over to the new system during the transformation.

The team achieved supply chain visibility through a complete electronic data interchange (EDI) with logistics carriers. The team had to make a trade-off between the TMS system’s key performance indicators (KPIs) visibility and making it function rich. Making it rich in functionality would have improved the KPIs and their visibility, but that would have consumed more time and cost.

Logistics in the post-pandemic ecosystem

Leaders should consider the learnings from previous integrations while planning a new one. TMS will remain critical for manufacturing corporates. But business leaders should not forget the ecosystem in which they operate. It may not be ready for digital transformation.

Organizations looking to transform their logistics and associated transportation systems should understand that it involves not just their IT landscape. It is inclusive of the ecosystem of freight carriers, suppliers, and partners. Even if a manufacturer is ready to implement digital technologies, the lack of maturity in the surrounding ecosystem could act as a showstopper. These factors should be considered while formulating the road map to mitigate risks and set realistic goals.

Digital technologies enable dynamic, optimized routing with real-time feedback from shipments and other external factors for traceability. Transportation reengineering should leverage these new technologies for business benefits. Organizations should implement a two-tiered IT architecture for critical IT systems, for resiliency and reliability during disruptions like a pandemic. This is even more important during horizontal integrations of complementary businesses. Such integrations are no longer just to expand the business, but also for unique and strategic capabilities.4 In case of transportation management, a unified TMS can help organizations achieve cost savings, timely order fulfillment capability, and customer delight.

References

- Don’t make this common M&A mistake, Graham Kenny, March 16, 2020, Harvard Business Review.

- 5 stages of logistics maturity, Rob van der Meulen, August 28, 2017, Gartner.

- Key logistics benchmarks: Cross-industry, February 14, 2020, APQC.

- Why companies are using M&A to transform themselves, not just to grow, Francois Mallette and John Goddard, May 16, 2018, Harvard Business Review.