The digital transformation journey

Insurance companies have avoided digital disruption longer than incumbents in many other industries. That reprieve, however, has ended.

Legacy insurance companies are facing challenges, from new upstarts (Lemonade) and established tech giants (Amazon). These industry newcomers offer personalized products and frictionless interactions, and speak the language of digital natives.

Legacy firms have learned they can no longer operate in ways that served them well for the last couple of centuries.

To thrive – or even just survive – the insurance industry has to accelerate its journey into the digital future.

In early 2018, Infosys surveyed more than 1,000 senior-management-level executives working in large organizations around the world with more than 5,000 employees and over $1 billion in annual revenue. That research on companies’ digital evolutions included responses from dozens of insurance industry executives.

Based on that survey, we produced a report — Infosys Survey Report — showing that incumbent organizations (as opposed to digital natives) fall into three clusters determined by their progress along the digital transformation journey:

Knowing that many organizations are rapidly intensifying their digital transformation efforts, Infosys conducted a new survey in November 2018 to gauge the pace of that change. This new survey showed an increase in explorers and decrease in visionaries among the dozens of insurance industry respondents. These findings differ from what executives overall have told us – companies can advance from the watcher to the explorer level without herculean effort, but reaching the visionary level is significantly more difficult.

Pressure is building on legacy firms to move faster along their digital transitions. Although digital disruptors were slow to arrive, insurtechs are now gaining traction in what had been a tradition-bound industry.

More explorers, fewer visionaries

The need to be visionaries

Almost every incumbent in the insurance industry is being pushed by disruptors or peers to digitally transform, whether it’s digitally-led claims journeys or new sources of data that influence underwriting.

Many companies will only survive if they become digital transformation visionaries.

Some incumbents unable to keep up with the pace of technological change have already succumbed to competitive pressures. Many more insurance companies will likely fall by the wayside. To avoid being blindsided by competitors and stay relevant, companies must find ways to transform their products, processes and business models using digitally-enabled approaches and technologies.

Navigating the transformation journey

Our most recent study takes a closer look at the transformation journey. We identified 22 key digital initiatives and then asked respondents where their companies stood on implementing each initiative:

- Not started (or in planning).

- Completed multiple proofs of concept.

- Completed pilot projects.

- Operating at scale.

We then developed the Digital Maturity Index and assigned each company an index score from 0 to 100 according to its progress on pursuing and implementing the 22 key initiatives.

Companies on the digital journey

Comparing clusters on their digital transformation journeys

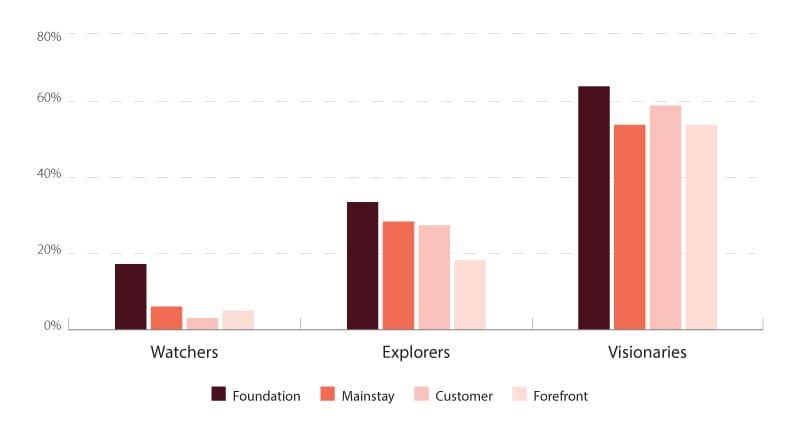

As insurance companies advance through the digital transformation journey from watchers to explorers to visionaries, they operate more and more key digital initiatives at scale. The types of projects change throughout the journey and can be grouped into four categories:

- Foundation initiatives must be implemented to modernize legacy systems.

- Mainstay initiatives represent the core elements of digital transformation, including automation and artificial intelligence (AI).

- Customer initiatives primarily impact the customer experience. They include omnichannel marketing and content personalization.

- Forefront initiatives harness cutting-edge technologies, such as augmented reality (AR), drones and blockchain.

Visionaries stand out – cluster progress across 22 digital initiatives

As shown in the previous figure, insurance visionaries are significantly more advanced than explorers in their implementation of virtually all initiatives, and watchers are far behind.

Watchers

- These companies typically operate at scale on only one or two digital initiatives, with perhaps a couple of others in the pilot testing phase.

- None in the insurance industry were operating at scale on the “internet of things,” AI, robotic process automation (RPA), content personalization, or most forefront initiatives.

- Twenty percent had completed drone pilot programs and another 20% reached scale. That was the only forefront initiative where watchers made progress in the insurance industry. Drones have shown they can assess damage in remote areas and collect data needed to underwrite large projects.

- Among the foundation initiatives, cybersecurity shows the most progress with more than half (54%) operating at scale. Compliance and liability pressures are driving insurance companies to invest here and protect their vast and rapidly growing collections of sensitive data.

- Watchers are gradually investing in Agile and DevOps, with 20% operating at scale, only slightly behind explorers and visionaries. However, our research indicates difficulty in converting these small wins to larger initiative success.

- Digital marketing is the sole customer initiative where insurance watchers have made significant progress. This is seen as a leading indicator of customer-centric initiatives to follow.

Explorers

- Further along than watchers, insurance industry explorers have completed pilot projects for an average of seven key digital initiatives.

- Organizations have progressed past the planning stage on four-fifths of the initiatives. Yet, they are operating at scale on only about six initiatives.

- Cybersecurity also shows progress for explorers, as the leading area in foundation initiatives. Explorers – and even watchers – performed better on cybersecurity than insurance industry visionaries. But that over performance could be explained by the small number of visionaries, where the relatively few respondents can tilt the results.

- Earlier investments in business intelligence have provided a foundation for big data and analytics, an obvious tool for the information-dependent insurance industry. Explorers have made as much progress here as in any other mainstay initiative.

- Organizations have also made more progress on digital marketing than the other customer initiatives. This rules-based, revenue-oriented initiative tends to provide a clear business case and also highlights the importance of growing sales.

Visionaries

- Slightly ahead of their peers, on average they are at scale for seven initiatives and have completed pilots on seven further initiatives.

- Insurance visionaries have either completed pilots or achieved scale on most key initiatives, with the biggest exceptions being forefront projects such as drones (25% pursuing) and virtual reality (VR) and AR, each at 13%. German insurance giant Allianz SE used AR to demonstrate potential dangers in an ordinary home, while other insurance firms use VR to train claims adjusters.

- The overall consistency of progress across initiatives is remarkable, and shows that a comprehensive approach is required to attain leadership. It also implies possible synergy across initiatives, where success in one area like big data may provide core capabilities for another initiative like internet of things. That technology has led some companies to experiment with auto and health insurance discounts based on sensor data. Dental insurer Beam provides its customers with internet-connected toothbrushes and then uses the data to inform premiums.

- Even in the forefront category, where progress is understandably less advanced than the others, there is still consistency across initiatives. From our discussions with industry executives and experts, this highlights a “lean forward” mindset that embraces the understanding that today’s advanced technologies will become a vital part of tomorrow’s operating system.

Changing focus, making progress

Visionaries have many more initiatives operating at scale

As insurance companies advance along their digital transformation journey, they tend to focus on different sorts of projects. Watchers are just trying to build a foundation for their digital transformation, so they are unlikely to have the bandwidth to launch mainstay, customer or forefront initiatives.

As companies reach the explorer stage, they turn their attention to a broader range of initiatives, including such mainstay ones as big data and analytics, RPA, and enterprise cloud. They can also spend time working on customer initiatives such as content personalization, digital product engineering and digital marketing. However, explorers must still invest time focusing on the basics, such as scaling the implementation of core foundational initiatives such as legacy modernization, application programming interfaces (APIs) and business process management (BPM).

Insurance visionaries bring many initiatives to scale along foundation, mainstay and customer categories. They are also the only cluster making substantial progress on scaling forefront initiatives such as 3D printing and blockchain technologies, which can be helpful as fraud detection tools or to secure information transfers.

Shifting barriers on the digital transformation journey

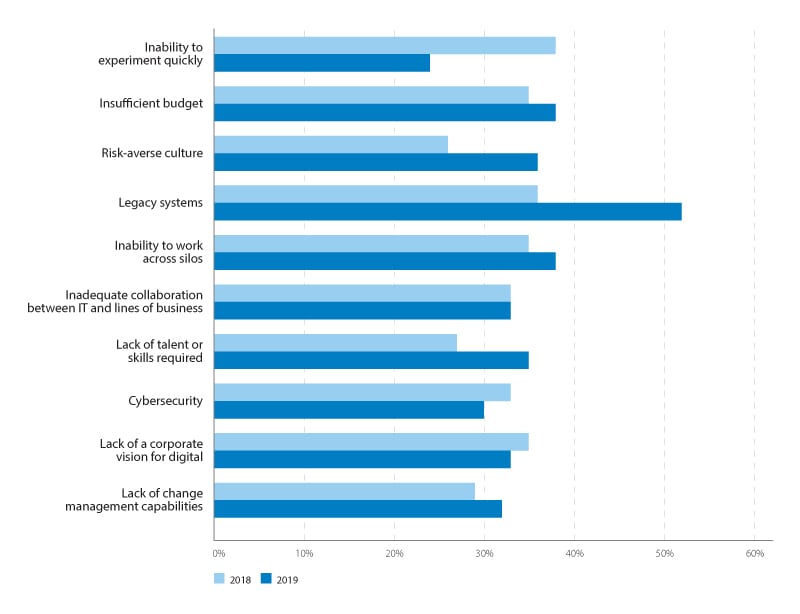

Our survey revealed that inability to experiment quickly is the greatest barrier to digital transformation that insurance companies faced in 2018. More than one-third of respondents (38%) worry that their companies lack the capacity for rapid experimentation that is essential for testing different technologies and figuring out which ones hold the most promise.

Most companies believe that they can quickly develop this capability. Only 24% of respondents in the insurance industry felt that lack of rapid experimentation skills would still frustrate their digital transformation in 2019.

Barriers to digital transformation

We believe that companies underestimate the challenge of mastering the art of rapid experimentation. Companies need to implement major cultural changes to become adept at rapid experimentation, according to Alok Uniyal, vice president and head of Agile and DevOps at Infosys. Significant cultural shifts rarely happen quickly.

While respondents feel that most barriers to digital transformation will diminish over time, they have persistent concerns over legacy systems.

Legacy systems currently rank as the second most commonly cited barrier (named by 36% of respondents), but insurance executives expect that it could become the most serious barrier in 2019.

Those massive legacy systems were once important advantages that allowed industry incumbents to hold off challengers. Now digital natives – backed by venture capital or peer-to-peer funding – cite their lack of legacy systems as major competitive advantages.

Insurers frequently operate with small margins and often don’t have technology budgets large enough to fund the transition to new cloud-based systems.

“Most of the top 20 insurers have implemented big legacy transformation projects on claims platforms and administration and billing systems,” Mark Andrews, domain director at U.K.-based consultancy Altus, told the website Raconteur. “But they tend to keep the old systems and build a layer on top, which is what holds them back, far behind other industries.”

Experience with digital transformation is a double-edged sword. On the one hand, the visionaries who have progressed the furthest along the digital transformation journey recognize the most barriers, identifying more than four from the list of 10 that we provided.

At the same time, insurance industry visionaries are also more optimistic than their counterparts in the watcher and explorer groups about overcoming these barriers. This demonstrates that companies become more confident as they gain experience with implementing successful pilots and bringing ideas to scale on their digital transformation journey.

Survey respondents weren’t confident that budgetary constraints would become less of a barrier in 2019. While 35% of insurance executives cite “insufficient budget” as a barrier to digital transformation in 2018, 38% feel that it will still be a serious stumbling block this year.

If organizations devote more investment to key digital initiatives, that would show that senior leaders are strengthening their commitment to digital transformation.

Participants also expect that change management will only grow harder as time goes on. While 29% of respondents named “lack of change management capabilities” as a barrier in 2018, 32% said it would be a problem this year for the insurance industry. Watchers and explorers are especially worried about managing change.

Digital maturity by industry

Our survey revealed significant differences in digital maturity by industry. We found that technology, manufacturing, telco and financial services companies had progressed furthest on their digital transformation journeys. Digital Maturity Index scores were distinctly lower in other industries such as consumer goods, logistics and health care. Insurance finished close to the middle of the 12 industries surveyed.

In both insurance and financial services, legacy businesses are facing intense competitive pressures from both startups and large tech companies muscling into the sector.

Legacy incumbents are trying to make progress toward digital transformation, but their efforts are hampered by regulations, security concerns and complex internal processes.

Industry ranking on the Digital Maturity Index

Accelerating the digital transformation journey: 5 key capabilities

In August 2018, Infosys conducted a research study that identified five capabilities that help companies, including those in the insurance industry, accelerate their digital transformation journeys: Agile and DevOps, automation and AI, design, learning, and proximity.

In our November 2018 executive survey, we looked deeper to understand company competencies in these areas. We found that companies with the highest Digital Maturity Index scores (i.e., the visionaries) do indeed have the strongest abilities in all accelerator categories.

Visionary companies have superior accelerator capabilities

Cluster average

The five digital capability accelerators above are powerful in their own right, and we examine each of them on the pages that follow. Before looking at the accelerators individually, it is worth reviewing them holistically at a summary level. When we reviewed client and industry digital transformation programs, we found multiple successes in the past two years where one of the accelerators was dominant. However, in discussions with executives about the next 12 months and beyond, the consistent message was that multiple accelerators will increasingly be needed for future success. Agile and DevOps programs will be required for the uncertainty that accompanies the frenetic ongoing pace of change. The amplification and intelligence from automation and AI will be required to make sense of an increasingly complex world.

Design will become a non-negotiable expectation that goes beyond functionality to experience, and will permeate more and more business functions.

The rate of change faced by enterprises, and the necessity for widespread adoption, virtually guarantee that learning will be a core part of any lasting transformation. Finally, the location or proximity to work will be a major factor in capability and program planning, both for strategic intent and cost management.

Let’s examine each of these digital capability accelerators.

>Digital transformation accelerator No. 1: Agile and DevOps

“There’s an overarching need for companies to be nimble and responsive, to understand company needs, and quickly develop solutions,” said Uniyal, the Infosys Agile leader.

“Agile and DevOps enable companies to beat competitors by quickly experimenting, validating ideas and scaling leading-edge solutions. They enable greater flexibility and higher productivity. DevOps helps by automating the Agile software development lifecycle, enabling companies to deploy new features on a nearly continuous basis.”

The visionary insurance companies that are furthest along the digital transformation journey have the strongest ability to deliver Agile programs at scale. They have fully adopted both an Agile mindset and Agile practices. Their IT developers and operations teams cooperate closely to achieve business objectives.

Their technology teams deliver results fast enough for these visionaries to stay competitive and fend off digital native rivals. Such companies are also likely to have a robust, stable DevOps platform that serves their entire enterprise.

At U.S. insurer Nationwide, executives implemented Agile a decade ago. The organization, however, began another major push in 2014 to extend the practice to almost all its software development lines, according to Gigabit magazine. The result was $60 million in annual savings.

“The products that we create are all information-based; they’re not products that you can touch and feel,” Guru Vasudeva, chief information officer at Nationwide, told Gigabit. “IT is the manufacturing arm of any financial services and insurance company.”

There are two primary barriers that prevent insurance companies from making more progress on Agile and DevOps.

One major organizational challenge is changing the culture to ensure that business cooperates with IT from the start.

Our research has found that about 80% of development projects are IT-led and IT-sponsored, without early involvement of business stakeholders.

If companies can change their culture and mindset to ensure early business and IT collaboration, they will dramatically improve the likelihood of Agile and DevOps success.

In addition to cultural change, insurance companies also need to make sure that their employees are trained in new ways of working. This retraining must extend throughout the organization so that all stakeholders have a good understanding of these new ways of working.

Agile and DevOps methods can be extremely useful in certain industries such as branded consumer goods where speed is critical to successfully keep pace with fast-changing trends. In other industries, such as banking, insurance and airlines, there are regulations, risk and audit controls that can impede efforts to scale up Agile and DevOps.

While our survey shows that many companies are confident — perhaps overconfident — in their ability to master rapid experimentation, the reality is that Agile and DevOps techniques are hard to master. Even companies that purport to have flexible, Agile teams may still rely on the same old structured, rigid waterfall development methods inside those teams.

There are practical steps that companies can take to improve their Agile and DevOps skills. Companies can work faster and scale quicker while meeting the demands of global markets by implementing Agile on a distributed basis.

“Companies need to become more dynamic and nimbler,” Uniyal said. “To react faster to changing markets and come up with improved products and services, companies need to have a culture of rapid experimentation, quick development, prototyping and validation. To accomplish this, they need to be able to visualize their end-to-end value chain. This is a major challenge in legacy organizations where the value chain may be fragmented. The best way to overcome this issue is by implementing Lean.”

Digital transformation accelerator No. 2: automation and AI

AI and automation have the potential to radically transform existing business models and unlock new opportunities. For example, insurer Liberty Mutual now uses a large-scale AI deployment to process claims and provide quotes for auto insurance.

What distinguishes visionaries from their peers when it comes to AI and automation? Our survey found that visionaries are more likely to have developed and started to implement well-articulated strategies and initiatives for AI, RPA and IT automation. They also tend to approach automation and AI as ways to amplify human capabilities rather than just reduce headcount and costs. Their employees have the skills to implement automation and AI technologies in ways that advance corporate strategic goals.

That said, insurance companies at all stages of their digital transformation journeys are grappling with the ethical implications and opacity of AI.

“We need a paradigm shift in how we interact with AI and automation,” said John Gikopoulos, global head of AI and automation at Infosys. “We should apply ethics and control at the personal level, rather than expecting a process, machine, or laws to govern these technologies once they are out in the world.”

Ethical concerns could come to a head as more internet of things insurance data is generated and collected. Disputes about the ownership and use of data are possible, particularly when customers switch companies.

Those ethics questions can also lead to regulatory action. Some U.S. state governments require additional disclosure that could involve propriety company data in usage-based plans, according to the National Association of Insurance Commissioners.

Companies need to figure out the best ways to harness these tools to develop useful solutions that meet client needs. To get the most benefit from automation and AI, most incumbents will need to convince their own workforce about the benefits of these technologies and reskill employees to make sure that people and machines can work seamlessly together to achieve superior results.

Digital transformation accelerator No. 3: design

Design skills enable companies to rethink every aspect of their business, from internal operations to external customer service. Insurance companies with superior design skills use technology to find novel solutions to serve human needs.

Our survey shows that companies with design strengths are better able to seize opportunities to improve both customer and employee experiences.

They are more likely to deploy technology in the form of digital product engineering, content personalization and AR.

Insurance visionaries understand that design is more than mere user experience. Instead of segregating user design within its own silo, they make sure that more people, in more functions across the company have responsibility to design products and services that maximize user satisfaction.

Design-led insurance companies have effective processes in place to continuously listen to customers. They are committed to testing ideas and iterating to make those ideas better over time. They measure design performance and results with the same rigor that they apply to tracking revenues and costs.

“It starts with empathy,” according to The Digital Insurer website. “Not just: What do our customers experience when they interact with us? How do they perceive pricing and communication? But: What do we miss? Which unsolved problems do they have? What makes them feel secure or insecure? What is the larger context in which they act?

When it comes to pursuing design-led solutions, Infosys design executive Corey Glickman warned against excessive prototyping. He said too many companies spend millions of dollars a year on prototypes and proofs of concept, without ever moving on to implement those pilots at scale. In times of disruptive change, companies must bite the bullet and make big bets. It sometimes takes an industry leader or innovative upstart to establish a new norm. “No one would have a digital twin today if GE hadn’t sunk millions of dollars into developing theirs,” Glickman pointed out.

Systems engineering has emerged as a critical role in the digital age. The best systems designers are diligent scientists with master’s degrees and many years of work experience. This type of talent is in short supply, exacerbating the war for talent. However, the good news is that a systems designer with experience in one area can typically apply his or her knowledge to other domains. “Systems designers understand how large, complex systems behave,” Glickman said.

“As a discipline, systems design is universal enough that someone with experience in financial services can apply their skills and experience to software design or health care.”

On a practical, operational level, our research has confirmed the effectiveness of breaking up large projects into small teams of highly-skilled programmers handling the hardest and most important challenges. These all-star coders are hands-on, working iteratively in physical and virtual whiteboard environments, efficiently pulling from reusable code libraries and writing their own fresh code every day. This approach can reduce development time from three months to as little as three weeks. With this arrangement, companies can deliver more effective programming, solve difficult problems faster, and reduce technical debt that may have accumulated through legacy programming and processes.

Finally, the success of design-led digital transformations depends on the involvement of senior executives. Design is helping to transform major components of enterprise operating models, and success requires buy-in and leadership from the top.

Digital transformation accelerator No. 4: learning

Companies are facing a significant gap between the digital skill sets they need and the talent available, according to Jonquil Hackenberg, partner at Infosys Consulting. “Recent graduates, even in desirable fields like data science and enterprise architecture, lack the experience and expertise to implement at scale,” warned Hackenberg. “Meanwhile, many legacy IT professionals struggle to engage with subject matter experts in a way that translates business needs to modern, scalable technology solutions.”

Visionary insurance companies are more likely than other firms to bridge this talent gap by investing in the digital tools and infrastructure necessary to support a robust, always-on, continuous learning and reskilling program for employees. Many leading insurance companies have built their own internal training, reskilling, and upskilling programs.

Property and casualty insurer Liberty Mutual has a GoForCode boot camp to train hundreds of employees through a range of learning options, including self-paced online classes, in-office workshops, and immersive coding courses. Company executives recognize the value of retaining their corporate body of knowledge in their employees.

Continuous learning is fundamental to develop the workforce of the future, one that can achieve and sustain digital transformation. Employees must become nimble, responsive and proactive enough to identify and seize the best opportunities made possible by emerging technologies and new business models. Our research findings suggest that such continuous learning programs play an especially important role to help employees develop skills in Agile and DevOps, areas that are as much mindset shifts as technical skills.

Employees realize the critical importance of continuous learning to keep themselves marketable and relevant in a rapidly changing business world. Beyond internal skills development, learning programs have the added benefit of supporting retention.

Employees appreciate when companies make investments in their career development.

Our research shows that watchers often overlook the substantial benefits of learning accelerators. For companies looking to make the move from watcher to explorer, investing in learning is an important early step.

Digital transformation accelerator No. 5: proximity

Even though many insurance companies are competing in a global marketplace and have access to a growing suite of collaboration and communication tools, distance still adds complications to any initiative or project. On the other hand, proximity enhances collaboration and can remove physical barriers to success in product and IT development projects.

“Value creation occurs when companies bring teams together end-to-end in proximity,” advised Deverre Lierman, leader of the Infosys Raleigh Technology Hub.

“Companies should deliberately structure their ecosystem and choose their partners with an eye to maximize innovation, speed and responsiveness.

The key is to capitalize on the benefits of high-quality, low-cost locations without sacrificing the advantages that proximity brings. Visionaries balance global delivery centers with nearby innovation hubs.”

These hubs may be internal or involve strategic partners.

Our data shows that visionaries are more likely than watchers or explorers to have implemented finely- tuned strategies to locate employees together in geographies that balance cost with proximity to partners and customers.

The insurer Allstate created a new group, CompoZed Labs, and series of innovation hubs to work on software development.

“We have our pods of product teams and pairing stations,” said Opal Perry, group chief information officer for Allstate’s claims division, according to software firm Pivotal. “We also have screens that very visibly show the build pipeline and I can just walk through a lab that may have many projects and see right away what’s humming on green, what’s red, and see who’s working on it.”

Still, even visionaries in the insurance industry depend on the contributions and efficiency of distributed development teams. Visionaries supply these teams with effective collaboration tools and implement standards to measure the quality of work these distributed teams deliver. To the extent that visionaries rely on global development centers, they also invest in the infrastructure and systems to minimize the impact of distance.

At the same time, visionaries recognize that there is no substitute for physical proximity and are quite willing to establish well-staffed technology and innovation hubs near important partners or customers. That is why Infosys is establishing six new technology and innovation hubs in the United States and staffing them with 10,000 American employees to serve its customers there. Such proximity is especially valuable when working on initiatives involving customer experience, such as product development, content personalization and AR.

Insurance companies looking to reap maximum benefits from proximity should locate their technology and innovation hubs near end users (i.e., clients) and in places that have intrinsic appeal for the talent that the company wishes to recruit and retain. Locations near top universities are also attractive, since those schools can provide a pipeline of candidates for recruitment and an ecosystem for incubating innovation ideas.

Companies at all stages of digital transformation should strive to create a culture that attracts talent. Our research shows that employees want to work in a collaborative and collegial environment, where they know they can focus on getting results without wasting time fighting turf wars.

Practices and mindset — what sets visionaries apart

Every incumbent insurance company knows that it needs to make progress on its digital journey, but our recent survey indicates most are not moving fast enough. The proliferation of insurtechs illustrates where the insurance industry has fallen short and where it needs to go.

As our survey showed, most legacy companies are still at the explorer or watcher stages of the digital transformation journey. How can they move to the visionary level? What sets visionaries apart from watchers and explorers?

According to our research, visionaries stand out in the way they have fully embraced the mindset and practices of both being agile and doing Agile.

To become more like visionaries, companies should put in place a formal digital transformation strategy, and share that plan with employees, customers and partners alike. They should also develop and implement a comprehensive strategy for using automation and AI to bolster human capabilities, rather than just focusing on cutting costs.

These are not trivial matters. Insurance firms will face real challenges around talent recruitment and reskilling, retooling legacy systems, building the five accelerator capabilities and fighting off lean, hungry digital native disruptors.

The truth is that incumbent insurance companies need to do three things, do them all well, and do them simultaneously:

Establish the technical foundations for digital transformation.

Build technological capabilities and talent.

Innovate at the speed of Agile.

There are two ways that companies can give themselves a boost on the digital transformation path. They can seek to amplify their existing capabilities by focusing on high-value projects with the greatest potential impact, and they can partner with other organizations to gain access to complementary skills and resources.

Amplify

Insurance companies have limited talent resources, so it makes sense to focus systems designers’ efforts on the biggest problems where the solutions they create will have the greatest impact. “You can amplify the impact of designers by assigning them to small teams where they can work together to deliver scalable solutions that can be replicated throughout the organization,” explained Infosys’ Glickman.

“If you have the right systems and process, a small number of talented individuals can have a big impact on a company’s digital transformation journey.”

The insurance industry needs to figure out which projects to prioritize and how to push the digital envelope where it will matter most. Visionaries are comfortable with different parts of the organization being at different steps in their digital transformation journeys.

Partner

Insurance industry executives told us that only about a quarter of digital initiatives are led and delivered internally; more than half are led internally and delivered by partners, while the remaining one-fifth are fully delegated.

Companies partner for nearly three-quarters of their digital initiatives

There is a significant difference in how clusters handle partnering in the insurance industry. Watchers are the most likely to run initiatives entirely internally. Explorers are most likely to lead projects internally, while having them executed externally. Visionaries are more likely than the others to let partners run and deliver initiatives on their behalf.

According to our respondents, partnering offers two primary advantages: higher chances of success and quicker implementation.

Partnerships have several advantages

According to our research, visionaries are more likely to form partnerships because they have the process and governance maturity needed to build and run them effectively. It’s the same reason companies that invest in architecture and data management are more likely to support API interfaces with external services. Visionaries also have experience building partnerships and understand the multi-faceted value of a good partnership, so they are more likely to pursue and forge additional partnerships when opportunities arise.

Insurance industry visionaries’ digital accomplishments also give them a better appreciation for the unique capabilities that partners bring to the table. When it comes to the vast world of technology, visionaries that develop certain technical skills also tend to learn that they cannot be experts at everything. Instead, they recognize the value of focusing on their core competencies and gaining access to other expertise through mutually-beneficial partnerships.

Respondents told us the best partnerships are built on strong personal relationships among humans. Our survey showed that insurance companies are willing to partner on almost any digital transformation initiative, but they are least likely to work with partners on legacy modernization, where they presumably feel they have the in-house knowledge to upgrade those systems on their own.

Survey participants reported that their companies were most likely to ask an external partner to both lead and deliver on sophisticated initiatives like RPA, blockchain, 3D printing and VR. Nearly one-third of incumbent insurance companies turn to partners for help with these sorts of initiatives that require specialized, hard-to-recruit expertise or existing products. At Liberty Mutual, the company partnered with Nest to provide home insurance customers with a free internet-connected smoke and carbon monoxide detector.

Also, insurance companies were more apt to favor internal leadership, while partnering with external help for execution on initiatives such as enterprise cloud, internet of things and IT automation. These areas also require specialized expertise and significant resources, but in-house staff may already have some experience in these fields and thus feel more confident directing such projects themselves.

According to our research, U.S.-based companies tend to view intellectual property (IP) even more as a proprietary advantage than their European and Asian counterparts. As a result, U.S.-based firms more often prefer to develop high-value innovation in-house.

European firms partner for IP in a more transactional manner, while Asian companies have shown more openness for partners to take leading roles in IP creation.

Accelerating the journey

As mentioned in the Amplify section above, every insurance company—including visionaries—needs to prioritize specific digital transformation projects in order to maximize the impact of scarce resources.

How can a company know which projects to prioritize?

- Analyze its level of digital maturity and develop a clear, honest evaluation of current initiatives relative to objectives.

- Assess the short-term future of its industry. What are the key threats from disruptors? Which emerging technologies hold the most promise? How are customer expectations changing? What impact will these factors have on business models?

- Ensure that the company has a solid digital foundation by modernizing legacy systems and working on APIs and BPM. Strength in these areas will enable success in other aspects of a digital transformation plan.

- Strengthen and refine the five accelerator capabilities: Agile and DevOps, automation and AI, design, learning, and proximity.

- Forge relationships with partners whose skills and services could promote faster, better progress toward digital transformation goals.

As with other change initiatives, senior insurance executives should take an active role in driving digital transformation initiatives.

“If IT is trying to push this along, by themselves, it’s not going to work,” said Peter Logothetis, group chief information officer at Allstate, according to software firm Pivotal. “It has to be the business model that starts out first. Our chairman and senior executives get that. As a matter of fact our chairman is on record saying that Allstate is no longer an insurance company. Allstate is a software company.”

Insurance industry leaders have to send a signal that such internal power struggles will not be tolerated. Digital transformation journeys can only succeed when individuals from multiple areas of the organization step outside their comfort zones and work across boundaries for the good of the entire enterprise.

The digital future is arriving at a rapid pace, and the consequences for inaction are more severe than ever. Insurtechs are changing how customers think about and interact with their insurance companies. Speed and flexibility – rarely a priority in the old insurance world – are now paramount.

With proper planning, cooperation, and commitment, business leaders and IT professionals can work together to position their companies for success, no matter which direction the digital winds may blow.

Survey methodology

In November 2018, the Infosys Knowledge Institute used a blind format to conduct an online survey that attracted responses from more than 1,000 CXOs and other senior-level respondents from companies with revenue upward of $1 billion. Respondents represented multiple industries and hailed from Australia, China, France, Germany, India, the U.K. and the U.S.

To gain additional qualitative insights, we also conducted phone interviews with more than a dozen industry practitioners and subject matter experts.