Insights

- The post-pandemic era has brought the focus to supply chain resiliency to recover from major disruptions.

- Business leaders should reengineer internal systems and processes for resiliency.

- Organizations should use digital technologies for real-time data feed from external factors to raise timely alerts and make decisions to minimize the impact of any negative incident.

- A “design for availability” approach with frugality can help manage supply issues for critical parts.

- Digital replicas should be tried out before physical implementation.

- Sustainability should be a priority in trade-offs with cost and timelines, keeping future generations in mind.

Supply chain disruptions have hindered the global economic recovery post-COVID-19. The disturbances shaved off 0.5 to 1 percentage point of global gross domestic product growth in 2021, according to the International Monetary Fund (IMF).1 Manufacturers are taking required initiatives such as supplier diversification, nearshoring, strategic partnerships, and freight tracking. However, many of the factors to successfully implement these initiatives are beyond manufacturers’ control.

Supply chain management traditionally emphasizes cost efficiency, faster delivery, and quality. But the post-pandemic era has brought organizations’ focus to resiliency in order to recover from major disruptions such as COVID-19. Organizations can mitigate the impact of supply chain disruptions by reengineering their internal systems and processes. Through these measures, enterprises can proactively recalibrate internal factors such as business models, IT applications, and workflow processes.

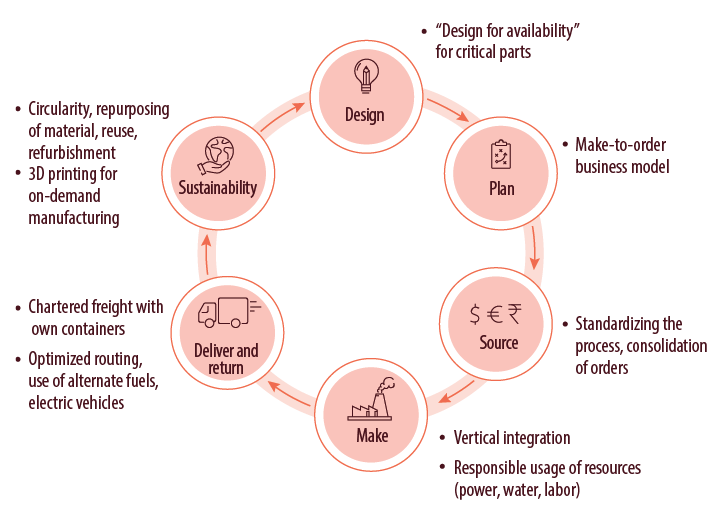

Supply chain resiliency measures can be taken at all stages of a product’s lifecycle, from design to end of life (see Figure 1). Products are redesigned to use existing resources to achieve flexible supply chain management. For example, the automotive industry faces a severe supply crunch of semiconductor chips. To manage this, Tesla, rewrote its vehicle software to make it work with available chips. On the sourcing and manufacturing sides, Ford decided to shift to a make-to-order approach. Instead of picking up an available model from a dealer, its customers place an order and wait for vehicle delivery.

Figure 1. Changes across a product’s lifecycle to enhance supply chain resiliency

Source: Infosys Knowledge Institute

Circularity promotes the reuse of critical materials. Renault Group has adopted a circular economy approach and reports that up to 36% of the mass of new vehicles made in Europe is from recycled materials.2 The above changes need necessary recalibration to internal systems and processes for them to work effectively.

Design for availability to resolve supply issues

The post-pandemic era is witnessing severe supply chain bottlenecks, leading to a shortage of critical parts and materials. In the initial stages of the product lifecycle, a “design for availability” approach can help manage supply issues for parts like semiconductor chips.3 Instead of waiting for the ideal part, the best and earliest possible alternative (in terms of functionality and cost) should be considered. Tesla followed this approach. Its modular vehicle architecture, where hardware and software were decoupled from each other, helped it rewrite software to match the chips available. Also, Volkswagen prioritized the chips available for use in its premium cars.

Homologation, or testing and approval of alternate parts with necessary changes, should be proactively carried out. Whenever there is a shortage, the product lifecycle management (PLM) system can suggest the best possible alternate part in stock.

Product makers must practice frugality to build only must-have features for customers. General Motors, for example, decided to stop providing heated and ventilated seats in its popular models, with an option to retrofit them later when the parts are available, while Tesla has used substitutes for chips that are not easily available.4 It also removed an electronic control unit in the steering system. This unit was a backup needed for “Level 3” hands-free, autonomous driving, which is not approved yet for usage.

Make-to-order business model

Organizations can switch from forecast-based, make-to-stock manufacturing to order-based, make-to-order manufacturing. It is not an easy change. Ford recently shifted its focus to this approach, helping it face the shortage of semiconductor chips.5 The finished goods inventory will be minimal in this way. However, the lead time for delivery of vehicles to customers will be much longer. Enterprise resource planning (ERP) systems need to transform to adapt to this change.

In the traditional make-to-stock business model, a standard bill of materials (BOM) in the ERP system is used to make a batch of products with the same product configuration. According to the demand forecast, the quantity is decided without waiting for a customer order. But in the make-to-order model, a sales order is created after the customer’s confirmation of a specific product. Thereafter, a production order is created based on the sales order and a BOM is created based on the customer’s preferred configuration. A material requirements planning system is run for the BOM. A work order is sent to the shop floor for parts made in-house and a purchase order is generated for bought-out parts. When all parts are ready for assembly, the statuses of the parts and finished goods are tracked.

The make-to-stock model needs the above changes to the ERP system and its integration with other systems, such as customer relationship management (CRM), to become efficient in the current environment.

Standardized procurement

For parts bought from suppliers, one approach is to standardize processes and consolidate orders. Infosys has designed and implemented a standardized model and purchasing tool for a leading multinational elevator manufacturer and service provider. It standardized the requisitioning process across the countries in which the firm operates. E-Catalogs were introduced. Using these techniques, manufacturers can leverage consolidated volume requirements at pre-negotiated pricing, resulting in cost savings.

The new system also provides spend visibility through which the purchasing manager can review non-catalog purchases. Catalog offerings can be strengthened through negotiated contracts regarding price points and lead times.

Vertical integration for in-house manufacturing

For critical in-house parts, manufacturers follow vertical integration. It helps them track and control the supply of critical components. For example, electric vehicle (EV) batteries need rare materials that are short in supply globally and absorb around 30% of the total EV cost. Carmakers that are ramping up EV manufacturing have started vertical integration to make their own batteries and associated components.

Ford is also considering shifting from purchasing batteries to making its own.6 Its upcoming BlueOval City factory will be vertically integrated for EV manufacture for cost efficiency and minimal carbon footprint. Although vertical integration is not economically feasible for all manufacturers, it is a sensible move for products that need investment due to high manufacturing volumes.

Delivery with control

The pandemic caused a choking of ports and a shortage of shipping containers. Amazon had started making its own shipping containers in 2018 and chartered its own ships to avoid supply chain bottlenecks.7 The move helped the retailer during the pandemic. Today, Amazon uses its own transportation network for 72% of its shipments. Amazon can decide which ports to visit and avoid those with a heavy backlog. While its competitors had to wait for months for their shipments to arrive, Amazon can fulfil supply within a few days.

Other retailers such as Walmart and Home Depot have started chartering their own bulk freighters post-pandemic. However, it is not possible for every retailer and manufacturer to have its own logistics. For instance, Mattel relies on nearshoring and contracting ocean freight capacity well in advance to ensure an adequate stock of toys for the holiday season.

Sustainability for least carbon footprint

Circular business models are expensive due to reverse logistics costs and the complexity of recycling products and parts. The collection systems will have to stretch over a vast distance between the point of use and remanufacturing. Because of parts specialization, it is difficult to gather sufficient volumes for recycling economically. Otherwise, it would require very deep stripping down to gather the base metals, rendering the process uneconomical. However, as additive manufacturing becomes more widely adopted, decentralized supply chains will become economical, local, and under the control of manufacturers.

As additive manufacturing becomes affordable and widely adopted, decentralized on-demand supply chains will become economical

For example, Siemens Energy has invested in additive manufacturing for its digital supply chain initiative.8 The goal is to reduce inventories while ensuring the speed of delivery of components, spare parts, and specialized tooling.

India’s largest fast-moving consumer goods manufacturer, Hindustan Unilever, has replaced coal with biomass and biodiesel across its 32 manufacturing plants.9 The move not only decreased the company’s carbon footprint, but also enhanced farmers’ income through biomass buying. It is in line with the company’s aim to achieve net-zero emissions by 2039.

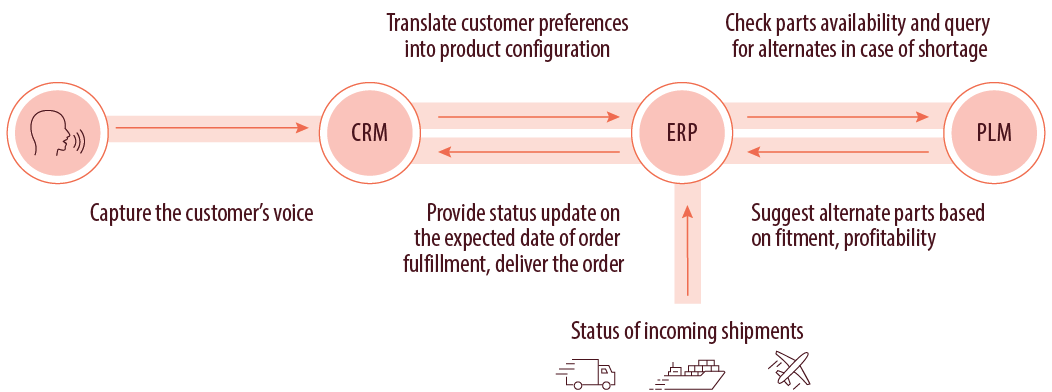

Integration between systems

Initiatives such as make-to-order business models and supply chain transparency need real-time shipment updates, especially if there is a delay. Seamless ongoing communication among ERP, PLM, CRM, and manufacturing execution systems is critical to keep stakeholders updated on order status (see Figure 2). Digital technologies will play a key role in the post-pandemic world, where unavoidable supply chain bottlenecks will be resolved through innovative steps.

Figure 2. Seamless information flow among IT systems for order fulfillment

Source: Infosys Knowledge Institute

Recommendations

The uncertainty, complexity, and volatility of supply chains cannot be wished away. But they are external to enterprises and beyond their circle of influence to control. Business leaders can cushion the impact of supply chain disruptions to a good extent by reengineering their internal systems and processes. They can improve the transparency of shipments and the velocity of information flow.

Business leaders should reengineer internal systems and processes to deal with supply chain disruptions

The right information at the right time is the key to timely and rational decisions. Organizations that use digital technologies for real-time data feed for external factors can raise timely alerts and make decisions to minimize the impact of any negative incident. To support such data feed, the U.S. government launched an information sharing initiative Freight Logistics Optimization Works (FLOW). As a part of it, ocean carriers, ports, trucks, and retailers will share key data related to cargo flow, to speed up the movement of goods and avoid any bottleneck.

Sustainability should be the priority in any trade-off with cost and time, aiming for the least carbon footprint

Digital replicas should be tried out before physical implementation. Affordable computing can digitally simulate multiple scenarios before they occur. Proactive measures help decision-makers decide what action to take up front when a situation really arises.

Sustainability should be a priority in trade-offs with cost and timelines, keeping future generations in mind. The lowest possible carbon footprint should be the primary objective, even if it is at the expense of losing some profitability. A triple bottom line or 3P (People, Planet, and Profit) approach is the need of the hour, where it is not just the profit but also the people and the planet that matter in the long term.

References

- IMF sees higher inflation as supply chains and Omicron slow economic growth, Emma Charlton, Jan. 25, 2022, World Economic Forum.

- Renault, actively developing circular economy throughout vehicles life cycle, May 30, 2017.

- Engineering Your Way Out of the Global Chip Shortage, Peter Hanbury, Bill Radzevych, and Benjamin Grant, Dec. 23, 2021, Harvard Business Review.

- Some Automakers Say the Chip Shortage Is Causing the Delay of Certain Features, Benjamin Preston, Oct. 5, 2021, Consumer Reports.

- Ford shifts focus to built-to-order to mitigate semiconductor shortage’s effects, Max Garland, Aug. 2, 2021, Supply Chain Dive.

- Ford to lead America’s shift to electric vehicles with new mega campus, Sept. 27, 2021, Ford.

- Amazon is making its own shipping containers — and waiting as little as 2 days outside ports, Grace Kay, Dec. 6, 2021, Business Insider.

- Siemens Energy invests in new digital platform for on-demand additive manufacturing services, March 1, 2022, Siemens Energy Press.

- HUL scraps coal usage across operations, replaces with green alternatives, Dec. 2, 2021, Business Standard.