How can businesses thrive in a fluctuating economy?

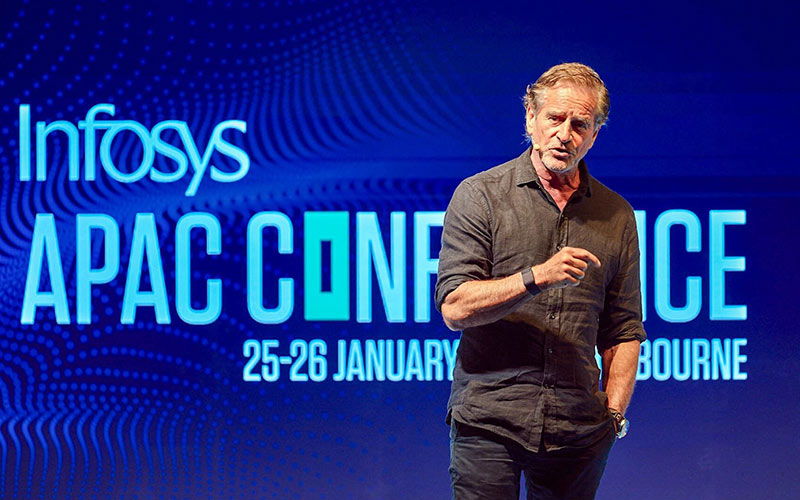

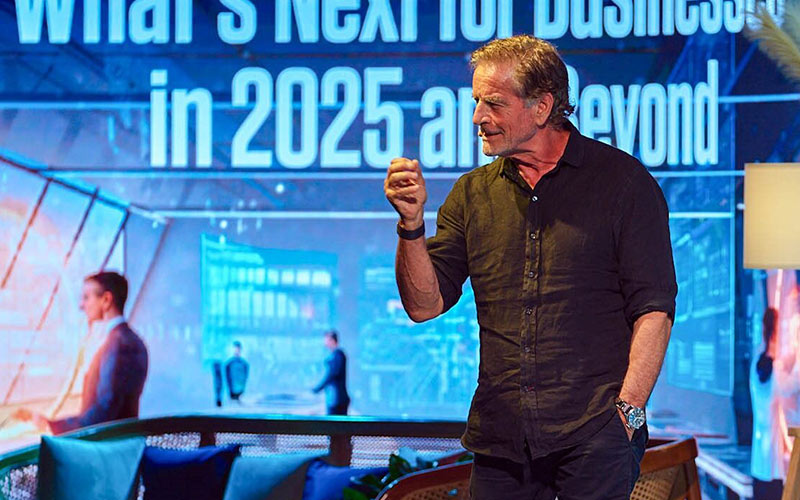

Mark Bouris, founder of Yellow Bricks Road, explores how the financial landscape is shaped by cycles of growth and contraction, with factors like interest rates, inflation, and market trends driving business success. In this session, Mark emphasizes the importance of anticipating economic shifts, refining strategies, and building resilience through AI-driven insights, smart risk-taking, and disciplined execution. He believes that long-term success hinges on adaptability and the ability to make bold, well-timed decisions.

Key Takeaways

Interest Rate Cycles Define Business Strategy

The cost of borrowing plays a key role in shaping business operations. By staying ahead of interest rate trends, companies can optimize their strategies, make informed decisions, and prepare for growth opportunities at the right time.

Recruitment and Retention Drive Business Success

A company’s success relies on attracting and retaining skilled brokers with competitive commissions, quality leads, and AI-driven onboarding. With enough brokers to meet demand, growth is ensured, especially when interest rates drop.

AI Is Not a Replacement for Human Expertise

AI enhances data analysis, automation, and decision-making, but its accuracy isn't always guaranteed. While AI tools are valuable in areas such as predicting trends, marketing, and customer experience, human intuition remains essential for optimal results.

Growth Requires Smart Planning and Execution

Business success hinges on timing — knowing when to invest, expand, or cut costs. Leveraging data to identify high-value markets can help attract better clients while recruiting and onboarding talent quickly is essential to staying ahead of competitors.

AI is critical. It doesn't do away, by the way, with what your instincts tell you. Or it doesn't do away with the skill that you might have acquired over, you know, in my case, 40 years of doing this stuff about interest rates.