The digital transformation journey

Financial services companies have confronted challenges from all sides in the past two decades. Stricter regulatory requirements, changing customer demands, nontraditional competition and other factors are all forcing organizations to innovate.

While the industry overall has continuously invested in technology, only a small fraction has reached the level needed to compete against digitally-native companies or legacy organizations that have transformed for the new era.

Financial services companies must accelerate their pace of digital adoption and learn how to deliver real-time services and enhanced customer experience. Failure means losing customers and market leadership.

In early 2018, Infosys surveyed more than 1,000 senior management level executives working in large organizations around the world that had more than 5,000 employees and over $1 billion in annual revenue. That research included responses from more than 100 financial services industry executives.

Based on that survey, we produced a report — The New Champions of Digital Disruption: Incumbent Organizations — showing that incumbent organizations (as opposed to digital natives) fall into three clusters determined by their progress along the digital transformation journey:

Knowing that many organizations are rapidly intensifying their digital transformation efforts, Infosys conducted a new survey in November 2018 to gauge the pace of that change. This new survey of financial services firms shows a slightly smaller percentage of watchers and explorers and more visionaries, a sign of greater progress than in other industries. Overall, company executives told us that their organizations can advance from the watcher to the explorer level without herculean effort, but reaching the visionary level is significantly more difficult.

Financial services firms must prepare for the stress of devouring their own businesses, not to win in the marketplace but to simply survive. As Silicon Valley continues to attack their profit pools, banks must be prepared to disrupt their overall structures, operations and leadership.

Fewer watchers, more visionaries

The need to be visionaries

Almost every incumbent financial services firm is being pushed by disruptors or peers to transform digitally. Stephen Lynch, CIO for consumer banking at a leading U.S. financial institution, believes that the pace and magnitude of the current technology-driven changes are unprecedented.

“Organizations have never had to transform in this manner before,” he said. “It’s very exciting — almost on par with the launch of the internet. It’s changing the economy so fast that we’re going to need all the global thought power we can get.”

Banks and financial services firms will survive only if they become digital transformation visionaries. Many will likely fall by the wayside. To stay relevant and avoid being blindsided by competitors, companies must find ways to transform their products, processes and business models using digitally-enabled approaches and technologies.

Navigating the transformation journey

Our most recent study takes a closer look at the transformation journey. We identified 22 key digital initiatives and then asked respondents where their companies stood on implementing each initiative:

- Not started (or in planning).

- Completed multiple proofs of concept.

- Completed pilot projects.

- Operating at scale.

We then developed the Digital Maturity Index and assigned each company an index score from 0 to 100 according to its progress on pursuing and implementing the 22 key initiatives.

Companies on the digital journey

Comparing clusters on their digital transformation journeys

As financial services companies advance through the digital transformation journey from watchers to explorers to visionaries, they operate more and more key digital initiatives at scale. The types of projects change throughout the journey and can be grouped into four categories:

- Foundation initiatives must be implemented to modernize legacy systems.

- Mainstay initiatives represent the core elements of digital transformation, including automation and artificial intelligence (AI).

- Customer initiatives primarily impact the customer experience. They include omnichannel marketing and content personalization.

- Forefront initiatives harness cutting-edge technologies, such as augmented reality (AR), drones and blockchain.

Visionaries stand out – cluster progress across 22 digital initiatives

As shown in the previous figure, financial services visionaries are significantly more advanced than explorers in their implementation of virtually all initiatives, and watchers are far behind.

| Watchers | Explorers | Visionaries |

|---|---|---|

|

|

|

Changing focus, making progress

Visionaries have many more initiatives operating at scale

As financial services companies advance along their digital transformation journeys, they tend to focus on different sorts of projects. Watchers are just trying to build a foundation for their digital transformation, so they are unlikely to have the bandwidth to launch mainstay, customer or forefront initiatives.

As companies reach the explorer stage, they turn their attention to a broader range of initiatives, including such mainstays as big data and analytics, enterprise cloud, and RPA, which helps with repetitive tasks such as opening accounts and following Know Your Customer regulations.

They can also spend time working on customer initiatives such as content personalization, digital product engineering and digital marketing. However, explorers must still invest time focusing on the basics, such as scaling the implementation of core foundational initiatives like legacy modernization, application programming interfaces (APIs) and business process management (BPM).

Financial services visionaries bring many initiatives to scale within foundation, mainstay and customer categories. They are also the only cluster making substantial progress on scaling forefront initiatives such as blockchain, originally created for cryptocurrencies but now gaining traction in the mainstream financial services industry. That technology is the basis for smart contracts, is used to facilitate international trade and can help verify online identities.

Shifting barriers on the digital transformation journey

Our survey revealed that an inability to experiment quickly is the greatest barrier to digital transformation that financial services companies faced in 2018. More than half of respondents (58%) worry that their companies lack the capacity for the rapid experimentation that is essential for testing different technologies and figuring out which ones hold the most promise. Most companies believe that they can quickly develop this capability. Only 18% of respondents in financial services felt that lack of rapid experimentation skills would still frustrate their digital transformation in 2019.

Barriers to digital transformation

We believe that the financial services industry underestimates the challenge of mastering the art of rapid experimentation. Companies need to implement major cultural changes in order to become adept at rapid experimentation, according to Alok Uniyal, vice president and head of Agile and DevOps at Infosys. Significant cultural shifts rarely happen quickly, but pressure is building on the financial services industry.

“Silicon Valley is coming and if banks don’t up their game, then tech companies will take over the industry’s business,” said Jamie Dimon, chairman, president and CEO of JPMorgan Chase. “There are hundreds of startups with a lot of brains and money working on various alternatives to traditional banking.”

While respondents to the Infosys survey feel that most barriers to digital transformation will diminish over time, they have persistent concerns over legacy systems.

Legacy systems currently rank as the third most commonly cited barrier (named by 42% of respondents), but financial services executives expect that it could become the most serious barrier in 2019.

According to Gartner estimates, banks need to triple their digital business innovation budgets to modernize legacy applications through 2020. Legacy systems are costly and also slow product time to market. Indeed, digital natives cite their lack of legacy systems as a major competitive advantage.

Experience with digital transformation is a double-edged sword. On the one hand, the visionaries who have progressed the furthest along the digital transformation journey recognize the most barriers, identifying four or more from the list of 10 that we provided.

At the same time, financial services visionaries are also more optimistic than their counterparts in the watcher and explorer groups about overcoming these barriers. This demonstrates that companies become more confident as they gain experience with implementing successful pilots and bringing ideas to scale on their digital transformation journeys.

Survey respondents are also confident that budgetary constraints will become less of a barrier in 2019.

While 41% of financial services executives cited “insufficient budget” as a barrier to digital transformation in 2018, 35% feel that it will still be a serious stumbling block this year. If organizations were to devote more investment to key digital initiatives, it would show that senior leaders are strengthening their commitment to digital transformation.

On the flip side, participants expect that change management will grow slightly harder as time goes on. While 32% in financial services named “lack of change management capabilities” as a barrier in 2018, 34% said it would be a problem in 2019. Watchers and explorers are especially worried about managing change.

Digital maturity by industry

Our survey revealed significant differences in digital maturity by industry. Financial services scored slightly higher than the median on the Digital Maturity Index, but it still trailed telecommunications, manufacturing and technology.

In the financial services industry, legacy organizations face intense competition from startups and large tech companies muscling into the sector. These legacy incumbents are trying to make progress toward digital transformation, but their efforts are hampered by regulations, security concerns and complex internal processes.

Industry ranking on the Digital Maturity Index

Accelerating the digital transformation journey: 5 key capabilities

In August 2018, Infosys conducted a research study that identified five capabilities which help companies, including financial services firms, accelerate their digital transformation journeys: Agile and DevOps, automation and AI, design, learning, and proximity.

In our November 2018 executive survey, we looked deeper to understand company competencies in these areas. We found that companies with the highest Digital Maturity Index scores (i.e., visionaries) do indeed have the strongest abilities in all accelerator categories.

Visionary companies have superior accelerator capabilities

Cluster average

Each of the five digital capability accelerators above is powerful in its own right, and we examine each of them on the pages that follow. Before looking at the accelerators individually, it is worth reviewing them holistically at a summary level. When we reviewed client and industry digital transformation programs, we found multiple successes in the past two years where one of the accelerators was dominant.

However, in discussions with executives about the next 12 months and beyond, the consistent message was that multiple accelerators will increasingly be needed for future success. Agile and DevOps programs will be required for the uncertainty that accompanies the frenetic, ongoing pace of change. The amplification and intelligence from automation and AI will be required to make sense of an increasingly complex world.

Design will become a non-negotiable expectation that goes beyond functionality to experience, and will permeate more and more business functions.

The rate of change faced by enterprises, and the necessity for widespread adoption, virtually guarantee that learning will be a core part of any lasting transformation. Finally, the location or proximity to work will be a major factor in capability and program planning, for both strategic intent and cost management.

Let’s examine each of these digital capability accelerators.

Digital transformation accelerator No. 1: Agile and DevOps

While the financial services industry has been a slow adopter of Agile and DevOps, these practices are now being implemented for new product delivery and software updates. Security, an industry cornerstone, has also led to the emergence of DevSecOps to fill security loopholes, minimize weaknesses and reduce risks. “There’s an overarching need for companies to be nimble and responsive, to understand company needs, and to quickly develop solutions,” Uniyal said.

“Agile and DevOps enable companies to beat competitors by quickly experimenting, validating ideas and scaling leading-edge solutions. They enable greater flexibility and higher productivity. DevOps helps by automating the Agile software development life cycle, enabling companies to deploy new features on a nearly continuous basis.”

The visionary financial services companies that are furthest along the digital transformation journey have the strongest ability to deliver Agile programs at scale. They have fully adopted both an Agile mindset and Agile practices. Their IT developers and operations teams cooperate closely to achieve business objectives. Their technology teams deliver results fast enough for these legacy companies to stay competitive and fend off digital native rivals. Such visionaries are also likely to have a robust, stable DevOps platform that serves their entire enterprise. One bank with a large, federated IT structure used Agile and DevOps practices to shorten the release cycle of new features from 12 weeks to four weeks. Besides improving service, those efforts also increased reliability by 25% and saved the company $2 million.

That approach also paid off for one of the world’s largest financial services firms. With over $1 trillion in trades, J.P. Morgan Asset Management executes nearly 1% of the world’s equity trades. Previously, the firm had long software change cycles, minimal coordination between development and operations, and quarterly software release cycles. To cut costs and risk, the firm adopted Agile and DevOps practices; over time, the release frequency improved dramatically from quarterly to daily releases. There are two primary barriers that prevent financial services companies from making more progress on Agile and DevOps.

One major organizational challenge is changing the culture to ensure that business cooperates with IT from the start.

Our research has found that about 80% of development projects are IT-led and IT-sponsored, without early involvement of business stakeholders.If companies can change their culture and mindset to ensure early business and IT collaboration, they will dramatically improve the likelihood of Agile and DevOps success.

In addition to facilitating culture change, financial services companies also need to make sure that their employees are trained in new ways of working. This retraining must extend throughout the organization so that all stakeholders have a good understanding of these new ways of working.

Agile and DevOps methods can be extremely useful in certain industries, such as branded consumer goods, where speed is critical in order to successfully keep pace with fast-changing trends. In banking, however, regulations, risk and audit controls can impede efforts to scale up Agile and DevOps. “As we transform our mobile apps using continuous delivery and DevOps, we have control processes that will have to be modified to also support new methods of delivery,” said Lynch. “Like many large firms, rethinking these essential parts of our build process is key to efficiency in digital channels.” While our survey shows that many companies are confident — perhaps overconfident — in their ability to master rapid experimentation, the reality is that Agile and DevOps techniques are hard to master. Even companies that purport to have flexible, Agile teams may still rely on the same old structured, rigid waterfall development methods inside those teams. There are practical steps that companies can take to improve their Agile and DevOps skills. Companies can work faster and scale quicker while meeting the demands of global markets by implementing Agile on a distributed basis.

“Companies need to become more dynamic and nimbler,” Uniyal said. “To react faster to changing markets and come up with improved products and services, companies need to have a culture of rapid experimentation, quick development, prototyping and validation. To accomplish this, they need to be able to visualize their end-to-end value chain. This is a major challenge in legacy organizations where the value chain may be fragmented. The best way to overcome this issue is by implementing Lean and related simplification initiatives.”

Digital transformation accelerator No. 2: automation and AI

AI and automation have the potential to radically transform existing business models and unlock new opportunities in financial services, from loan approvals to customer-and employee-facing chatbots.

What distinguishes visionaries from their peers when it comes to AI and automation? Our survey found that visionaries are more likely to have developed and started to implement well-articulated strategies and initiatives for AI, RPA and IT automation. They also tend to approach automation and AI as ways to amplify human capabilities — freeing them from repetitive tasks — rather than just reduce headcount and costs. Their employees have the skills to implement automation and AI technologies in ways that advance corporate strategic goals.

That said, financial services companies at all stages of their digital transformation journeys are grappling with the ethical implications and opacity of AI.

“We need a paradigm shift in how we interact with AI and automation,” said John Gikopoulos, global head of AI and Automation at Infosys. “We should apply ethics and control at the personal level, rather than expecting a process, machine or laws to govern these technologies once they are out in the world.”

In highly regulated industries, such as financial services, AI’s ethical issues could expose organizations to even more scrutiny.

Better tools are constantly coming to market that give financial services companies new ways to create AI applications. Companies need to figure out the best ways to harness these tools to develop useful solutions that meet client needs. To get the most benefit from automation and AI, most incumbent companies will need to convince their own workforce about the benefits of these technologies and reskill employees to make sure that people and machines can work seamlessly together to achieve superior results.

“The focus on AI is often narrow and deep at large organizations,” said Andy Maguire, group chief operating officer at HSBC. These companies have hundreds of thousands of employees, but AI generally affects fewer than 1% of them.

In HSBC’s branches and call centers, large-scale digitization has already started. But that hasn’t eliminated the need for people in those areas, Maguire said. AI often frees employees from mundane and repetitive work, allowing them to focus more on judgment-based projects and work requiring critical thinking. “If we educate people to do the things we need them to do tomorrow and in the next decade, I think it’s all going to be OK,” he said.

“There are many misconceptions about how quickly large-scale AI transformation will take place,” Infosys president Mohit Joshi said. While it’s true AI is already being integrated into companies of all sizes, we’re still at least 15 to 20 years away from AI being the heart of a major corporation and making many of the decisions that senior executives make now, he said. In the meantime, AI alleviates much of the drudgery work in financial services, known for its torturous 100-plus-hour workweeks.

Digital transformation accelerator No. 3: design

Design skills enable the financial services industry to rethink every aspect of its business, from internal operations to external customer service. Financial services companies with superior design skills use technology to find novel solutions to serve human needs.

Our survey shows that companies with design strengths are better able to seize opportunities to improve both customer and employee experiences. They are more likely to deploy technology in the form of digital product engineering, content personalization and AR.

Financial services visionaries understand that design is more than mere user experience. Instead of segregating user design within its own silo, they make sure that more people in more functions across the company have responsibility to design products and services that maximize user satisfaction.

Design-led companies have effective processes in place to continuously listen to customers. They are committed to testing ideas and iterating them to improve over time. They measure design performance and results with the same rigor they apply to tracking revenues and costs.

When it comes to pursuing design-led solutions, Infosys design executive Corey Glickman warned against excessive prototyping. He said too many companies spend millions of dollars a year on prototypes and proofs of concept, without ever moving on to implement those pilots at scale. In times of disruptive change, companies must bite the bullet and make big bets. It sometimes takes an industry leader or innovative upstart to establish a new norm. “No one would have a digital twin today if GE hadn’t sunk millions of dollars into developing theirs,” Glickman pointed out.

Systems engineering has emerged as a critical role in the digital age. The best systems designers are diligent scientists with master’s degrees and many years of work experience. This type of talent is in short supply, exacerbating the war for talent. However, the good news is that a systems designer with experience in one area can typically apply his or her knowledge to other domains. “Systems designers understand how large, complex systems behave,” Glickman said.

“As a discipline, systems design is universal enough that someone with experience in financial services can apply their skills and experience to software design or health care.”

On a practical, operational level, our research has confirmed the effectiveness of breaking up large projects into small teams of highly skilled programmers handling the hardest and most important challenges.

These all-star coders are hands-on, working iteratively in physical and virtual whiteboard environments, efficiently pulling from reusable code libraries and writing their own fresh code every day. This approach can reduce development time from three months to as little as three weeks. With this arrangement, companies can deliver more effective programming, solve difficult problems faster, and reduce technical debt that may have accumulated through legacy programming and processes.

Finally, the success of design-led digital transformation depends on the involvement of senior executives. In the early digital era, design involved taking individual physical processes such as teller banking and putting them online, first through ATMs and then through apps in the smartphone era. Now design is helping to transform major components of enterprise operating models, and success requires buy-in and leadership from the top.

Digital transformation accelerator No. 4: learning

Companies are facing a significant gap between the digital skill sets they need and the talent available, according to Jonquil Hackenberg, partner at Infosys Consulting. “Recent graduates, even in desirable fields like data science and enterprise architecture, lack the experience and expertise to implement at scale,” warned Hackenberg. “Meanwhile, many legacy IT professionals struggle to engage with subject matter experts in a way that translates business needs to modern, scalable technology solutions.”

Visionary financial services companies are more likely than other firms to bridge this talent gap by investing in the digital tools and infrastructure necessary to support a robust, always-on, continuous learning and reskilling program for employees.

Continuous learning is fundamental to developing the workforce of the future, one that can achieve and sustain digital transformation. Employees must become nimble, responsive and proactive enough to identify and seize the best opportunities made possible by emerging technologies and new business models. Our research findings suggest that such continuous learning programs play an especially important role to help employees develop skills in Agile and DevOps, areas that require mindset shifts as much as technical skills.

Employees realize the critical importance of continuous learning to keep themselves marketable and relevant in a rapidly changing business world. Beyond internal skills development, learning programs have the added benefit of supporting retention. Employees appreciate when companies make investments in their career development.

Many leading financial services firms have built their own internal training, reskilling and upskilling programs.

Our research shows that watchers often overlook the substantial benefits of learning accelerators. For companies looking to make the move from watcher to explorer, investing in learning is an important early step.

A large number of banks focus on learning and reskilling as fundamental components of their culture. ING is setting up an “analytics academy” to refresh its staff’s data skills. In 2018, JPMorgan Chase introduced mandatory training in Python for employees in its asset management division. NatWest plans to invest £1 million in a training academy for its 70,000 employees, and even CEO Ross McEwan enrolled in the training program.

Digital transformation accelerator No. 5: proximity

Even though many financial services firms are competing in a global marketplace and have access to a growing suite of collaboration and communication tools, distance still adds complications to any initiative or project. On the other hand, proximity enhances collaboration and can remove physical barriers to success in product and IT development projects.

“Value creation occurs when companies bring teams together end-to-end in proximity,” advised Deverre Lierman, leader of the Infosys Raleigh Technology Hub.

“Companies should deliberately structure their ecosystem and choose their partners with an eye to maximize innovation, speed and responsiveness. “The key is to capitalize on the benefits of high-quality, low-cost locations without sacrificing the advantages that proximity brings. Visionaries balance global delivery centers with nearby innovation hubs.”

These hubs may be internal or involve strategic partners. M&T Bank recently announced it will hire hundreds of new employees to staff its planned tech hubs. And BBVA Compass created an Agile-inspired development center in Birmingham, Alabama, that’s designed to operate like a tech startup.

Our data shows that visionary financial services companies are more likely than watchers or explorers to have implemented finely tuned strategies to locate employees together in geographies that balance cost with proximity to partners and customers.

Still, even visionaries depend on the contributions and efficiency of distributed development teams. Visionaries supply these teams with effective collaboration tools and implement standards to measure the quality of work these distributed teams deliver. To the extent that visionaries rely on global development centers, they also invest in the infrastructure and systems to minimize the impact of distance.

At the same time, visionaries recognize that there is no substitute for physical proximity and are quite willing to establish well-staffed technology and innovation hubs near important partners or customers. That is why Infosys is establishing six new technology and innovation hubs in the United States and staffing them with 10,000 American employees to serve its customers there. Such proximity is especially valuable when working on initiatives involving customer experience, such as product development, content personalization and AR.

Financial services companies looking to reap maximum benefits from proximity should locate their technology and innovation hubs near end users (i.e., clients) and in places that have intrinsic appeal for the talent that the company wishes to recruit and retain.

Locations near top universities are also attractive, since those schools can provide a pipeline of candidates for recruitment and an ecosystem for incubating innovation ideas.

Companies at all stages of digital transformation should strive to create a culture that attracts talent. Our research shows that employees want to work in a collaborative and collegial environment, where they know they can focus on getting results without wasting time fighting turf wars.

Practices and mindset — what sets visionaries apart

Every incumbent financial services company knows that it needs to make progress on its digital journey, but our recent survey indicates most are not moving fast enough.

As our survey showed, most legacy companies are still at the watcher or, at best, the explorer stage of the digital transformation journey. How can they move to the visionary level? What sets visionaries apart from watchers and explorers?

According to our research, visionaries stand out in the way they have fully embraced the mindset and practices of both being agile and doing Agile.

To become more like visionaries, companies should put in place a formal digital transformation strategy, and share that plan with employees, customers and partners alike. They should also develop and implement a comprehensive strategy for using automation and AI to bolster human capabilities rather than just focusing on cutting costs.

These are not trivial matters. Companies will face real challenges around talent recruitment and reskilling, retooling legacy systems, building the five accelerator capabilities, and fighting off lean, hungry digital native disruptors.

The truth is that incumbent financial services firms need to do three things, do them all well and do them simultaneously:

- Establish the technical foundations for digital transformation.

- Build technological capabilities and talent.

- Innovate at the speed of Agile.

There are two ways that financial services companies can give themselves a boost on the digital transformation path. They can seek to amplify their existing capabilities by focusing on high-value projects with the greatest potential impact, and they can partner with other organizations to gain access to complementary skills and resources.

JPMorgan Chase continues to do just that. As part of its digital foundation, the financial services giant has invested in and implemented new technologies. The bank has set up incubators, formed strategic partnerships and established alliances with fintechs and startups. By practicing Agile and DevOps, JPMorgan Chase is now able to make changes at speed.

Amplify

Financial services companies have limited talent resources, so it makes sense to focus systems designers’ efforts on the biggest problems where the solutions they create will have the greatest impact. “You can amplify the impact of designers by assigning them to small teams where they can work together to deliver scalable solutions that can be replicated throughout the organization,” explained Infosys’ Glickman.

“If you have the right systems and process, a small number of talented individuals can have a big impact on a company’s digital transformation journey.”

The financial services industry needs to figure out which projects to prioritize and how to push the digital envelope where it will matter most. Visionaries are comfortable with different parts of the organization being at different steps in their digital transformation journeys.

Here’s a key insight — not everything needs to be Agile.

The CIO at one financial services company agreed that prioritization and proper allocation of scarce resources could be key to having the desired impact. “Right now, we’re trying to do a little bit in each area and bring the entire organization along simultaneously,” he acknowledged.

“While this is delivering progress, we’ll likely focus more attention on making faster changes in a smaller number of high-priority areas. That may be the only way to accomplish our digital transformation in a big way.”

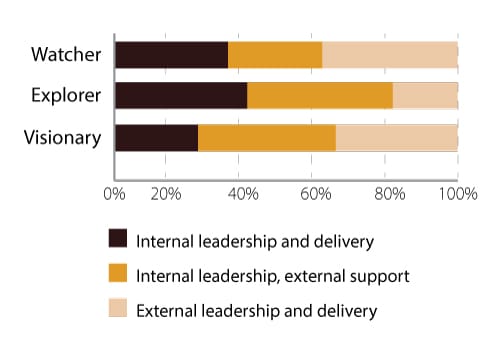

Partner

Financial services executives told us that nearly 40% of digital initiatives are led and delivered internally, while more than 40% are led internally and delivered by partners and the remaining 20% are fully delegated.

Companies partner for nearly two-thirds of their digital initiatives

There is a significant difference in how clusters handle partnering. Across industries, watchers are the most likely to run initiatives entirely internally. Explorers are most likely to lead projects internally, while having them executed externally. Visionaries are more likely than the others to let partners run and deliver initiatives on their behalf. The results were slightly different in financial services, where watchers are more likely than explorers to rely on external partnerships for digital initiatives.

Visionaries are more likely to partner on digital initiatives

According to our respondents, partnering offers two primary advantages: higher chances of success and quicker implementation.

Partnerships have several advantages

According to our research, visionaries are more likely to form partnerships because they have the process and governance maturity needed to build and run them effectively. It’s the same reason companies that invest in architecture and data management are more likely to support API interfaces with external services. Visionaries also have experience building partnerships and understand the multifaceted value of a good partnership, so they are more likely to pursue and forge additional partnerships when opportunities arise.

Visionaries’ digital accomplishments also give them a better appreciation for the unique capabilities that partners bring to the table. When it comes to the vast world of technology, visionaries that develop certain technical skills also tend to learn that they cannot be experts at everything. Instead, they recognize the value of focusing on their core competencies and gaining access to other expertise through mutually beneficial partnerships.

Respondents told us the best partnerships are built on strong personal relationships among humans.

Our survey showed that companies are willing to partner on almost any digital transformation initiative, but they are least likely to work with partners on legacy modernization, where they presumably feel they have the in-house knowledge to upgrade those systems on their own.

In financial services, participants reported that their companies were most likely to ask an external partner to both lead and deliver on such sophisticated initiatives as AI, RPA and blockchain. One-fourth to one-third of incumbent companies turn to partners for help with these sorts of initiatives that require specialized, hard-to-recruit expertise.

Financial services firms were more apt to favor internal leadership, while partnering with external help for execution on initiatives such as APIs, 3D printing and enterprise cloud. These areas also require specialized expertise and significant resources, but in-house staff may already have some experience in these fields and thus feel more confident directing such projects themselves.

According to our research, U.S.-based companies tend to view intellectual property (IP) even more as a proprietary advantage than their European and Asian counterparts do. As a result, U.S.-based firms more often prefer to develop high-value innovation in house.

European firms partner for IP in a more transactional manner, while Asian companies have shown more openness for partners to take leading roles in IP creation.

Accelerating the journey

As mentioned in the Amplify section above, all financial services companies — including visionaries — need to prioritize specific digital transformation projects in order to maximize the impact of scarce resources.

How can a company know which projects to prioritize?

- Analyze its level of digital maturity and develop a clear, honest evaluation of current initiatives relative to objectives.

- Assess the short-term future of its industry. What are the key threats from disruptors? Which emerging technologies hold the most promise? How are customer expectations changing? What impact will these factors have on business models?

- Ensure that the company has a solid digital foundation by modernizing legacy systems and working on APIs and BPM. Strength in these areas will enable success in other aspects of a digital transformation plan.

- Strengthen and refine the five accelerator capabilities — Agile and DevOps, automation and AI, design, learning, and proximity.

- Forge relationships with partners whose skills and services could promote faster, better progress toward digital transformation goals.

As with other change initiatives, senior financial services executives should take an active role in driving digital transformation initiatives.

Leaders have to send a signal that internal power struggles will not be tolerated. Digital transformation journeys can succeed only when individuals from multiple areas of the organization step outside their comfort zones and work across boundaries for the good of the entire enterprise.

The digital future is arriving at a rapid pace, and the consequences for inaction are more severe than ever. With proper planning, cooperation and commitment, business leaders and IT professionals can work together to position their companies for success, no matter which direction the digital winds may blow.

Survey methodology

In November 2018, the Infosys Knowledge Institute used a blind format to conduct an online survey that attracted responses from more than 1,000 CXOs and other senior-level respondents from companies with revenue upward of $1 billion. Respondents represented multiple industries and hailed from Australia, China, France, Germany, India, the U.K. and the U.S.

To gain additional qualitative insights, we also conducted phone interviews with more than a dozen industry practitioners and subject matter experts.

Survey coverage