Physical retail is facing an existential crisis, with 2.6 times more stores closing than opening.1 At the current rate of store closures, it’s estimated that by the end of 2019, in the U.S. alone, store closures could touch 12,000.

What can be done to revive the physical store? The focus should be on where digital is dropping the ball — namely, the large number of missed opportunities in abandoned carts and the high level of returns faced by online retail channels. Physical stores that have well-designed integration with the customer’s digital journey could turn some of these missed opportunities into revenue. Yet currently, physical stores are not providing an offering that’s compelling or complementary to their digital counterparts’ similar initiatives. According to our research, retail stores have the following drawbacks: 2

- Underwhelming physical spaces: Footfall is declining, with 31% of shoppers going to a store less frequently than they did five years ago.

- Deficient in-store technologies: Retailer mobile apps are underutilized, with only 18% of shoppers using a retailer’s mobile app most of the time they are in the store, down from 34% the year previous.

- Disappointing human experiences: Retailers don’t understand their shoppers’ likes, wants and needs, and therefore they struggle to design compelling offers and experiences in stores.

What can retailers do to change this harsh reality?

Enter harmonized retail

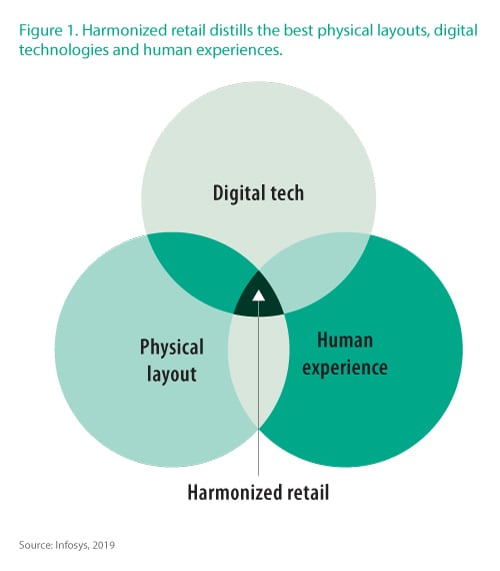

Steve Dennis, president and founder of SageBerry Consulting as well as a senior Forbes contributor coined the term harmonized retail in 2015. Harmonized retail works at the intersection of physical layouts, digital technologies and human experiences. In the physical retail store context, it is the sweet spot (Figure 1) where all three get it right at the same time in order to amplify the in store experience.

“Harmonized retail is really the blend of digital, physical and human experience design. It is never tech for tech’s sake,” notes Chris Walton, CEO and co-founder of Red Archer Retail as well as a regular Forbes contributor, in a recent conversation with the Infosys Knowledge Institute. “All three need to be woven together, like a fabric, to bring to life experiences that live up to a brand’s promise and that meet the consumer in his or her right context at all times.”

The ideal harmonized retail environment enables digital and physical channels to share customer data and journeys, feeding each other sales opportunities and insights that enable them to better target individuals. From the experience point of view, the connection between both should be seamless, consistent and attractive to the consumer.

Harmonized retail: one block at a time

Harmonized retail starts with charting the customer journey for a retailer. For this, retailers must list all the touch points customers go through for an in-store experience, right from discovering the store to post-purchase interaction. Once this is done, various interactions can be segmented into various stages in a customer journey. This is how harmonized retail blocks (Figure 2) are created, becoming sequential stages aligned with the customer journey. Customers might come in at different stages, but retailers must quickly identify the stage the customer is at so that retailer intent matches shopper context through the right engagement block.

Attract

The “Attract” block is about incentivizing customers to use the physical store. Understanding a customer’s digital journey is crucial here, as it’s a key component of driving physical store visits. For instance, it is claimed that 60% of physical store sales are influenced by the digital shopping experience at diverse retail brands such as Target, Nordstrom and Neiman Marcus.3

Effective and continuous communication with customers over social media plays another key role in engaging with customers online at the right moments to attract them. Infosys research reveals that digital identification permission has grown tremendously, with the likelihood of digitally identifying shoppers up from 57% in 2017 to 73% in 2018. As shoppers are willing to identify themselves and are over the initial “creepy factor,” it presents a huge opportunity for retailers to use this information for personalization.

We found that 59% of shoppers would like to receive alerts about the specific store they are in, and 65% would like to redeem an offer or loyalty reward. A key 2025 trend is that retailers will upgrade their customer relationship management platforms for robust personal data to create rich customer profiles and target individual shoppers at scale. While CRM platforms can help identify the right target audience, the use of artificial intelligence can enhance the targeted information displayed to customers so that they can make more informed and relevant choices. For instance, American department store chain Kohl’s rolled out store Wi-Fi to track customers’ browsing patterns at a more granular level to drive deeper customer engagement.

GPS-based sensors can determine the proximity of the customer to the store, and loyal online customers can be identified before they enter the store in order to prepare retailers for the next block. Starbucks offers recommendations on the food and drinks at the nearest store based on the weather outside through its AI-driven recommendation engine. However, inventory accuracy and visibility are challenges that retailers still face, according to a National Retail Foundation/Forrester study. Today’s customers aren’t confident they can buy online and return or pick up an item at the store. That confidence comes from a retailer’s omnichannel capability to allocate space and stage pickups for online returns. Robust order management systems and human resources at the store are critical to managing customer requests efficiently.

Engage

The “Engage” block is about delivering personalized and contextualized experiences to customers who are already identified. This involves targeted content personalization harmonized across all channels: physical, digital and human brand experiences.

Our research underscores the need for retailers to invest significantly in proximity marketing to engage with customers inside the store. While retailers are talking about it, very few are actually adept at in-store personalization.

Layout planning through A/B testing can align real estate selling space with customer preferences for an optimal shopping experience. Beacons provide retailers an opportunity to recapture a shopper’s mobile attention within the store by sending out a unique signal that a customer’s smartphone intercepts, and a targeted, personalized message will subsequently land in their smartphone through the retailer’s app.

A majority of customers (66%), according to our research, are most frequently checking a retailer’s mobile app in the store for offers and loyalty rewards. Additionally, beacons are used in two ways:

- Assist customers around the store and direct them to the right aisles.

- Drive customers to an augmented reality experience for an evolved usage.

ABI Research forecasts 400 million beacons will be deployed by 2020.4 Top retailers such as Macy’s and Target are using beacons to realize the power of personalization across their stores. However, technologies such as beacons must combine with the human element — store associates to guide a customer through the shopping journey and to humanize the brand in as many offers and deals as they desire.

Explore and select

“Explore and select” is about making the customer central to the real-time interaction with smart objects and smarter associates. Shopping has become an experiential part of a customer’s existence, and our research cites that around 62% of shoppers either want “interactive, shoppable screens” or are using them now.

Smart shelves, mirrors and carts can augment the experience for digital commerce firms with crucial data that companies lack about the customer to pave the way for a new harmonized reality, where off-line drives online as much as online drives off-line. The smart shelf system works on radio frequency identification technology and ”internet of things” sensors that accurately provide real-time inventory visibility in order to reduce shrinkage.

Smart robots can help the customer with in-store navigation and purchase recommendations based on historical data. Buyers trust their mobile phones mainly to compare prices in a physical store. With real-time analytics, store associates can offer individual customers personalized discounts.

Seventy-six percent of buyers prefer to try on items before they purchase them.5 How does a blended experience in a smart fitting room look like? As a customer enters the smart fitting room, RFID readers capture the item details and display them along with color codes and sizes on the smart screen. The customer then places an e-request from the smart screen, and that is received by a store associate who assists on either general requests or product requests to bring the items to the fitting room. For this to work, store associates must be able to pick up the conversational thread and engage with customers on a one to-one level.

Transact

The “Transact” block makes paying for goods as seamless as possible. Self-checkout and autonomous checkout are tools to enable this.

Infosys research says a majority of customers (60%) prefer grab-and-go stores with self-checkout from their smartphones. Retailers use self checkout and autonomous checkout to facilitate this much-desired shopping experience. Not surprisingly, we find that millennials show the highest level of interest in scan-and-go technology.

Amazon Go is setting the standard in autonomous checkout, with surveillance powered by hundreds of ceiling-mounted cameras and sensors. Customers scan their phones as they walk into the store, and the phone can detect movement when items are picked up from the shelves; customers are automatically billed by the Amazon Go app as they exit through the turnstiles.

Legacy point-of-sale systems do not integrate efficiently with modern enterprise systems. Investing in a modernized POS system, as in a mobile-first or a cloud-based POS, will improve the customer experience by offering inventory information, product recommendations, customer profiling, key performance indicators and so forth. This is possible through integration with enterprise systems such as those for payment, inventory, accounting, CRM, human resources and so on (Figure 3).

Deliver

“Deliver” is about getting into a customer’s hands a product that can either be sent to or picked up from one of multiple locations. This can be done through omnichannel investments in “buy online, return/pickup in store” options.

In another paper on harmonized retail, we speak about how Walmart and Target are competing with pure-play retailers such as Amazon through same-day deliveries. U.S. retailers such as Best Buy take this a step further to make collection by guests easier. We also see how Kohl’s can attract shoppers under 35 years old through a partnership with Amazon for returns (Figure 4).

This cooperation model is possible because of this new click-and-collect era, with store pickups accounting for a third of U.S. online sales during the 2018 holiday season.6 However, there is clearly room for improvement, as 24% of buy-online-pick-up-in-store orders were not ready for pickup after pickup notifications were sent.7

Stein Mart, an American discount department store chain, faced declining sales and is betting on Amazon lockers in more than 200 stores. Amazon lockers are self-service kiosks making it convenient for customers to pick up or return purchases. Customers can choose to have their order delivered to these kiosks for free. American drugstore chain Rite Aid added this type of lockers to 900 stores, while French mass-retail group Casino added 1,000 lockers in France.8

Walmart has an in-home delivery project that goes beyond delivery to people’s homes to go right into their refrigerator. With a Walmart smart lock outside their homes and garages, customers can have items delivered to their kitchen or garage. The Walmart employee uses a wearable camera device and a one-time code to access the customer’s house. This allows customers to be able both to control the Walmart worker’s access and to monitor the delivery remotely.

The next harmonized block

Our research indicates that 65% of consumers want reminders on loyalty rewards. However, we find customers face the following issues when it comes to loyalty points:

- Loyalty program fatigue: Inconvenience of keeping track of various loyalty programs that lapse on expiry.

- Non-tailored offers: Uninteresting deals that fail to arouse excitement, as they don’t suit a customer’s tastes.

- Inflexible operations: Hassles during claim redemption of loyalty points due to complex portal operability.

Customer loyalty ties together the harmonized retail blocks long after the customer leaves a store. It’s what feeds back into physical and digital channels so that human experiences are enhanced. This is the next harmonized block that retailers will be measured by as a reflection of their performance on customer lifetime value.

References

- “Weekly US and UK Store Openings and Closures Tracker 2019, Week 21,” Coresight Research, May 23, 2019

- “The Reinvention Of Retail Demands New Metrics,” Forbes, January 2018

- “New BLE Beacons Coverage,” ABI Research

- “How to use 3D body imaging to innovate in the apparel or footwear industry,” Body Labs, 2016

- “How U.S. retailers turn their bane into boon with ‘click and collect,’” Reuters, February 25, 2019

- “Order Online Pickup In Store Same Day: 300 Secret Shoppers At 10 Top Retailers Getting It Right,” Forbes, February 25, 2019

- “Stein Mart Deploys Amazon Lockers At Nearly 200 Stores,” Retail Touchpoints, May 21, 2019