New opportunities and technologies are transforming the in-store shopping experience - both digitally and physically. Consumer behavior is changing, creating different incentives and expectations. After a rough start, retailers have started to embrace e-tailing. A retailer’s objective in this digital, omnichannel market surpasses customer satisfaction. The goal is customer delight.

Digital disruption has forced every retailer to become a tech company. The ever-changing digital advancement is forcing retailers to embrace technology, not only to meet customer demands but also to move ahead of competitors. The retail industry will see more change in the next five years than it has seen in the past fifty years. Managing this change will be key to retail store survival.

Pain points with the traditional model

Demand forecasting

The biggest challenge for store owners is to have the right product at the right time in the right condition. When they are overstocked, stores resort to deep discounts to move merchandise. If stores are understocked, customers can be disappointed with the selection and not return to them. Both scenarios lead to revenue loss.

Workforce allocation

The expertise of and interaction with store associates is an advantage of in-store shopping. The challenge for retailers is to have the appropriate number of employees at certain times and in strategic locations. Overstaffing increases operation costs while being understaffed can lead to customer dissatisfaction. Anticipating seasonal change when more or fewer employees are needed at certain times of the year is also a challenge.

High operating costs

Retail space in a prime location is likely to bring more foot traffic, but it comes at a greater expense. Saving money by renting or buying in a less desirable space may mean fewer customers coming in. Providing convenient parking is also a costly but valuable element when it comes to getting shoppers inside.

Shrinkage

It is impossible to completely eliminate theft in an in-store retail setting. Theft includes both shoplifting and employee skimming.

Personalization

Modern consumers prefer a smaller selection of products tailored to their tastes over a saturated market offering endless but irrelevant options. Retailers need to identify customers’ needs on a personal level and find ways to market those products to specific targets.

Quality over cost

Customer expectations have switched from “affordable” to “worth the cost.” Low price is no longer the sole standard; many consumers consider qualities such as source, authenticity or prestige when choosing products.

Slow checkout

Consumers prefer online shopping instead of waiting in long in store lines.

Returns and exchanges

The effort involved with returning or exchanging items when the store is not conveniently located can also push consumers online.

Drivers for store transformation

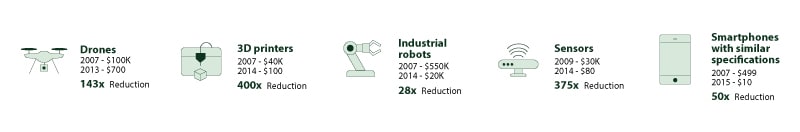

Reduced cost

The decreasing cost of hardware and technology allows more stores to make the digital transition. Tools such as 3D printers and drones now sell for a fraction of their cost than they did ten years ago.

Changing customer priorities

Today’s shoppers spend more on travel and luxury brands than those of previous generations. Consumers feel time-starved and seek the best possible shopping experiences. Buyers look for omnichannel opportunities that allow them to buy anything, anywhere, at any time.

Online competition

The increase in online retail options for consumers has remade the retail landscape. According to industry analyst Adobe Analytics, online spending on Thanksgiving Day 2018 increased 28 percent from 2017. This is up from 2017’s 18 percent growth rate.

Trends in physical store transformation

Social media

Social media facilitates immediate and frequent interaction with retailers, which is craved by today’s phone obsessed market. Retailers can develop two-way relationships through social media by communicating information to buyers and receiving feedback instantly. In addition, retailers can use social media to lure shoppers to physical stores.

Contextualization

As companies modernize, they often face obstacles that keep data and teams in silos. Customer segments alone are no longer enough to create personalized messages.

An Infosys study shows that 86 percent of consumers and 96 percent of retailers agree that personalization has an impact on purchasing decisions.

Today’s solutions leverage hundreds of attributes at the individual shopper level. Through artificial intelligence (AI) and machine learning, retailers can attract, upsell, and cross-sell highly specific targets while maximizing retention. This new approach could allow traditional retailers to compete against megastores like Amazon and Walmart.

London’s Topshop increased sales after offering its loyal customers the unique experience of watching the London Fashion Week show from its Oxford Street store. During the event, patrons could buy clothes, accessories, and makeup worn by the models – all with a single click.

Danish footwear retailer Ecco is launching a concept store in Amsterdam where customers can have their feet scanned and a 3D printer will produce midsoles tailored exactly to the customer’s feet.

Geofencing and beacons

Using technology to identify and communicate with potential buyers in a store’s proximity can generate foot traffic. Beacons can send personalized offers and details about the store and can gather data on store traffic to optimize manpower and workflow. This technology also helps solicit customer feedback and document customer movement within the store for improved aisle design and store layout.

Triggered by a beacon that interacts with an app, shoppers at Coborn’s, a grocery chain in Minnesota and South Dakota, are greeted as they enter the store. The app sorts customers’ shopping list by aisle and suggests relevant offers in real time as they move through the store. Customers can also use the product locator function to find specific items.

Melissa, an international shoe retailer, uses Facenote face recognition technology to sort customer information. Customers can send in a photo or take one in the store. As they enter, Facenote identifies them and sends specific information about their purchasing history and preferences to the sales staff.

Several large retailers offer an app that transforms into an interactive store map as customers enter the store.

Endless aisle

In-store kiosks where customers can order products that are out of stock or sold exclusively online create the impression of an endless aisle. Stores partner with fulfillment suppliers to offer almost limitless inventory, competing directly with online megastores. The endless aisle combines the immediacy of in-store shopping with the flexibility of online purchasing.

Smart carts

Customers can use radio frequency identification (RFID) readers and sensor-enabled smart carts to scan the codes on items they place in or take out of the cart. Smart carts have a number of benefits for both customers and stores:

Smart fitting rooms

Smart options for fitting rooms help consumers get the products they want while supporting retail employees with useful data. When a customer enters the smart fitting room with clothes to try on, RFID readers capture the item details and displays them on a smart screen built into the dressing room mirror, along with additional size, color, and style options. Then the customer can send an e-request for assistance or for additional items that a sales associate receives on a smart device. The associate responds to the request and, again using RFID and the smart device, can track the location of the requested items in the store.

Self-checkout and no checkout

Scan-and-go technology improves the buyer experience by offering flexible and efficient ways to scan, bag, and pay for items. No checkout is now possible with apps that integrate with store shelves and cameras, sensing when merchandise is removed from a shelf and placed in a cart or put back on the shelf. When the customer leaves the store, the total bill is automatically deducted from the wallet within the app.

For shoppers, these advanced checkout options save time and effort. Store owners can designate less space and fewer employees to the checkout process. Price accuracy is ensured, and shrinkage is less likely with the removal of the cashier in the process.

Point-of-sale

The future of point-of-sale (POS) technology includes mobile options, cloud-based solutions, and systems that accept new payment methods such as Apple Pay and contactless payment via near-field communication. POS packages vary in the capabilities offered.

Omnichannel experience

Omnichannel opportunities combine the benefits of physical and digital retail settings. The option to interact with a retailer on multiple platforms is convenient for the consumer and helpful for the retailer.

Here are examples of two different omnichannel journeys:

Consumer A browses Facebook, follows a link to CrowdSaver, and becomes a “fan.” The retailer lowers the price, and the consumer shops online and picks up the purchase at the nearest store.

Consumer B logs on to Foursquare, notices a coupon for a nearby store, redeems the coupon at the store, and buys other items during the visit.

Tech that makes it happen

Artificial intelligence

It is now possible to gather an overwhelming amount of data about consumers and their purchasing habits. The challenge is to analyze the data and create actionable insights that can be integrated quickly. AI, machine learning, edge computing, and predictive analytics not only help retailers gather and process large amounts of data, but also provide analysis and advice.

Digital kiosks

When shoppers swipe their loyalty cards at kiosks at the front of the store, they are greeted by name and given personalized suggestions and discounts based on their purchasing history. The kiosks are also used to print coupons, manage accounts, process payments, and order products.

Augmented reality

Augmented reality (AR) helps consumers make purchasing decisions by adding a level of understanding and engagement. AR can offer product details to match consumer interests, add real time information about price and location, and even show how to use an item or how it might fit the customer.

Blockchain

Blockchain technology allows manufacturers, retailers, and consumers to see a product at every step in production and distribution. The entire transaction of a product journey can be recorded into blockchain and integrated in POS technology.

Today’s consumers look beyond price; they are interested in the legitimacy of a brand name product or how their produce was farmed.

Customers at the French hypermarket Carrefour can scan a QR code on a free range chicken to see how and where it was farmed and whether antibiotics were used.

Smart shelf technology

Smart shelves sense when inventory is depleted and send a signal to be restocked. This allows retailers to anticipate demand and know instantly when an item goes out of stock. Warehouses and distributors are automatically notified to provide immediate replenishment. This technology gives retailers real time insight into the popularity of items, guiding them in decisions about what and how much to stock.

Making the change

Advances in technology and physical changes within stores mean retailers can reach and analyze highly specific target markets with increasing precision. Anticipating consumer needs, tracking inventory in real time, receiving consumer feedback, and communicating directly with individual shoppers are game changing advantages for the in-store retail arena.