Insights

- Empowering customers: Rule 1033 from the Consumer Financial Protection Bureau (CFPB) gives consumers control over their financial data, increasing competition among banks and promoting open banking by mandating data sharing with third-party providers.

- Urgency for large banks: Large banks must comply with Rule 1033 by April 1, 2026, requiring efficient resource allocation and system updates to meet regulatory requirements.

- Implementation strategy: Implementing Rule 1033 involves assessment, technology upgrades, industry collaboration, staff training, consumer communication, and continuous compliance monitoring.

- Challenges: Banks face challenges such as technological complexity, data security, regulatory compliance, and maintaining consumer trust, requiring significant investment and expertise.

- Competitive advantage: Proactively embracing Rule 1033 and investing in necessary technologies can give banks a competitive edge by enhancing customer experience and driving loyalty through innovative financial products.

Empowering customers

The final Rule 1033 from the Consumer Financial Protection Bureau (CFPB) marks a watershed moment in consumer rights, giving individuals control over their financial data. Designed to enhance competition and accelerate the shift to open banking, the rule mandates that financial institutions share customer data with third-party data providers at the discretion of customers. The goal is to curb the misuse or wrongful monetization of sensitive personal financial data, enabling consumers to "vote with their feet" against subpar service and discouraging risky data collection practices, such as screen scraping. Rule 1033 breaks the chains of data exclusivity that previously bound customers to their banks, ushering in an era of greater market exploration.

Urgency for large banks to implement Rule 1033

Large banks with assets over $250 billion must implement Rule 1033 by April 1, 2026. This schedule requires these institutions to prioritize compliance efforts, allocate resources efficiently, and ensure their systems and processes meet the new regulatory requirements. Failure to do so could result in penalties and loss of consumer trust.

Implementing CFPB Rule 1033 in banks

Implementing CFPB Rule 1033 in banks involves a comprehensive approach that addresses both technological and operational aspects. Banks must develop strategies that not only comply with the regulatory requirements but also enhance their service offerings and maintain a competitive edge. This process begins with a thorough understanding of the rule’s provisions and their implications for various banking functions. A detailed implementation strategy includes:

- Assessment and planning: Assess current data management practices and identify compliance gaps. Create a comprehensive strategy document that outlines the implementation process, including application-level impact analysis and a prioritized roadmap for integration with key milestones.

- Technology upgrades: Invest in advanced data management and security technologies to ensure secure data sharing and protection. Upgrade existing systems and integrate new solutions to facilitate compliance.

- Collaboration with industry leaders: Partner with SaaS providers such as Ninth Wave to enhance solution implementation, accelerate time to market, and simplify compliance while providing robust, secure, and industry-leading open finance solutions.

- Staff training and awareness: Train employees on new regulatory requirements and the importance of data security and consumer privacy. Ensure all staff members are aware of their roles and responsibilities in the implementation process.

- Focus on consumer data privacy and innovation: Emphasize on safeguarding consumer data privacy and fostering innovation in the marketplace. The approach aims to prevent anticompetitive behavior from incumbent financial institutions and ensure consumer-friendly innovation.

- Consumer communication: Develop clear communication strategies to inform consumers about their rights under Rule 1033 and how they can access and share their financial data securely.

- Compliance with regulatory requirements: The rule requires covered data providers to make available to consumers or to authorized third parties, the data that relates to the consumer’s covered accounts.

- Continuous monitoring and improvement: Establish mechanisms for continuous monitoring of compliance and regular updates to implementation strategies based on evolving regulatory guidelines and technological advancements.

This approach is designed to help financial institutions navigate the new era of open banking, improve customer engagement, and ensure compliance with regulatory requirements.

Yet, implementation isn’t easy

While the implementation of CFPB Rule 1033 is essential for advancing open banking and enhancing consumer access to financial data, banks face substantial challenges in this process, including:

- Technological complexity: Upgrading and integrating new technologies can be complex and costly, requiring significant investment and expertise.

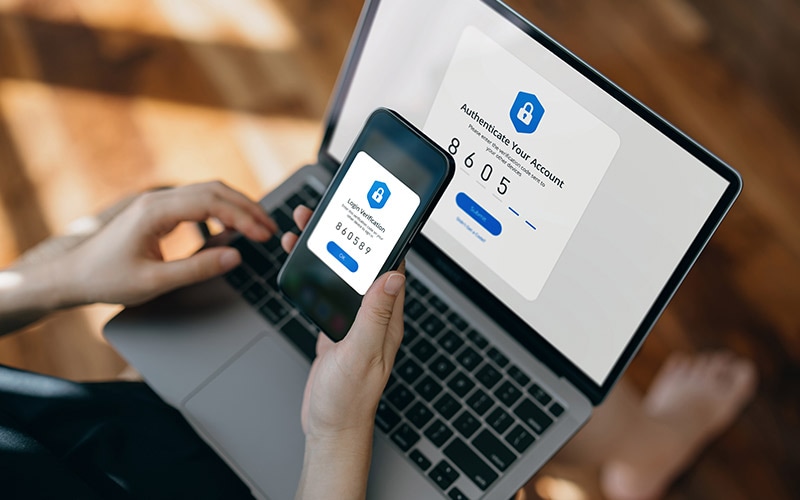

- Data security: Ensuring the security of consumer data during transmission and storage is paramount, necessitating robust cybersecurity measures.

- Regulatory compliance: Keeping up with evolving regulatory requirements and ensuring ongoing compliance can be resource intensive.

- Consumer trust: Building and maintaining consumer trust in the bank’s ability to protect their data and providing secure access is crucial for successful implementation.

Banks must navigate the technological complexities and substantial costs associated with upgrading and integrating new systems. Robust data security measures are critical to protect consumer information during transmission and storage. Additionally, staying abreast of evolving regulatory requirements and maintaining ongoing compliance demand considerable resources. Lastly, building and sustaining consumer trust in the bank's ability to safeguard data and provide secure access is paramount for successful regulation implementation.

Robust data security measures are critical to protect consumer information during transmission and storage.

A customer-centric mindset to succeed

Banks that proactively embrace CFPB’s Rule 1033 and invest in necessary technologies and processes are likely to gain a competitive advantage. Larger banks have a shorter compliance cycle than their smaller competitors, which means allocating more resources. This presents them with an opportunity to innovate, deliver better experiences, and strengthen their market position. Banks that can seamlessly integrate third-party services and offer innovative financial products will stand out, driving customer loyalty and growth.

Banks that proactively embrace CFPB’s Rule 1033 and invest in necessary technologies and processes are likely to gain a competitive advantage.

While the jury is still out as to who will win more customer mindshare and wallet share, it is clear that banks that prioritize technology adoption to enhance customer experience will benefit. By embracing initiatives such as API development, data security, and management systems, banks can meet regulatory requirements and capitalize on the benefits of enhanced data utilization and open banking.